Imagine yourself planning your dream vacation abroad, only to realize that managing your finances could become a currency conundrum. Enter HDFC Bank’s Prepaid Forex Card, a hassle-free way to avoid exchange rate fluctuations and keep your travel expenses under control.

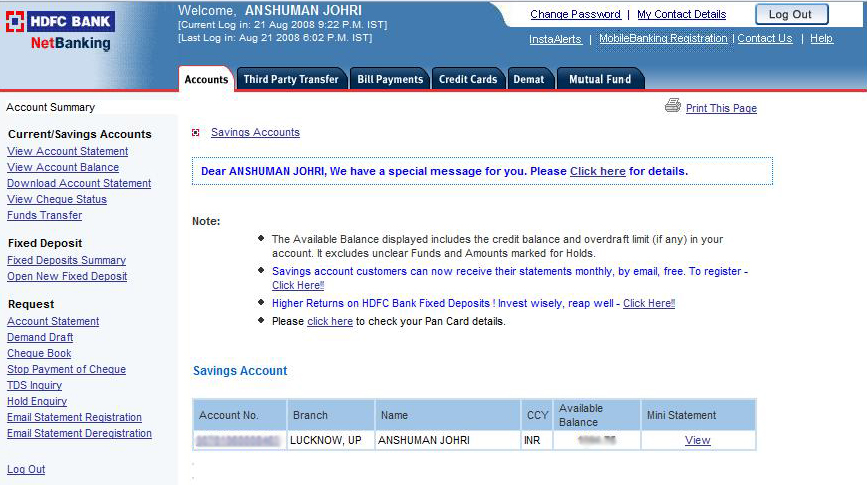

Image: www.svtuition.org

Now, logging into your HDFC NetBanking account to manage your Prepaid Forex Card is a breeze. In this comprehensive guide, we’ll walk you through the step-by-step login process, delve into the features and benefits, and provide valuable tips for making the most of this financial tool.

HDFC NetBanking Prepaid Forex Card: What it is and How it Works

An HDFC Prepaid Forex Card is a versatile payment option designed specifically for seamless and efficient foreign exchange transactions. It’s a prepaid card that you can load with a specific amount of foreign currency before your trip, eliminating the need to carry cash or travelers’ checks.

The card is linked to your HDFC NetBanking account, providing you with the convenience and security of managing your funds online. You can easily check your card balance, view recent transactions, and even block the card in case of loss or theft.

Logging into HDFC NetBanking for Prepaid Forex Card Management

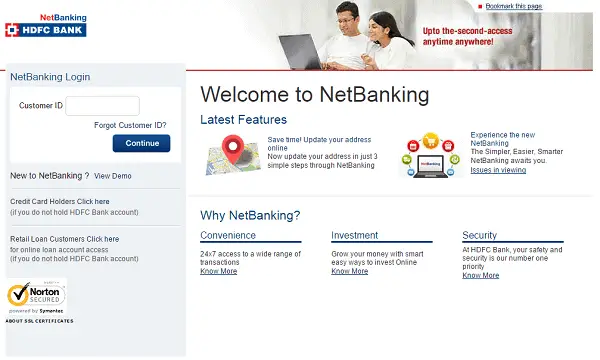

- Visit the HDFC Bank website (https://www.hdfcbank.com/) and click on “NetBanking Login” in the top right corner.

- Enter your Customer ID and Password to access your account.

- Once logged in, click on the “Cards” tab and select “Manage Forex Cards.”

- From here, you can view your Prepaid Forex Cards, check balances, and perform various other operations.

Features and Benefits of HDFC Prepaid Forex Card

- Convenience: Manage your forex transactions from anywhere with HDFC NetBanking, eliminating the need for physical bank visits.

- Fixed Exchange Rates: Lock in the exchange rate when you load your card, protecting you from currency fluctuations.

- Easy Acceptance: Your Prepaid Forex Card is accepted at millions of merchants and ATMs worldwide, providing you with peace of mind.

- Security: Enjoy the highest level of security with chip-and-PIN technology and 24/7 fraud monitoring.

Image: guidetologin.com

Tips for Making the Most of Your HDFC Prepaid Forex Card

Follow these expert tips to enhance your Prepaid Forex Card experience:

- Load your card carefully: Determine your estimated travel expenses and load an appropriate amount of currency to avoid overspending or leaving unused funds on the card.

- Check transaction fees: Be aware of any transaction fees associated with using your card at ATMs or merchants, as these can vary.

- Keep receipts: Retain receipts from all your purchases for record-keeping and expense tracking.

Frequently Asked Questions (FAQs)

- Where can I use my Prepaid Forex Card?

- Your card is accepted at millions of merchants and ATMs displaying the Visa/MasterCard logo worldwide.

- Is there a minimum or maximum loading amount?

- Yes, there are minimum and maximum loading limits set by HDFC Bank.

- What happens if I lose my card?

- Report the loss immediately to HDFC Bank and they will block the card for your security.

Hdfc Netbanking Prepaid Forex Card Login

Conclusion

HDFC Netbanking Prepaid Forex Card is an invaluable tool for travelers seeking a secure, convenient, and cost-effective way to manage their foreign exchange while abroad. By following the tips and tricks outlined in this guide, you can maximize the benefits of this financial solution and make the most of your trip.

Are you ready to streamline your travel expenses and embrace the convenience of HDFC Prepaid Forex Card? Explore the features, benefits, and login instructions today and set yourself up for a stress-free financial experience on your next overseas adventure.