Introduction

Delve into the enigmatic realm of financial markets, where currencies, precious metals, and global economies intertwine. Forex, live gold, and silver rates stand as pivotal indicators, dictating the pulse of international trade and investment. In this comprehensive guide, we will unravel the complexities of these markets, arming you with the knowledge and insights to navigate their ever-shifting currents.

Image: www.reddit.com

Forex: The Lifeblood of Currency Exchange

Foreign exchange (forex) is the marketplace for trading currencies, offering a gateway to international commerce. This vibrant arena facilitates the exchange of currencies used by different nations, ensuring seamless transactions across borders. As global trade and economies expand, the forex market plays an increasingly crucial role, fueling economic growth and stability.

Key Concepts in Forex

- Currency Pairs: Forex trading revolves around pairs of currencies, where one currency is bought while the other is sold simultaneously. The most traded pair is the Euro and US Dollar (EUR/USD).

- Exchange Rate: The exchange rate reflects the value of one currency relative to another. It indicates the amount of one currency required to purchase a single unit of another.

- Bid-Ask Spread: Every currency pair has a bid price (selling price) and an ask price (buying price). The difference between these prices represents the spread, which serves as a commission for market makers.

Live Gold and Silver: Precious Metals with Timeless Value

Gold and silver have captivated humanity for millennia, embodying intrinsic worth and serving as a hedge against inflation. These precious metals maintain a tangible presence in the financial world, influencing both individual investors and central banks.

Image: ysifopukaqow.web.fc2.com

Understanding Gold and Silver Trading

- Spot Price: Spot prices reflect the current real-time market value of gold and silver. These prices are crucial for determining the value of physical bullion and other derivative investments.

- Paper Contracts: Gold and silver futures contracts allow traders to speculate on future price movements without taking physical possession of the underlying assets.

- Physical Bullion: Physical gold and silver can be purchased in various forms, including coins, bars, and jewelry. These tangible investments provide a tangible store of value in uncertain economic times.

Unveiling the Forex, Live Gold, and Silver Rate Interplay

The interplay between forex and precious metal rates adds another layer of complexity to market analysis. Currency fluctuations can significantly impact the value of gold and silver, as these assets are priced in US dollars. This dynamic relationship underscores the importance of considering all three markets when making investment decisions.

Currency Impacts

- A strengthening US dollar can lead to a decrease in the price of gold and silver, as it becomes more expensive for non-US buyers.

- Conversely, a weakening US dollar can boost the value of precious metals, making them more attractive investments for those holding other currencies.

Demand and Supply Factors

Market forces such as economic growth, inflation, and geopolitical events influence the supply and demand of gold and silver, ultimately affecting their prices. Forex rates also play a role in shaping market sentiment, influencing the flow of investment capital.

Exploring Trading Strategies: Profound Insights for Market Navigation

Navigating the dynamic world of forex and precious metal markets requires a well-rounded approach to trading strategies. Understanding the nuances of technical analysis, risk management, and trading psychology empowers traders to make informed decisions.

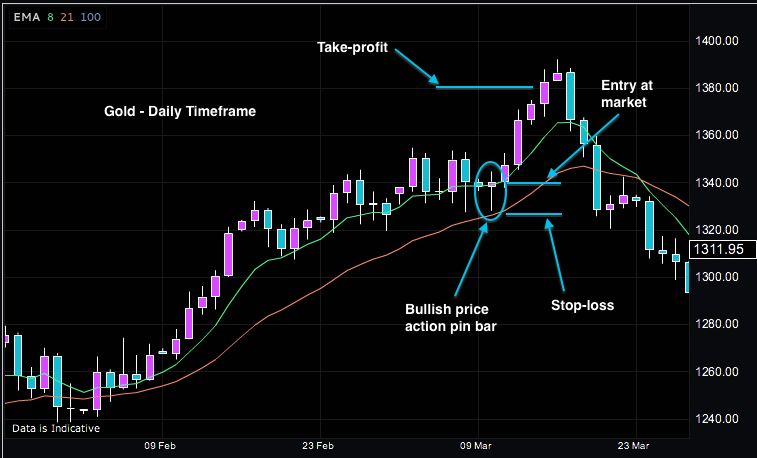

Technical Analysis: Unveiling Price Patterns

Technical analysis examines historical price data to identify potential trading opportunities. By analyzing charts and patterns, traders seek to predict future price movements based on past trends. Some popular technical indicators include moving averages, trendlines, and support and resistance levels.

Risk Management: Preserving Capital

Protecting trading capital is paramount. Effective risk management involves employing techniques such as stop-loss orders, position sizing, and hedging strategies. These measures limit exposure to potential losses, ensuring the long-term sustainability of trading endeavors.

Trading Psychology: Overcoming Emotional Barriers

Trading psychology requires a disciplined mindset. Emotional biases and impulsivity can cloud judgment, leading to poor trading decisions. Cultivating self-control, patience, and the ability to objectively evaluate market conditions are essential for achieving trading success.

Forex Live Gold Silver Rates

https://youtube.com/watch?v=96zqcTfSqbY

Conclusion: Harnessing Market Knowledge for Financial Success

Mastering the complexities of forex, live gold, and silver rates grants a competitive edge in the labyrinth of financial markets. By understanding the intricacies of currency exchange, precious metal trading, and their interconnectedness, investors and traders can better navigate market fluctuations and make informed decisions. Embrace the principles outlined in this guide, continuously expand your knowledge, and seize the opportunities that these dynamic markets offer.