Foreign exchange (forex) transactions can often be a hassle, especially when traveling abroad. The need to carry multiple currencies, keep track of exchange rates, and worry about transaction fees can be daunting. Enter HDFC Forex Prepaid Net Banking – a game-changer that simplifies the process, making forex transactions a breeze.

Image: www.pinterest.com

HDFC Forex Prepaid Net Banking is an online platform that allows you to load multiple currencies onto a single prepaid card. With this card, you can make payments and withdraw cash in foreign countries without the hassle of exchanging currency.

Benefits of HDFC Forex Prepaid Net Banking

- Convenience: Load and manage multiple currencies online, eliminating the need to carry physical cash.

- Competitive exchange rates: Get competitive exchange rates compared to other methods, such as cash exchange or credit cards.

- Transaction fees: Pay only a nominal transaction fee, which is typically lower than other forex services.

- Security: The card is protected by chip and PIN technology, ensuring the safety of your funds.

- Wide acceptance: The card is accepted at millions of ATMs and POS terminals worldwide.

Using HDFC Forex Prepaid Net Banking

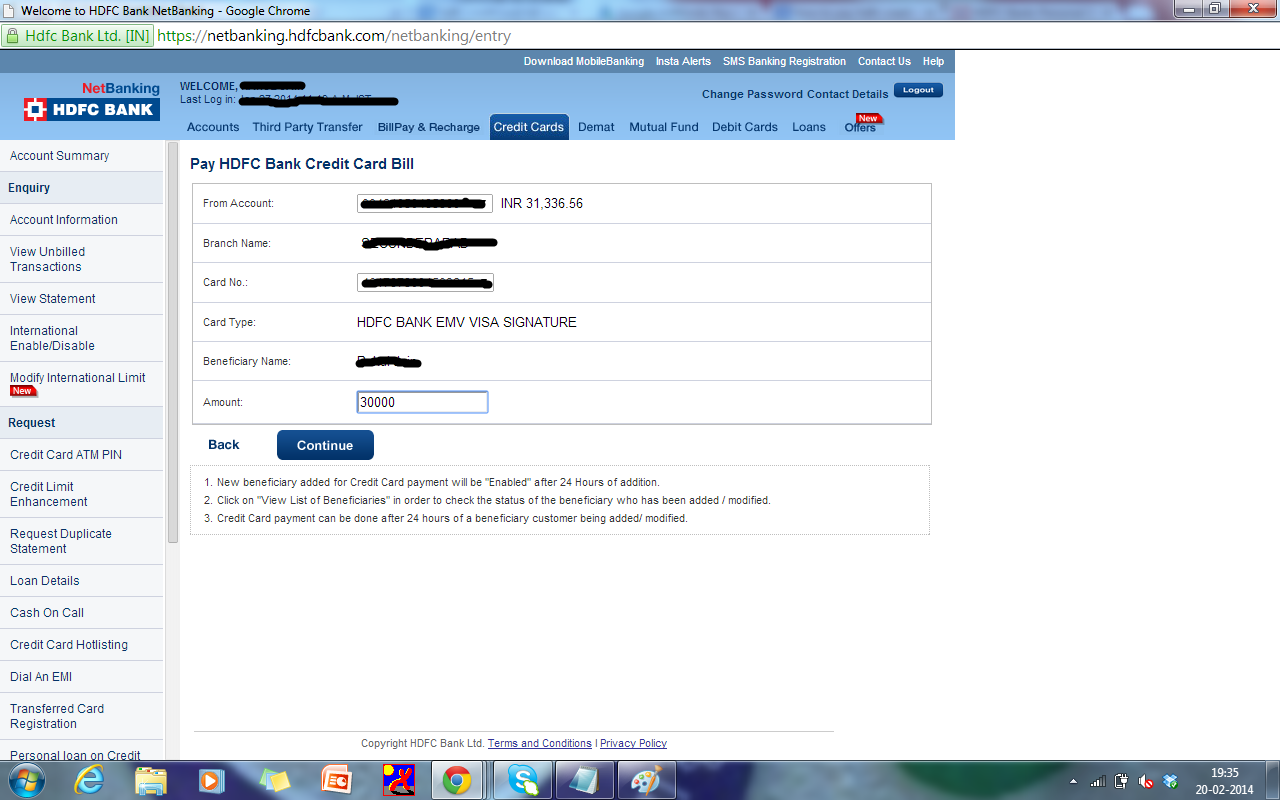

To use HDFC Forex Prepaid Net Banking, you must have an active HDFC Bank account. Once you have created an account, you can follow these steps:

- Log in to HDFC Net Banking: Visit the HDFC Bank website and log in to your account.

- Go to Foreign Exchange: Click on the “Forex” tab and select “Forex Prepaid Card.”

- Load currencies: Choose the currency you want to load, enter the amount, and pay using your HDFC Bank account.

- Activate and use the card: Once the card is loaded, activate it and start using it for transactions abroad.

Tips for Using HDFC Forex Prepaid Net Banking

- Choose the right currency based on your travel destination.

- Load sufficient funds to avoid running out of money abroad.

- Inform HDFC Bank of your travel plans to avoid card blocking.

- Check the exchange rate before loading currencies to get the best deal.

- Use the card for small purchases and withdrawals to minimize transaction fees.

Image: fipocuqofe.web.fc2.com

FAQs on HDFC Forex Prepaid Net Banking

Q: Can I load multiple currencies onto the card?

A: Yes, you can load up to 23 currencies onto the card.

Q: Where can I use the card?

A: The card is accepted at millions of ATMs and POS terminals worldwide that display the MasterCard or Visa logo.

Q: Are there any withdrawal limits?

A: Yes, there are daily withdrawal limits based on the card type.

Hdfc Forex Prepaid Net Banking

Conclusion

HDFC Forex Prepaid Net Banking is a must-have for travelers who want to simplify their foreign exchange transactions. With its convenience, competitive exchange rates, and security features, it is the perfect solution for hassle-free international financial management. If you’re planning to travel abroad, consider getting an HDFC Forex Prepaid Card and experience the ease and benefits it offers!