A Seamless Way to Fund Your International Transactions

Navigating the world of foreign exchange can be a daunting task, especially when managing multiple currencies and fluctuating exchange rates. Fortunately, HDFC offers a convenient solution: the HDFC Forex Card. This card allows you to store multiple currencies, making international payments a breeze. To ensure a smooth experience, understanding how to add money to your HDFC Forex Card is essential.

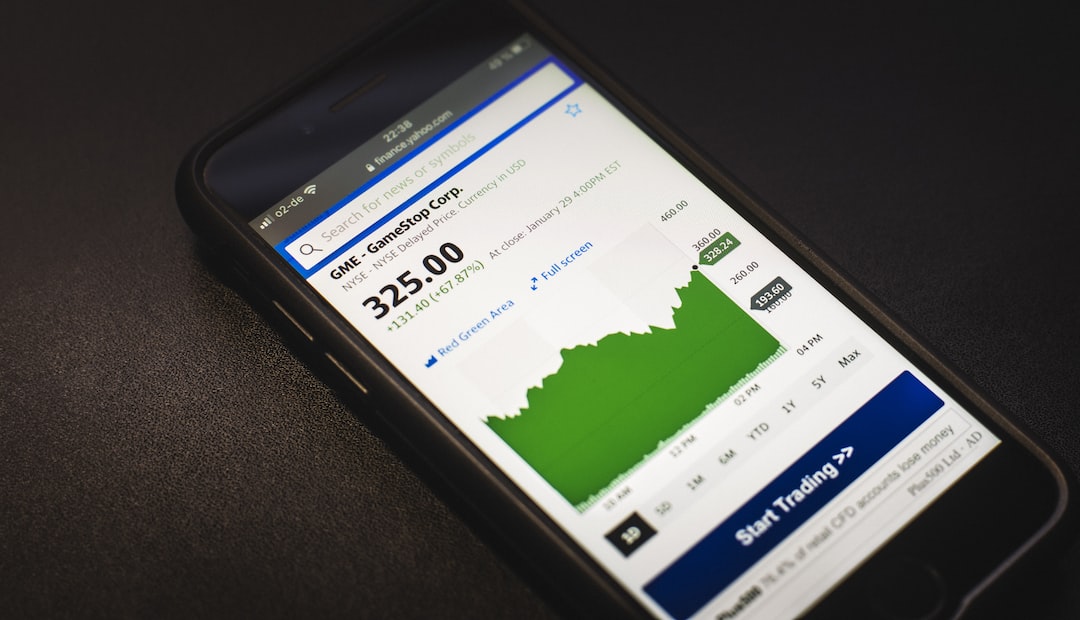

Image: www.forex.academy

**Adding Funds via NetBanking**

The most convenient method to add funds to your HDFC Forex Card is through NetBanking. Simply log in to your HDFC Bank NetBanking account, navigate to the ‘Forex’ tab, and select ‘Add Funds.’ Enter your card number, the currency you wish to add, and the amount. Confirm the transaction and the funds will be reflected on your card instantly.

**Adding Funds at HDFC Branches**

You can also add funds to your HDFC Forex Card by visiting your nearest HDFC branch. Carry your card, cash, or a cheque to the branch and request the teller to add the funds. The process is quick and easy, providing you with cash on your Forex Card for immediate use.

Tips and Expert Advice for Effective Forex Card Usage

To maximize the benefits of your HDFC Forex Card, consider the following tips from industry experts:

**Load Multiple Currencies:**

Avoid exchange rate losses by loading multiple currencies onto your Forex Card. This allows you to make payments in different countries without incurring additional conversion fees.

**Monitor Exchange Rates:**

Keep an eye on exchange rates to identify the best time to add funds or make purchases. Taking advantage of favorable exchange rates can save you significant money.

**Use Your Card Strategically:**

Maximize your savings by using your Forex Card for purchases made in the local currency of the country you are visiting. This eliminates the need for currency conversion at retail stores.

Frequently Asked Questions (FAQs)

Q: How can I check my Forex Card balance?**

A:** You can check your Forex Card balance online through NetBanking or by calling HDFC Bank’s customer care.

Q: Are there any fees associated with adding funds to my Forex Card?**

A:** HDFC Bank does not charge any fees for adding funds to your Forex Card through NetBanking. However, if you add funds through a branch, you may incur a nominal transaction fee.

Image: www.youtube.com

Add Money To Forex Card Hdfc

https://youtube.com/watch?v=00gS-NjPYwY

Conclusion

Adding money to your HDFC Forex Card is a simple and convenient process that empowers you to manage your international finances effortlessly. By leveraging the tips and advice provided in this guide, you can optimize your Forex Card usage and make the most of your international transactions. Whether you’re a frequent traveler or an occasional visitor, the HDFC Forex Card offers a secure and cost-effective way to navigate the world of foreign exchange.

Is adding money to your Forex Card a topic that interests you? Share your thoughts in the comments below and let us know if you have any further questions.