In today’s interconnected world, international travel and business transactions have become commonplace. An essential tool for savvy travelers and globetrotting professionals alike is the Axis Bank Forex Card. This prepaid card offers a convenient and secure way to manage foreign exchange expenses, but navigating transaction charges can be daunting. This comprehensive guide will demystify Axis Bank Forex card transaction charges, empowering you to make informed decisions and optimize your global spending.

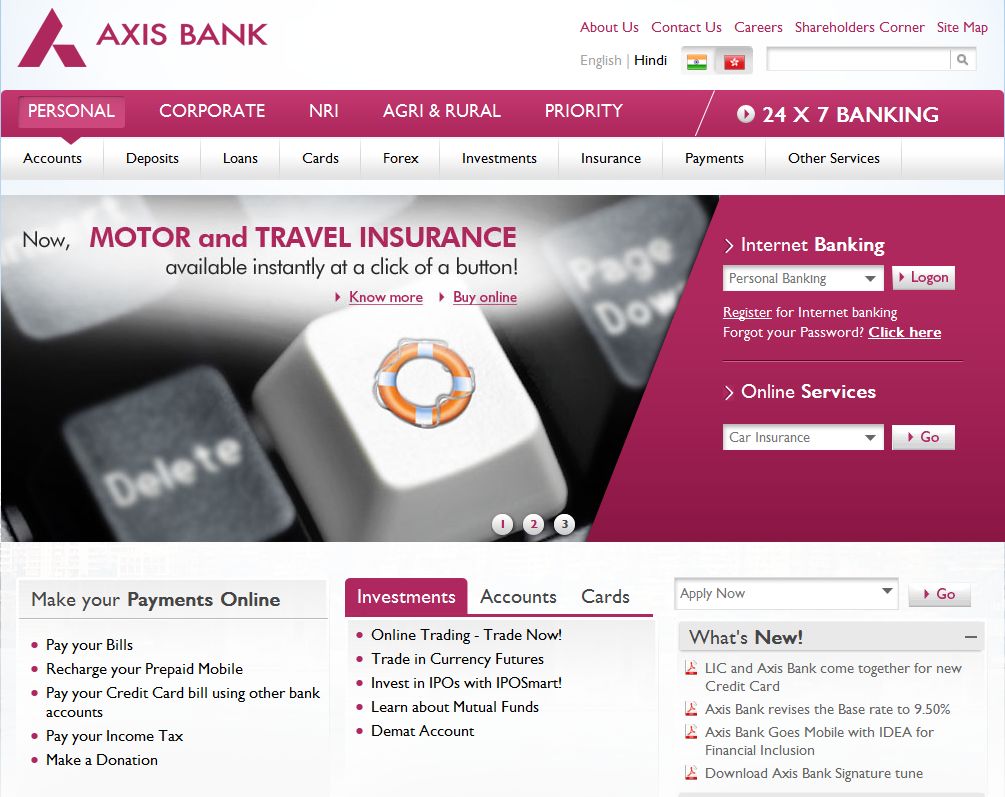

Image: brokerreview.net

Understanding Foreign Exchange Transactions

Before delving into Forex card charges, let’s understand the fundamentals of foreign exchange. When exchanging one currency for another, you’re essentially buying and selling those currencies at a predetermined exchange rate set by financial institutions. This rate can fluctuate based on various factors like supply and demand, economic conditions, and geopolitical events.

Breaking Down Axis Bank Forex Card Transaction Charges

Now, let’s unravel the specific charges associated with Axis Bank Forex cards:

-

Currency Conversion Margin: This is the spread between the buy and sell exchange rates offered by Axis Bank. It represents the bank’s profit margin in processing your transaction.

-

Transaction Fee: This is a flat fee charged for each Forex card transaction. It’s typically a small percentage of the transaction amount.

-

ATM Withdrawal Fee: If you withdraw cash using your Forex card at an ATM abroad, you’ll likely incur an ATM withdrawal fee charged by the bank that owns the ATM.

-

Foreign Transaction Fee: This is an additional charge levied on all foreign transactions, including those made with a Forex card. It’s usually a percentage of the transaction amount.

Factors Influencing Transaction Charges

Several factors can influence the transaction charges associated with Axis Bank Forex cards:

-

Currency Pair: The exchange rates and transaction fees can vary depending on the currencies being exchanged.

-

Transaction Amount: Larger transactions may attract lower transaction fees, as banks offer volume discounts.

-

Country of Transaction: Charges may vary based on the foreign country where the transaction is made.

-

Type of Transaction: Fees may differ for different types of transactions, such as purchases, ATM withdrawals, and online payments.

Image: allaboutforexs.blogspot.com

Optimizing Your Forex Card Spending

To minimize transaction charges on your Axis Bank Forex card, consider the following strategies:

-

Choose the Right Card: Compare different Forex cards offered by Axis Bank to find one that matches your spending habits and travel destinations.

-

Plan Large Transactions: If you’re making a sizeable purchase, wait for favorable exchange rates and combine multiple transactions into a single larger one.

-

Avoid ATM Withdrawals: ATM withdrawals generally incur higher fees compared to using your Forex card for purchases. Use your credit or debit card for cash withdrawals where possible.

-

Check Fees Before Transacting: Always review the transaction charges displayed before completing a Forex card transaction to avoid unexpected expenses.

Axis Bank Forex Card Transaction Charges

Conclusion

Understanding Axis Bank Forex card transaction charges is crucial for making informed decisions while managing your financial needs abroad. By embracing these insights, you can minimize charges, optimize your spending, and empower yourself as a global traveler or international businessperson. Remember, the ability to navigate foreign exchange transactions with confidence unlocks a world of opportunities for seamless and cost-effective global financial management.