Foreign exchange cards, or forex cards, are a convenient and secure way to manage your money when traveling abroad. HDFC Bank, one of India’s leading financial institutions, offers a variety of forex cards, including the HDFC Forex Card Euro. This card provides a number of benefits for travelers to the Eurozone, including competitive exchange rates, zero transaction fees, and wide acceptance at ATMs and retail outlets.

Image: www.forex.academy

Understanding Forex Cards

Forex cards are prepaid cards that can be loaded with the currency of your choice. When you use the card to make a purchase or withdraw cash, the amount is deducted from the balance on the card. This eliminates the need to carry large amounts of foreign currency with you, reducing the risk of loss or theft.

Benefits of HDFC Forex Card Euro

- Competitive Exchange Rates: HDFC Bank offers competitive exchange rates, ensuring that you get the most value for your money.

- Zero Transaction Fees: There are no transaction fees charged by HDFC Bank when you use your HDFC Forex Card Euro abroad.

- Wide Acceptance: HDFC Forex Card Euro is accepted at ATMs and retail outlets throughout the Eurozone, giving you the flexibility to access your funds whenever you need them.

How to Use an HDFC Forex Card Euro

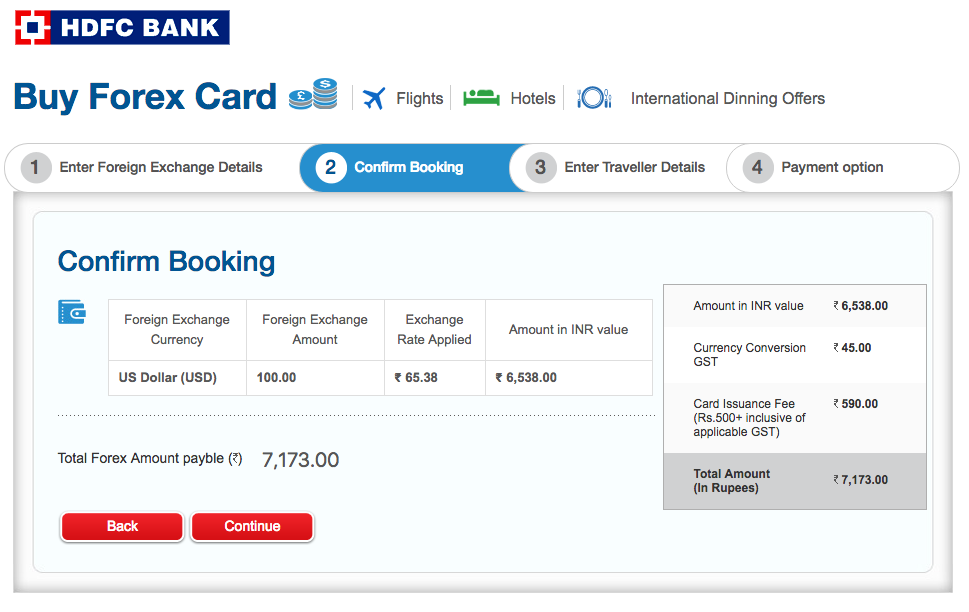

- Purchase the Card: You can purchase an HDFC Forex Card Euro from any HDFC Bank branch or through the HDFC Bank website.

- Load Funds: Load funds onto your card using your HDFC Bank account or through online banking.

- Activate the Card: Before you travel, activate your card by calling the HDFC Bank customer care number or through the HDFC Bank Mobile Banking app.

- Use the Card: Take your HDFC Forex Card Euro with you on your trip and use it to make purchases or withdraw cash as needed.

Image: www.pdfprof.com

Tips and Expert Advice for Using Your HDFC Forex Card Euro

Here are some tips and expert advice to help you get the most out of your HDFC Forex Card Euro:

- Monitor Exchange Rates: Keep an eye on exchange rates before you travel and load your card when the Euro is favorable.

- Use ATMs Sparingly: Withdraw cash from ATMs only when necessary, as each withdrawal may incur a small transaction fee at the ATM.

- Inform HDFC Bank: Notify HDFC Bank if you plan to use your card in multiple countries, as this may trigger fraud alerts.

- Secure Your Card: Keep your HDFC Forex Card Euro safe and secure at all times by storing it in a separate location from your passport and other valuables.

FAQ on HDFC Forex Card Euro

- What is the validity period of an HDFC Forex Card Euro?

- The validity period of an HDFC Forex Card Euro is two years.

- Can I use my HDFC Forex Card Euro to make online purchases?

- Yes, you can use your HDFC Forex Card Euro to make online purchases at any website that accepts Euro.

- Are there any restrictions on the amount I can load onto my HDFC Forex Card Euro?

- Yes, there are limits on the amount you can load onto your HDFC Forex Card Euro per day, per month, and per year. These limits may vary depending on your account type and KYC status with HDFC Bank.

Hdfc Forex Card Euro Rate

Conclusion

The HDFC Forex Card Euro is a convenient and secure way to manage your money when traveling to the Eurozone. With competitive exchange rates, zero transaction fees, and wide acceptance, the HDFC Forex Card Euro is an essential tool for travelers who want to make the most of their trips.

If you’re planning a trip to Europe, consider purchasing an HDFC Forex Card Euro to enjoy the benefits of secure, convenient, and cost-effective currency management.