In the realm of forex trading, Bollinger Bands stand as a cornerstone strategy, guiding traders towards potential opportunities amidst market volatility. This article delves into the intricacies of Bollinger Bands, exploring their history, fundamental principles, and how they empower traders within the dynamic Forex Factory community. Get ready to uncover the secrets of this versatile technical tool and elevate your forex trading strategies.

Image: forexezy.com

Unraveling Bollinger Bands: A Guiding Light in Market Chaos

Conceptualized by John Bollinger in the 1980s, Bollinger Bands comprise a set of three lines plotted around a price chart, encapsulating the recent price action within a defined range. The innermost band represents a simple moving average (SMA), typically of a 20-period duration, acting as a central reference point. Flank it with two additional bands, calculated as standard deviations away from the central line, and you have the foundation of Bollinger Bands.

The power of Bollinger Bands lies in their adaptability, allowing traders to adjust the number of standard deviations used, catering to their unique trading styles and market conditions. This flexibility makes them a versatile tool, applicable across diverse trading strategies and assets.

Navigating Forex Factory with Bollinger Bands

Within the bustling Forex Factory community, Bollinger Bands find their place as an indispensable tool, empowering traders to decode market dynamics and make informed decisions. Their ability to identify potential overbought and oversold conditions is particularly valuable, helping traders steer clear of extreme market movements.

When prices hover near the upper band, Bollinger Bands signal potential overbought zones, indicating a heightened likelihood of a price reversal to the downside. Conversely, prices flirting with the lower band suggest oversold conditions, increasing the probability of an upward price correction.

Understanding these overbought and oversold signals is crucial, as they provide traders with valuable insights into potential market turning points. However, Bollinger Bands are not foolproof and should be combined with other technical indicators and forms of market analysis to enhance trading accuracy.

Image: www.metatrader4indicators.com

Bollinger Bands Strategy Forex Factory

Beyond the Basics: Advanced Bollinger Band Strategies

While the core Bollinger Band principles remain steadfast, traders have devised sophisticated strategies to enhance their trading arsenal. These advanced techniques delve deeper into the Bollinger Band structure, incorporating additional indicators and refinements to improve signal accuracy.

One such strategy involves tracking the position of the Bollinger Bands relative to support and resistance levels. When prices approach a support or resistance level while simultaneously testing the outer Bollinger Bands, it can indicate a potential breakout or reversal opportunity.

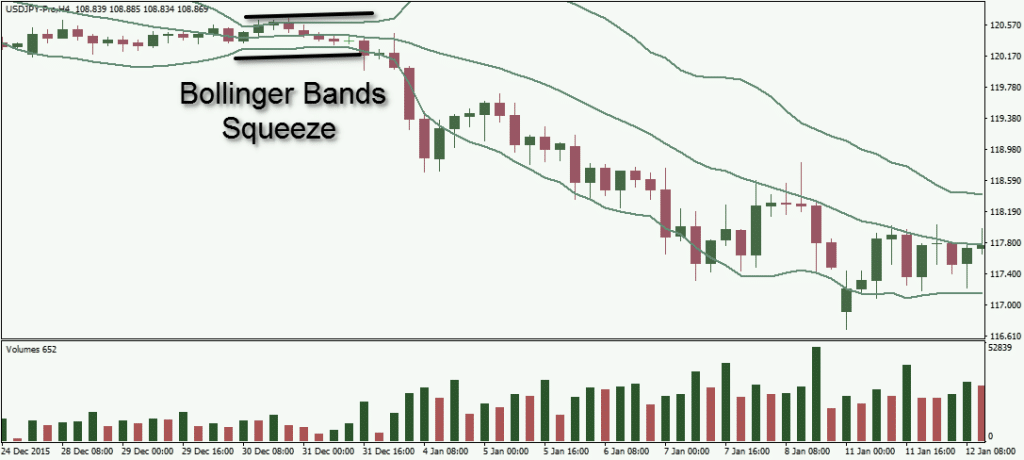

Another advanced Bollinger Band strategy utilizes the concept of Bollinger Band “squeezes.” These squeezes occur when the Bollinger Bands converge, indicating a period of low volatility. Identifying and trading breakout opportunities following a Bollinger Band squeeze can yield significant rewards.