In the fast-paced and ever-evolving world of forex trading, choosing the right currency pair can determine your success or setback. With numerous currency pairs available, it’s crucial to identify the one that aligns with your trading strategy and optimizes your potential for profit. This article delves into the factors that influence the ideal forex pair selection, providing valuable insights to guide your trading decisions.

Image: www.gotradehere.com

Factors to Consider When Choosing the Best Forex Pair

The best forex pair for you depends on several key factors:

-

Volatility: Volatility measures the extent of price fluctuations in a currency pair. Higher volatility implies greater potential for profit but also higher risk. Balancing volatility with your risk tolerance is essential.

-

Liquidity: Liquidity refers to the ease with which you can buy or sell a currency pair without significantly affecting its price. High liquidity reduces transaction costs and ensures smoother trading.

-

Correlation: Correlation measures the degree to which two currency pairs move in tandem. Diversified pairs with low correlation offer better risk management opportunities.

-

Trading Hours: Currency pairs have specific trading hours depending on the economic zones they represent. Choose pairs that align with your available trading time.

-

Spreads: Spreads are the difference between the bid and ask price of a currency pair. Lower spreads reduce transaction costs and improve profitability.

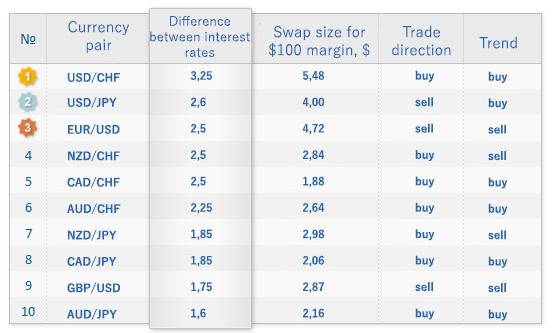

Top Forex Pairs for Today

Based on the aforementioned factors, here are some of the commonly traded and recommended forex pairs for today:

- EUR/USD (Euro/US Dollar): Boasting high liquidity and volatility, EUR/USD is the most traded pair globally.

- USD/JPY (US Dollar/Japanese Yen): This pair is known for its high volatility and carry trade opportunities.

- GBP/USD (British Pound/US Dollar): GBP/USD exhibits moderate volatility and is popular for scalping and day trading strategies.

- USD/CHF (US Dollar/Swiss Franc): USD/CHF is considered a safe-haven pair, offering stability during market turbulence.

- AUD/USD (Australian Dollar/US Dollar): This pair represents one of the G10 currencies and offers a balance of volatility and liquidity.

Tips for Choosing the Best Pair for Your Trading Strategy

- Identify Your Risk Appetite: Determine your tolerance for risk and choose pairs that align with it. Higher volatility pairs come with higher risk and reward potential, while lower volatility pairs offer more stability.

- Consider Your Trading Style: Scalpers and day traders may prefer high-volatility pairs, while swing traders and long-term investors can opt for more stable pairs.

- Monitor Economic Data: Stay informed about economic events and data releases that can affect currency prices. This will help you make informed decisions and adjust your trading strategies accordingly.

- Diversify Your Portfolio: Diversifying your currency pairs can mitigate risks and enhance your overall profitability.

Image: app.jerawatcinta.com

What Is The Best Forex Pair To Trade Today

Conclusion

Choosing the right forex pair for trading is crucial for maximizing your potential for success. By carefully considering the factors outlined above and understanding your trading style, you can select the currency pair that aligns with your goals and strategies. Remember to stay up-to-date with market news and economic data, and constantly adapt your approach based on the evolving market dynamics. With diligent research and thoughtful decision-making, you can navigate the ever-changing forex landscape and make informed trades that enhance your profitability and pave the way for trading success.