Introduction

In the fast-paced world of forex trading, making informed decisions about entries can significantly impact your profitability. Whether you’re a seasoned trader or just starting out, understanding the nuances of forex gain or loss entry is crucial for long-term success. This article delves into the intricacies of this concept, providing you with a comprehensive guide to maximize your trading potential.

Image: www.facebook.com

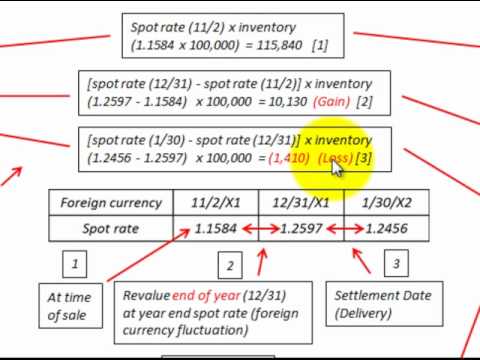

Forex, short for foreign exchange, involves the trading of currencies against each other. Traders aim to profit from the fluctuations in exchange rates, which are influenced by various economic, political, and global events. To enter a forex trade effectively, you need to understand the concept of gain or loss entry, which determines whether you’re profiting or losing right from the start.

Section 1: Understanding Gain and Loss Entry

Gain entry occurs when you buy a currency at a lower price than the market price at the time of your trade’s execution. This means you’re entering the trade with a profit. Loss entry, on the other hand, occurs when you buy a currency at a higher price than the market price at execution. This means you’re starting the trade with a loss.

The difference between your entry price and the current market price determines your initial profit or loss. This initial gain or loss can significantly impact your overall trading profitability, especially for short-term traders who rely on quick gains.

Section 2: Factors Influencing Gain or Loss Entry

-

Order Type: The order type you use can influence your entry price. Market orders execute your trade immediately at the prevailing market price, which can result in gain or loss entry depending on market fluctuations. Limit orders allow you to specify your desired entry price, giving you more control over your entry.

-

Market Volatility: High market volatility, caused by unexpected news events or economic data releases, can lead to significant price fluctuations. This can result in wider spreads and increased slippage, making it more difficult to achieve a favorable entry price.

-

Liquidity: Liquidity refers to the ease with which a currency pair can be traded. Less liquid currency pairs can have wider spreads and lower trade volumes, which can impact your entry price.

Section 3: Strategies for Optimizing Gain or Loss Entry

-

Use Limit Orders: Limit orders allow you to specify your desired entry price, reducing the risk of unfavorable gain or loss entry caused by market fluctuations.

-

Trade During Periods of Lower Volatility: Avoid trading during highly volatile market conditions to minimize the impact of slippage and wider spreads.

-

Choose Liquid Currency Pairs: Focusing on highly liquid currency pairs with tight spreads ensures better entry prices and reduced execution risk.

-

Monitor Market News and Events: Stay informed about upcoming news releases and economic events that may affect the market, allowing you to adjust your trading strategy accordingly.

Image: forexrobotcom.blogspot.com

Section 4: Managing Gain or Loss Entry in Your Trades

-

Calculate Potential Profit or Loss: Before entering a trade, calculate your potential profit or loss based on your entry price and target exit price. This helps manage risk and set realistic expectations.

-

Use Stop-Loss Orders: Place stop-loss orders to limit potential losses if the market moves against you, ensuring that your trades don’t incur significant drawdowns.

-

Consider Position Sizing: Manage your risk by adjusting your position size based on your account balance and risk tolerance. Smaller position sizes limit potential losses, while larger positions can increase potential profits.

Forex Gain Or Loss Entry

Section 5: Conclusion

Mastering forex gain or loss entry is essential for successful trading. By understanding the factors that influence entry price, implementing strategic techniques, and managing your trades effectively, you can significantly improve your profitability and risk management. Remember, knowledge, discipline, and a well-defined trading plan are the cornerstones of successful forex trading. Continue to educate yourself, stay informed about market conditions, and always trade with a clear understanding of the potential risks and rewards involved.