Introduction:

Every investor, trader, and business owner seeks an indicator that can provide insights into the overall health of an economy. The Market Facilitation Index (MFI) is a valuable tool that serves this purpose effectively. In this comprehensive guide, we will delve into the depths of the MFI, exploring its significance, components, and how it can empower you to make informed decisions in the financial markets.

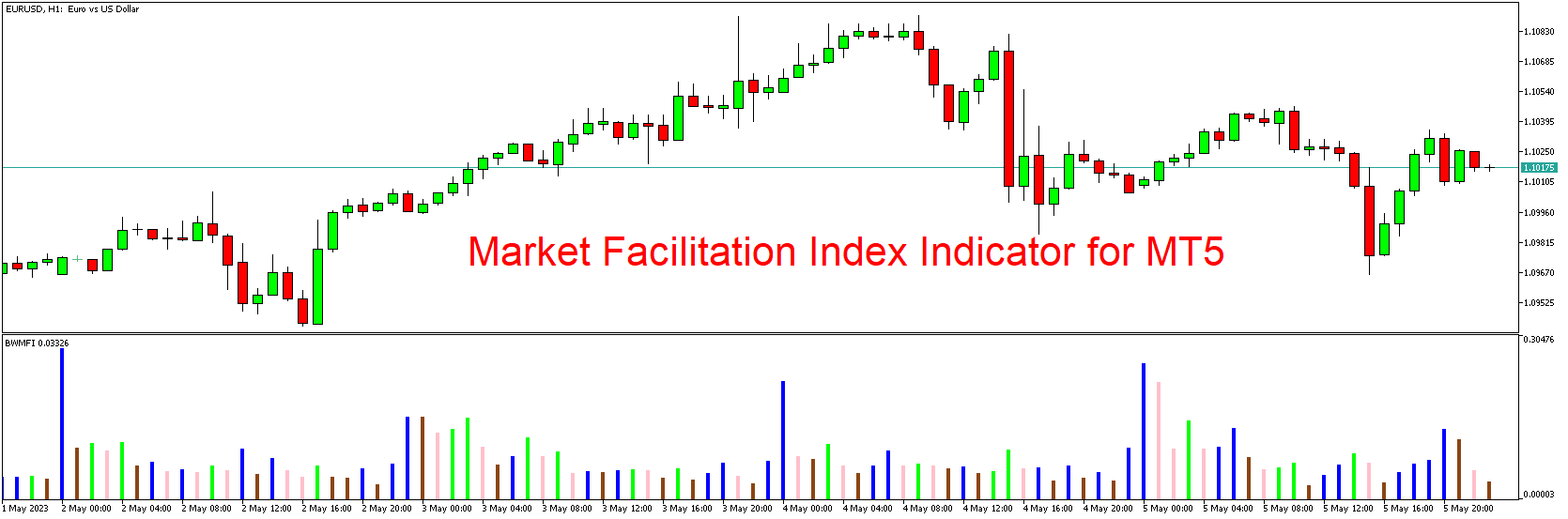

Image: indicatorshub.com

Understanding Market Facilitation Index:

The MFI is a composite index that measures the ease with which stock market transactions are executed. It considers various factors related to the efficiency and liquidity of the market, including price movements, trading volume, and volatility. A high MFI value indicates a smooth and efficient market, while a low value suggests market friction or inefficiencies.

The MFI is commonly used by investors and traders to gauge overall market sentiment and identify potential trading opportunities. It provides insights into the underlying health of the economy, serving as an early warning system for potential market disruptions or booms.

Components of MFI:

The MFI is a composite index that encompasses the following components:

- Price Range Index: Measures price volatility by considering the range between the high and low prices of a defined period.

- Volume-Weighted Average Price Index: Assesses the average price of transactions weighted by the trading volume.

- Trin Index: Compares the number of advancing stocks to declining stocks, providing an indication of market sentiment.

- Up/Down Volume Ratio Index: Determines the ratio of bullish (up) volume to bearish (down) volume, reflecting market participation.

- Relative Volatility Index: Measures price volatility relative to a defined period, adjusted for the average volatility.

MFI and Economic Strength:

The MFI is closely correlated with economic strength. A high MFI value typically indicates a strong and growing economy characterized by healthy corporate profits, stable consumer spending, and low unemployment rates. Conversely, a low MFI value is often associated with economic weakness, characterized by market volatility, declining corporate earnings, and potential recessionary risks.

Understanding the MFI provides valuable insights into the broader economic outlook, helping investors and traders make informed decisions about asset allocation, risk management, and investment strategies.

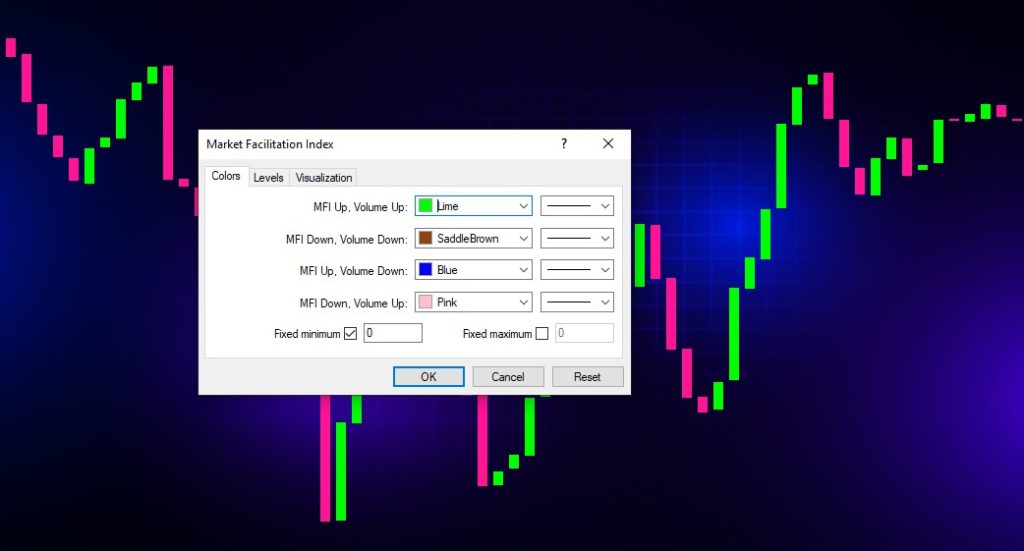

Image: forexleaderboard.com

Practical Applications of MFI:

- Trading Strategies: Traders can use the MFI to identify potential trading opportunities. A rising MFI combined with other bullish indicators may signal a market upswing, while a falling MFI could suggest an impending market correction.

- Market Timing: Investors can use the MFI to time their market entry and exit points. High MFI values indicate favorable conditions for investment, while low values suggest caution or potential rebalancing.

- Economic Analysis: Economists and analysts utilize the MFI to assess the health of the broader economy. A high and sustained MFI is typically interpreted as a sign of economic growth, while a low and declining MFI may indicate potential economic weakness.

- Central Banking Policy: The MFI can provide insights for central banks in setting monetary policy. High MFI values may signal the need for tightening to manage inflation, while low MFI values may warrant accommodative measures to stimulate economic growth.

Market Facilitation Index Indicator

Conclusion:

The Market Facilitation Index (MFI) is a powerful tool that empowers investors, traders, and analysts to understand market dynamics and make informed decisions. By analyzing price movements, trading volume, and volatility, the MFI provides insights into the health of an economy and its financial markets. Whether you are seeking alpha in your trades or managing your investment portfolio, the MFI should be an integral part of your financial literacy toolkit. Embrace its wisdom, and you will be well-positioned to conquer the complexities of the financial landscape.