Introduction: Embark on a Global Adventure

The world is at your fingertips with an HDFC Forex Card, your indispensable companion for international excursions. Whether you’re a seasoned traveler or embarking on your first global expedition, this article will guide you through the effortless online login process and unravel the numerous benefits of this exceptional travel tool. Prepare to unlock a world of seamless transactions and financial freedom, empowering you to make memories that last a lifetime.

Image: forexscalpingforum.blogspot.com

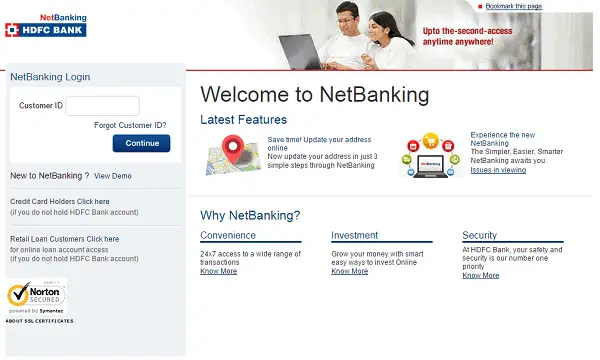

Online Login: A Swift and Secure Gateway

Accessing your HDFC Forex Card online is a breeze. Simply follow these simple steps:

- Visit the HDFC Bank website and click on “Forex Card” at the top menu.

- Choose “Login” and enter your card details (16-digit number, expiry date, and CVV).

- Enter the One-Time Password (OTP) you receive via SMS.

Once logged in, you’ll have access to a user-friendly portal where you can manage your card, track expenses, and stay up-to-date with the latest currency rates.

Benefits of an HDFC Forex Card

An HDFC Forex Card offers an array of advantages that make it the ideal choice for discerning travelers:

- Convenience: Bypass the hassle of carrying cash or exchanging currency, making payments and withdrawals with ease.

- Competitive Exchange Rates: Secure the most competitive rates at the time of your transaction, minimizing foreign exchange fluctuations.

- Worldwide Acceptance: Your card is accepted at millions of merchants and ATMs worldwide, ensuring accessibility wherever your travels take you.

- Peace of Mind: Rest assured with 24/7 customer support and the protection of Chip & PIN technology, safeguarding your funds against unauthorized access.

- Value-Added Perks: Enjoy exclusive discounts, reward points, and travel privileges tailored to your specific needs.

Comprehensive Overview of the HDFC Forex Card

Image: www.pinterest.com

Definition:

An HDFC Forex Card is a prepaid travel card designed specifically for making international payments. It’s akin to a debit card, but is denominated in foreign currency, allowing you to avoid currency conversion fees and fluctuations.

History:

HDFC Bank introduced the Forex Card in 2001, empowering Indian travelers with financial convenience during their overseas ventures.

Meaning:

An HDFC Forex Card symbolizes freedom, flexibility, and peace of mind for globetrotters. It enables travelers to focus on creating unforgettable memories without worrying about financial constraints or currency hassles.

Detailed Guide: Unlocking the Power of Your HDFC Forex Card

- Load Your Card: Choose from a wide range of foreign currencies and load your card before you travel. You can deposit funds online, through NetBanking, or at any HDFC Bank branch.

- Manage Your Card: Track your expenses, set alerts for transactions, and lock or unlock your card conveniently through the online portal.

- Withdraw Cash: Access local currency at ATMs worldwide using your Forex Card. Remember to notify the bank of your travel dates to prevent any inconvenience.

- Make Purchases: Pay for goods and services with ease anywhere VISA or MasterCard is accepted. Swipe your card or use contactless payment options for a seamless experience.

- Monitor Your Card: Stay up-to-date with your card balance and transaction history in real-time through SMS alerts and the online portal.

Latest Trends and Developments in Forex Cards

- Chip & PIN Enhancements: HDFC Bank recently introduced cards with embedded chips and PIN numbers, providing an additional layer of security against fraud and unauthorized use.

- Mobile App Integration: Manage your card on the go with the HDFC Bank Mobile Banking App, accessing account information, activating cards, and setting up alerts right from your smartphone.

- Multi-Currency Cards: Benefit from the flexibility of carrying multiple currencies on a single card, allowing for convenient transactions in different countries without currency conversion charges.

Tips and Expert Advice for Using Your HDFC Forex Card

- Plan Ahead: Determine your currency needs, load your card accordingly, and inform the bank of your travel dates to avoid any inconveniences.

- Keep Your Card Secure: Treat your Forex Card like a valuable asset. Store it safely, memorize your PIN, and notify the bank immediately in case of loss or theft.

- Monitor Your Expenses: Stay aware of your card balance and transaction history to avoid unnecessary charges. Utilize the online portal and SMS alerts to keep track of your spending.

- Maximize Your Benefits: Utilize the exclusive perks and discounts associated with your Forex Card. From discounts on airfares to complimentary lounge access, explore the benefits tailored to your specific requirements.

- Leverage Mobile Convenience: Download the HDFC Bank Mobile Banking App to access your Forex Card account on the go, enabling you to make transactions and manage your card remotely.

FAQ: HDFC Forex Card Online Login and Usage

Q: Can I load my HDFC Forex Card in multiple currencies?

A: Yes, HDFC Bank offers multi-currency Forex Cards, allowing you to load and carry different currencies on a single card.

Q: How long is an HDFC Forex Card valid?

A: The validity period for an HDFC Forex Card is generally 5 years, after which it will expire and need to be renewed.

Q: What documents do I need to apply for an HDFC Forex Card?

A: You will need to provide a valid Indian passport, proof of identity (PAN Card or Aadhaar Card), and a recent passport-size photograph.

Q: Are there any transaction limits for using an HDFC Forex Card?

A: Daily limits apply to both cash withdrawals and purchases made using your Forex Card. These limits vary depending on the card variant and country of usage.

Hdfc Forex Card Online Login

Conclusion

Embracing an HDFC Forex Card is an investment in a seamless and rewarding travel experience. Whether you’re a seasoned globetrotter or preparing for your first international escapade, this powerful financial tool empowers you with convenience, security, and peace of mind. Embrace the advantages, unlock the world’s wonders, and create memories that will last a lifetime.

Are you intrigued by the possibilities an HDFC Forex Card offers? Share your questions, experiences, or travel plans in the comments below.