In the fast-paced world of cryptocurrency trading, where market volatility reigns supreme, human traders often struggle to keep up with the relentless pace. This is where deriv trading bots enter the scene, offering a solution that transcends human limitations.

Image: beamstart.com

What are Deriv Trading Bots?

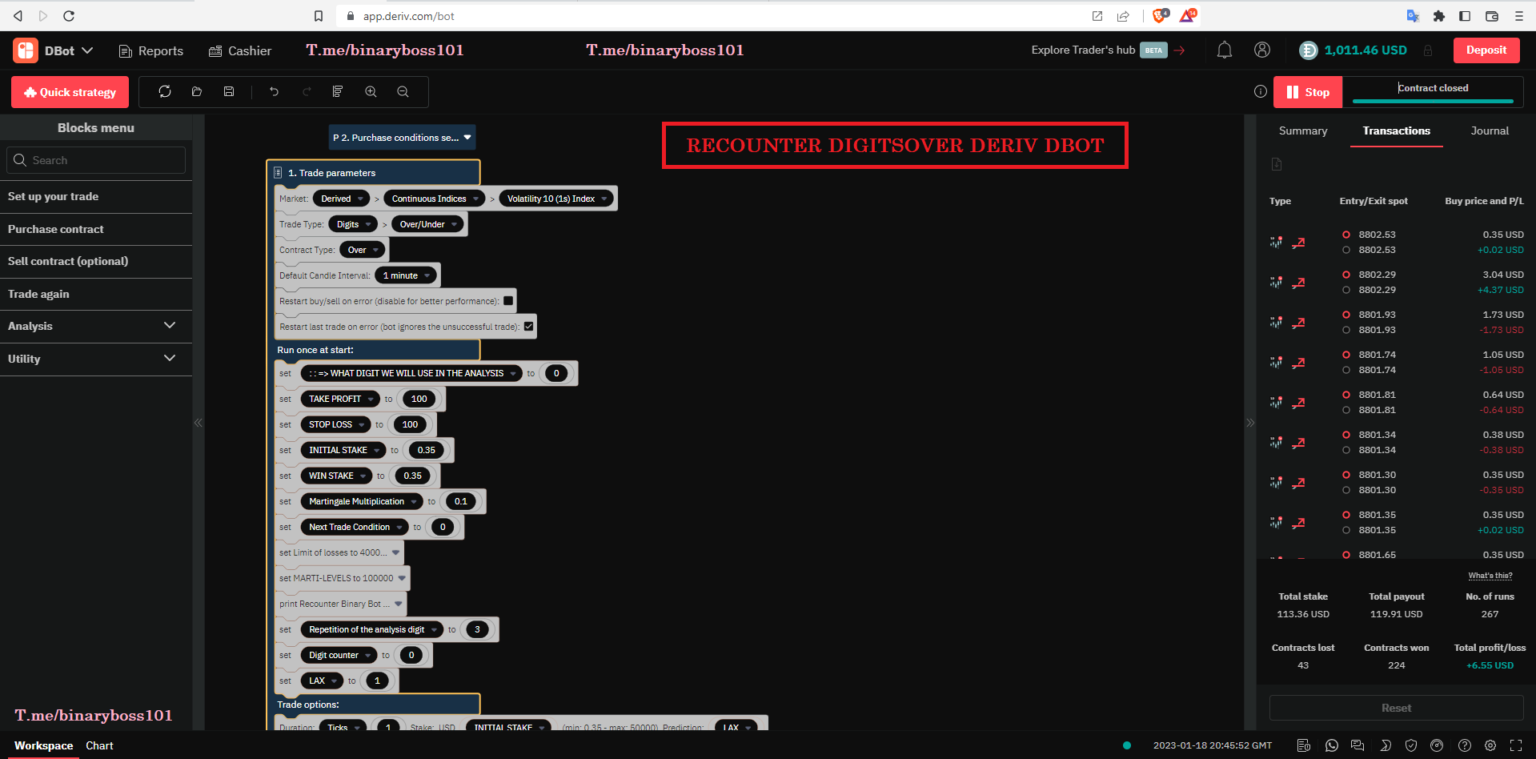

Deriv trading bots are automated software programs designed to execute trades in the deriv market based on predefined parameters. They continuously monitor market trends, identify trading opportunities, and place trades accordingly, eliminating the need for manual intervention. Whether you’re a seasoned trader or a novice just starting out, deriv trading bots can empower you with a competitive edge in the ever-fluctuating crypto landscape.

Dive into the World of Deriv Trading Bots

Let’s delve deeper into the realm of deriv trading bots, exploring their benefits, functionality, and how they can revolutionize your trading experience.

Benefits of Deriv Trading Bots:

-

Lightning-Fast Decision-Making: Bots act instantly, capitalizing on fast-moving market opportunities that often go unnoticed by human traders due to limited speed and reaction time.

-

Emotionless Trading: Bots are immune to human emotions, which can cloud judgment and lead to irrational trading decisions. They execute trades based solely on predefined rules, minimizing the risk of emotional errors.

-

Time Efficiency: Bots operate 24/7, allowing you to maximize profits even when the markets are closed or you’re away from your trading station. They free up your time to focus on other aspects of your trading strategy or personal life.

-

Backtesting and Optimization: Deriv trading bots allow you to backtest different trading strategies in simulated market conditions, helping you refine your approach before risking real capital.

How Do Deriv Trading Bots Work?

Deriv trading bots typically operate using the following steps:

-

Market Analysis: The bot collects and analyzes real-time market data, including price fluctuations, volatility, and trading patterns, to identify potential opportunities.

-

Execution of Trades: Once an opportunity is identified, the bot executes the trade according to the set parameters, including the type of trade (e.g., long/short), leverage, and exit conditions.

-

Risk Management: Bots can implement pre-set risk management mechanisms to protect your capital. This includes features such as stop-loss orders, position-sizing strategies, and diversification.

Image: ultimatetrading.tools

Types of Deriv Trading Bots

Trend-Following Bots: These bots identify and follow market trends, placing trades in line with the prevailing momentum.

Range Trading Bots: Designed for markets that show limited volatility, these bots capitalize on price movements within a defined range.

Arbitrage Bots: These bots exploit price discrepancies between different exchanges, buying from one exchange and selling at another to generate profit.

Expert Insights on Deriv Trading Bots

Gianluca Masserini, a seasoned crypto trader, shares his experience with deriv trading bots: “Deriv bots have been game-changers for me. They allow me to capture opportunities that would be impossible to notice manually. The ability to trade around the clock has significantly increased my profits.”

How to Choose the Right Deriv Trading Bot

Choosing the right deriv trading bot is crucial for success. Here are a few tips:

-

Matching Your Needs: Consider your trading style, risk tolerance, and investment goals when selecting a bot.

-

Reputation and Reviews: Research the credibility of the bot provider based on customer reviews, industry recognition, and the track record of the bot’s performance.

-

Transparency: Opt for bots that provide clear documentation, detailed trading strategies, and realistic profitability expectations.

Deriv Trading Bots

Embracing the Future of Cryptocurrency Trading

Deriv trading bots are here to stay, offering traders an unparalleled level of speed, objectivity, and time efficiency. By embracing these automated tools, you can optimize your trading strategy, mitigate risks, and unlock new avenues for profit.

As the cryptocurrency landscape continues to evolve, the role of deriv trading bots will only become more pronounced. Embrace this technological advancement and empower yourself to navigate the ever-changing markets with greater confidence and success.