Introduction

Image: robotforexkaskus.blogspot.com

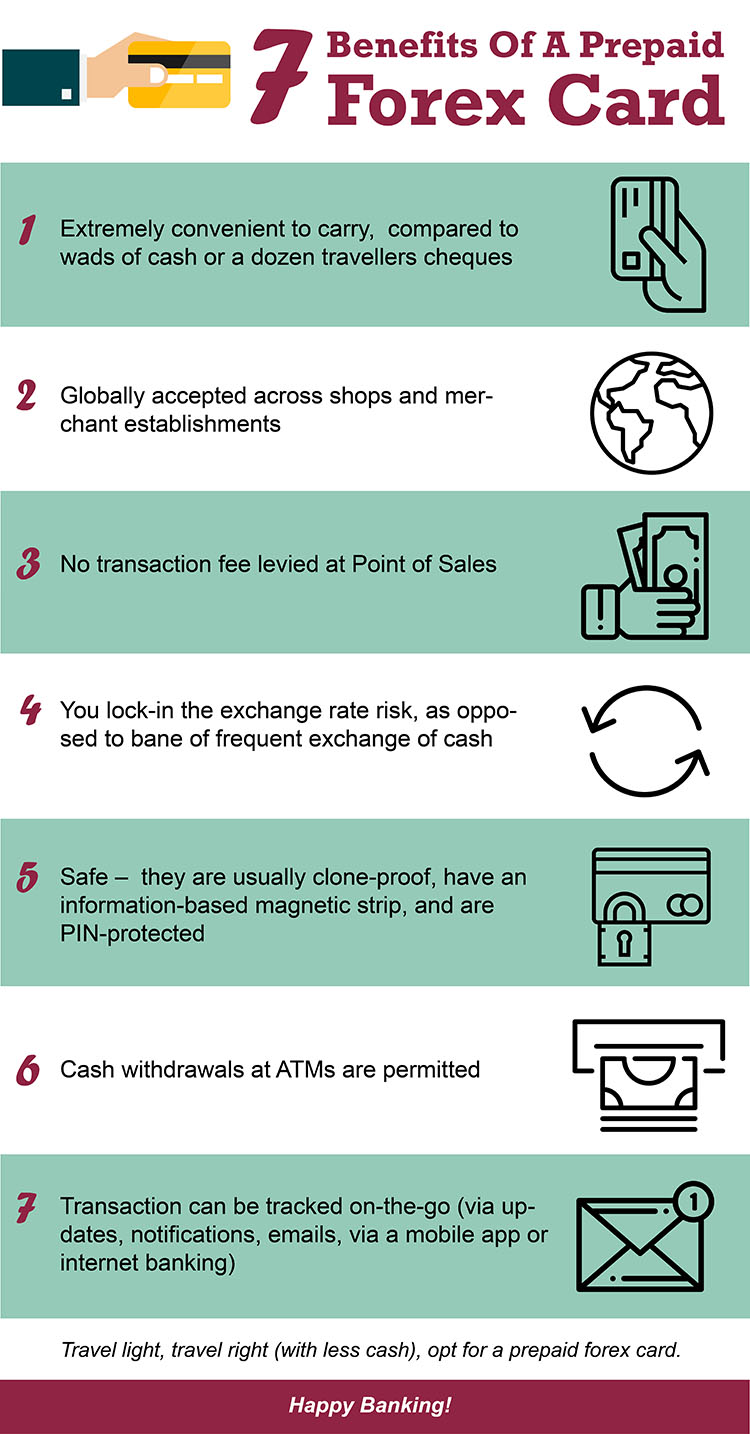

In the labyrinth of international transactions, the Axis Bank Forex Card emerges as a beacon of convenience. Empowered with this versatile tool, globetrotters can effortlessly withdraw funds in foreign lands, enjoying seamless access to local currencies. However, understanding the intricacies of withdrawal charges associated with Forex cards is paramount to optimize your financial experiences. Join us on a quest to unravel the nuances of Axis Bank Forex Card withdrawal charges, equipping you with the knowledge to navigate the monetary landscapes abroad with confidence.

Navigating the Forex Card Withdrawal Maze

-

ATM Withdrawal Fees: When withdrawing cash from Automated Teller Machines (ATMs) abroad, an additional fee is levied over and above the standard transaction charges. Axis Bank charges a withdrawal fee of 2.5% of the transaction amount, capped at INR 500 per withdrawal.

-

Counter Withdrawal Fees: If you prefer to withdraw cash over the counter at banks or exchange bureaus, you will encounter a slightly higher fee. Axis Bank charges a counter withdrawal fee of 3.5% of the transaction amount, capped at INR 500 per withdrawal.

-

Currency Conversion Margin: Forex cards offer the convenience of converting your home currency into foreign currencies at competitive rates. However, a marginal conversion fee is applied to cover the expenses incurred in currency exchange. Axis Bank applies a currency conversion margin of up to 3.5% on each transaction.

-

Minimum Withdrawal Amount: To safeguard against excessive transaction costs, Axis Bank imposes a minimum withdrawal amount. The minimum withdrawal amount varies depending on the country and currency, typically ranging from 500 to 1,000 units of the local currency.

-

Foreign Transaction Fee: Some banks, including Axis Bank, may charge a foreign transaction fee (FTF). This fee is a percentage-based charge applied to all card transactions made abroad. Axis Bank charges an FTF of 3.5% (excluding GST) on Forex Card transactions.

Maximizing Value: Minimizing Withdrawal Costs

-

Plan your Withdrawals: To minimize withdrawal expenses, plan your cash requirements in advance and make fewer, larger withdrawals instead of multiple small ones. This strategy reduces the impact of fixed fees.

-

Utilize Axis Bank ATMs: Axis Bank operates a network of ATMs in major cities worldwide. Using Axis Bank ATMs while abroad can eliminate the added expense of inter-bank fees.

-

Avail Forex Card Promotions: Axis Bank periodically offers promotions and discounts on Forex Card usage. Keep an eye out for such opportunities to reduce withdrawal charges.

-

Compare Fees and Rates: Before deciding on a Forex Card provider, diligently compare the withdrawal charges and currency conversion rates offered by different banks. This comparison can help you identify the most cost-effective option for your financial needs.

-

Consider Alternative Methods: While Forex Cards offer convenience, they may not always be the most economical option. Explore alternative methods of carrying foreign currency, such as cash, traveler’s checks, or preloaded currency cards.

Additional Considerations

-

The withdrawal charges discussed apply to withdrawals made in foreign currencies. Withdrawals made in Indian Rupees (INR) are subject to domestic transaction charges as per prevailing regulations.

-

The Forex Card withdrawal limits are determined by the bank based on the card variant and your account profile. Contact your bank to ascertain your specific limits.

-

Keep abreast of the latest exchange rates to make informed decisions when making withdrawals abroad. Exchange rates fluctuate frequently, impacting the amount of foreign currency you receive.

Conclusion

We hope this comprehensive guide has illuminated the intricacies of Axis Bank Forex Card withdrawal charges. These charges are an inevitable aspect of international cash withdrawals but understanding them empowers you to make informed decisions and navigate the financial crossroads of global travel. By employing the strategies outlined above, you can minimize expenses, optimize your withdrawals, and embrace the world with financial confidence.

Image: wallstreet20forexrobotreview.blogspot.com

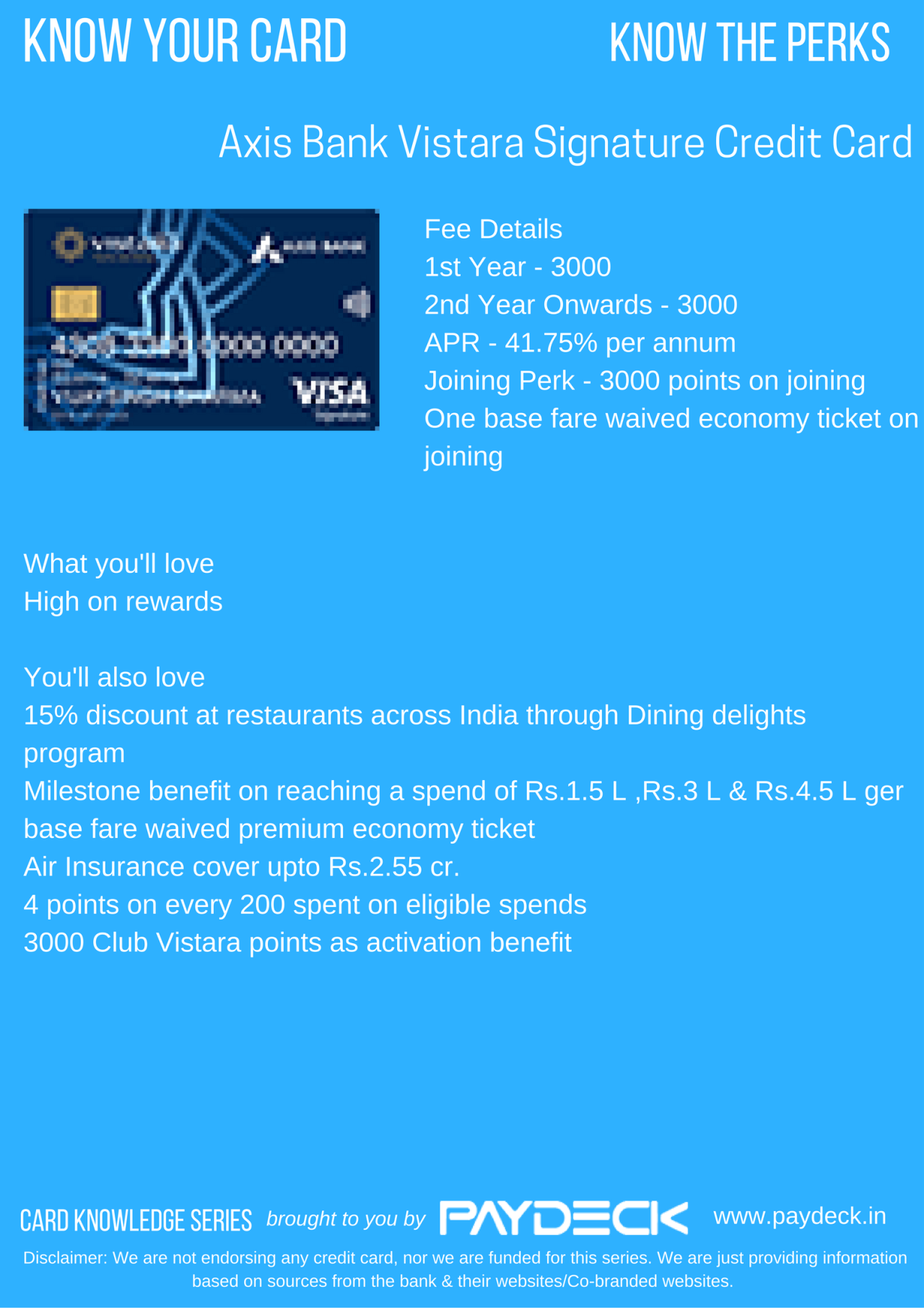

Axis Bank Forex Card Withdrawal Charges