Introduction

Image: www.forexcrunch.com

In the dynamic world of forex trading, where the ebb and flow of currency valuations dictate profits and losses, mastering the art of price action analysis is a key to unlocking success. Unlike technical indicators that rely on mathematical formulas, price action trading involves interpreting raw market data to determine potential trading opportunities. It’s a time-tested approach that empowers traders to make informed decisions based on the price movements themselves.

Understanding Price Action

Price action analysis relies on the premise that all relevant information is reflected in the price chart. By studying historical price movements, traders can identify patterns and trends that can provide insights into future price direction. Candlestick charts are a preferred visualization tool in price action trading, providing detailed information about market sentiment through open, high, low, and close prices.

Key Price Action Patterns

-

Double Bottom and Double Top: These reversal patterns indicate a change in market trend. A double bottom forms when price falls twice to the same support level before reversing higher, while a double top forms when price rises twice to the same resistance level before reversing lower.

-

Inverted Hammer and Hammer: These candlestick patterns signal a possible trend reversal. An inverted hammer forms when the lower wick is at least twice the size of the body and the upper wick is negligible. A hammer forms when the upper wick is at least twice the size of the body and the lower wick is negligible.

-

Bullish and Bearish Engulfing Candles: These candlestick patterns indicate a strong commitment to a trend. A bullish engulfing candle has a smaller green candle fully consumed by a succeeding larger green candle. A bearish engulfing candle has a smaller red candle fully consumed by a succeeding larger red candle.

-

Trend Lines: Trend lines are diagonal lines drawn along the peaks or troughs of a price chart, indicating the overall trend direction. Traders use trend lines to identify potential support or resistance levels.

-

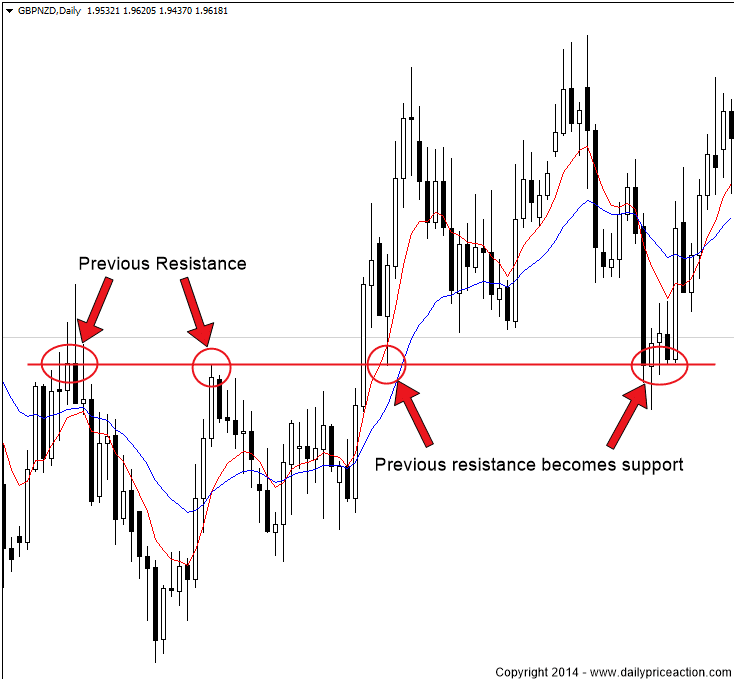

Support and Resistance Levels: Support is a price level at which a downtrend is expected to bounce, while resistance is a price level at which an uptrend is expected to pause or reverse. These levels are identified by studying historical price movements.

Benefits of Price Action Trading

-

Simplicity and Coherence: Price action analysis is relatively straightforward to learn and apply, making it accessible even to beginner traders.

-

Objectivity and Clarity: Price action patterns are not based on subjective interpretations, providing traders with a clear and consistent framework for decision-making.

-

Timeliness and Accuracy: By focusing on price movements themselves, price action trading provides traders with real-time insights and timely trade signals.

-

Flexibility and Adaptability: Price action analysis can be applied to any currency pair or time frame, making it a versatile trading approach that can be adapted to different market conditions.

Conclusion

Mastering the best forex price action strategy empowers traders with the knowledge and skills to navigate the volatile forex market effectively. By understanding key price action patterns and utilizing support and resistance levels, traders can identify potential trading opportunities with increased accuracy and confidence. Remember, price action trading is an ongoing journey that requires practice and patience. Embrace the learning curve, and reap the rewards of this time-honored trading approach.

Image: www.youtube.com

Best Forex Price Action Strategy