In the tumultuous and ever-evolving world of finance, currency trading, also known as forex trading, has emerged as a lucrative and accessible realm where individuals from all walks of life can capitalize on the fluctuations of global currencies. But before you embark on this exhilarating journey, it’s imperative to arm yourself with the essential knowledge and strategies to navigate this vast market.

Image: funnydogsz.blogspot.com

What is Forex Trading?

Forex, short for foreign exchange, involves trading currencies against each other. It’s the largest financial market globally, with a daily turnover exceeding $5 trillion. Currencies are traded in pairs, with the value of one currency being expressed in terms of another. For instance, EUR/USD represents the euro (EUR) against the US dollar (USD).

Benefits and Challenges of Forex Trading

Forex trading offers numerous advantages, including:

Flexibility: Trade anytime, anywhere, as the market is open 24 hours a day, five days a week.

Profitability: Potential for significant returns by capitalizing on currency price fluctuations.

Leverage: Leverage allows you to trade with more than your initial investment, magnifying potential profits (and losses).

However, forex trading also presents challenges:

Volatility: Currency prices can change rapidly, leading to unpredictable market conditions.

Risk: Forex trading involves risk, and it’s possible to lose your investment.

Competition: The market is highly competitive, with experienced traders constantly seeking opportunities.

Essential Terms and Concepts

Before delving into the intricacies of forex trading, it’s crucial to understand some key terms:

Pip: The smallest price increment in a currency pair.

Spread: The difference between the bid price (the price you can sell at) and the ask price (the price you can buy at).

Leverage: The ability to trade with borrowed capital, increasing potential profits but also magnifying losses.

Stop-loss order: An order that automatically closes a trade when a certain price level is reached, limiting potential losses.

Image: www.infographicszone.com

How to Get Started

-

Choose a reputable broker: Find a regulated and trustworthy broker to provide access to the market.

-

Open a trading account: Fund your account with the minimum required amount.

-

Learn the basics: Educate yourself about forex trading through books, articles, and online resources.

-

Practice with a demo account: Test your strategies and gain experience without risking real money.

-

Start trading: Transition to real-time trading with caution, gradually increasing your investment as your confidence grows.

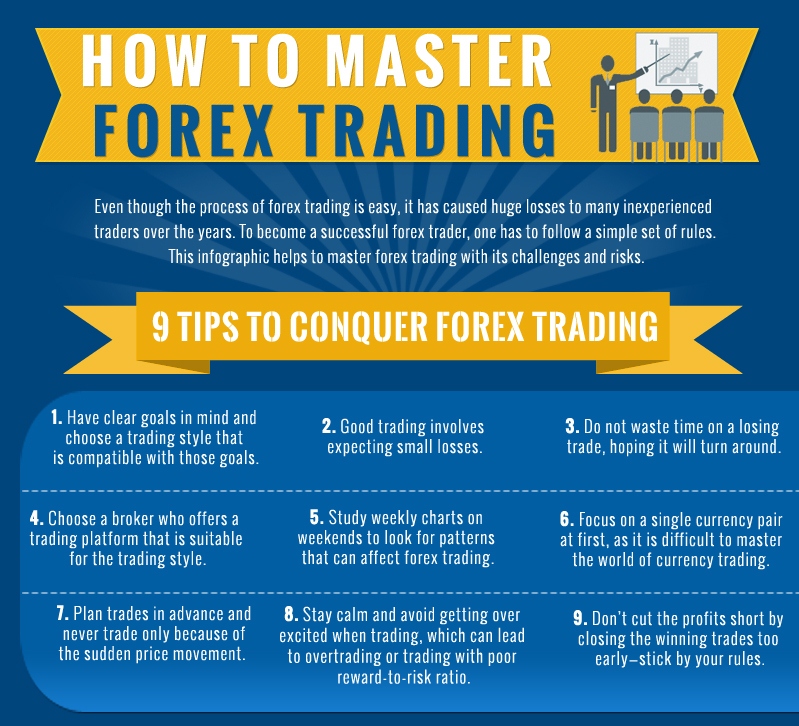

Expert Insights and Actionable Tips

-

Master technical analysis: Study charts and indicators to identify market trends and predict price movements.

-

Manage risk effectively: Implement stop-loss orders and control your leverage to mitigate potential losses.

-

Stay up-to-date: Follow market news and economic data to make informed trading decisions.

What You Need To Know About Forex Trading

Conclusion

Forex trading offers immense opportunities for financial growth, but it’s not a path to quick riches. Success requires discipline, research, and continuous learning. By embracing the knowledge and strategies outlined in this comprehensive guide, you can unlock the lucrative potential of forex trading and secure your financial future.

Embark on this exciting financial adventure with confidence, knowing that you have the necessary tools and insights to navigate the forex markets and achieve financial success.