The vibrant world of forex trading beckons to investors seeking lucrative opportunities. An integral aspect of this realm is understanding the intricate dance of gold price fluctuations. Traversing the forex gold price live chart empowers traders with invaluable insights, enabling them to navigate the markets with confidence and precision.

Image: fxtalk.com

Decoding the Forex Gold Market

Gold, a coveted precious metal, holds immense sway in the global financial arena. Traders worldwide flock to the forex gold market, where they can speculate on the value of gold against various currencies. This market operates around the clock, offering unparalleled liquidity and a vast pool of participants, setting the stage for dynamic price movements and boundless trading opportunities.

The Forex Gold Price Live Chart: A Window to Market Dynamics

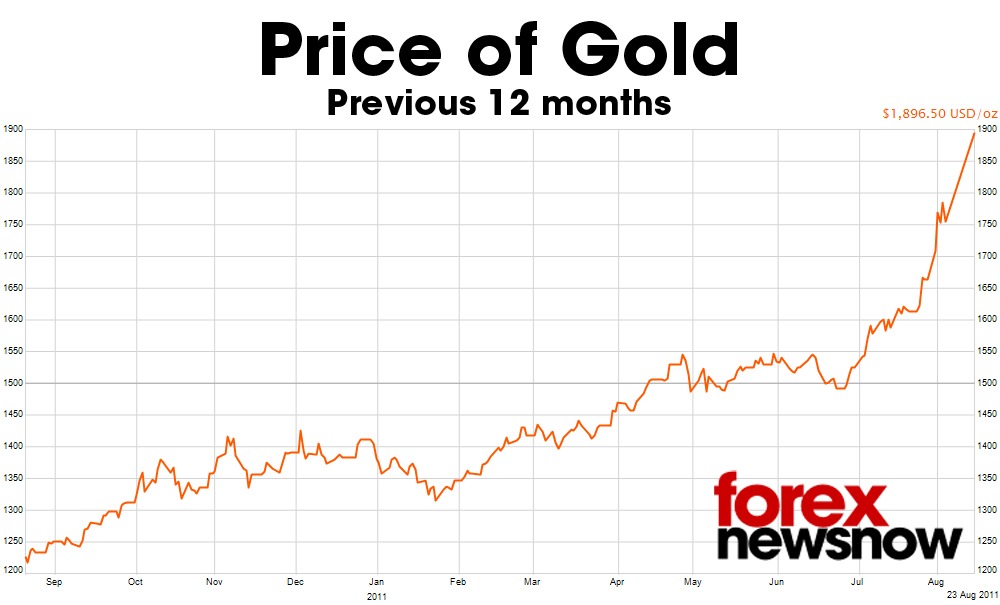

At the heart of successful forex gold trading lies a profound understanding of the live price chart. This indispensable tool provides a real-time snapshot of gold’s value, empowering traders to discern market trends, identify trading signals, and make informed decisions with unwavering confidence.

The live chart meticulously tracks gold’s price fluctuations against a chosen currency, typically the US dollar. Its pulsating lines represent the ebb and flow of supply and demand forces, reflecting traders’ collective sentiment and expectations. By scrutinizing this chart, traders can discern market momentum, spot emerging patterns, and anticipate potential price movements.

Navigating the Forex Gold Price Live Chart

Deciphering the forex gold price live chart requires a keen eye and a grasp of basic charting techniques. Several prominent chart patterns, such as trendlines, support and resistance levels, and candlestick formations, provide valuable clues about market sentiment and potential price trajectories.

For instance, a rising trendline indicates a bullish market, with buyers driving prices higher over time. Conversely, a falling trendline suggests a bearish sentiment, with sellers dominating the market and driving prices downwards.

Image: www.forexnewsnow.com

Tips and Expert Advice for Forex Gold Traders

Venturing into the forex gold market demands prudence and a well-honed strategy. Seasoned traders offer their sagacious counsel to help you navigate this dynamic landscape.

- Conduct thorough market research: Delve into historical data, news sources, and expert analyses to gain a multifaceted understanding of market trends and drivers.

- Employ risk management strategies: Implement stop-loss orders to safeguard your capital from excessive losses, and adhere to strict money management principles.

Harnessing these invaluable tips can bolster your trading prowess, mitigating risks and maximizing your profit potential.

FAQs on Forex Gold Price Live Chart

- Q: What factors influence forex gold prices?

A: Gold prices are swayed by a myriad of factors, including global economic conditions, geopolitical events, supply and demand dynamics, and central bank policies. - Q: How can I use technical analysis to trade forex gold?

A: Scrutinize live charts for patterns, trends, support and resistance levels, and candlestick formations to discern market sentiment and anticipate potential price movements.

Forex Gold Price Live Chart

Conclusion

Exploring the intricate intricacies of the forex gold price live chart unlocks a wealth of insights for traders seeking to conquer the dynamic markets. By embracing the tips and advice presented herein, you can venture forth with confidence, unearthing the secrets to forex gold trading success.

Delving into the world of forex gold trading can be an exhilarating adventure, fraught with rewards and pitfalls alike. Are you game to embark on this captivating journey and discover the true potential that lies within? The forex gold market beckons, inviting you to unravel its enigmas and reap its boundless rewards.