In the dynamic world of forex trading, identifying support and resistance levels is akin to having a crystal ball, giving you a glimpse into potential price movements and enhancing your trading strategies. Support and resistance are crucial concepts that allow traders to pinpoint areas where the trend may reverse, creating opportunities for profitable trades. This article will delve into the intricacies of identifying support and resistance in forex, empowering you with the knowledge to become a forex sniper.

Image: www.mycashbackforex.com

Decoding Support and Resistance: The Guardians of Price Action

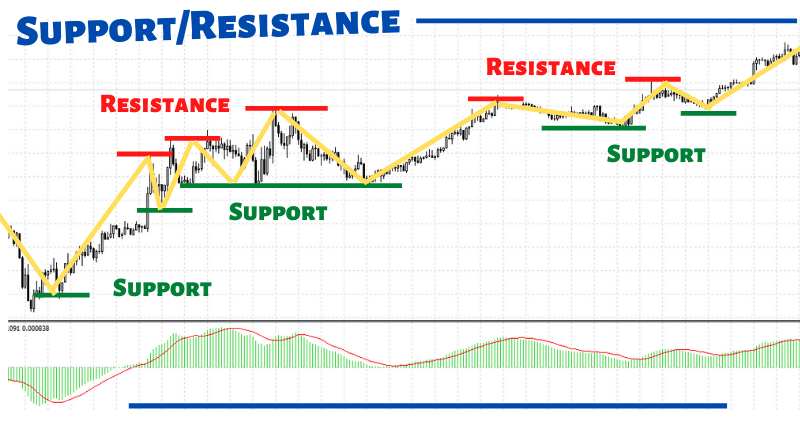

Support and resistance levels are invisible barriers that act as magnets for price action. Support is a price level where buyers step in and halt the decline, preventing further price drops. Conversely, resistance is a price level where sellers become active, suppressing price increases and marking a potential reversal point. These levels form a tug-of-war zone, where buyers and sellers engage in an intense battle for price control.

Identifying Support and Resistance: A Six-Step Approach

-

Trend Identification: Determine the overall trend of the market, identifying whether it’s an uptrend or a downtrend. The main support level for an uptrend is the recent swing low, and the main resistance is the recent swing high.

-

Horizontal Lines: Plot horizontal lines at the identified swing highs and lows to visualize potential support and resistance levels.

-

Multiple Touchpoints: Look for areas where price has repeatedly found support or resistance, creating stronger and more reliable levels.

-

Psychological Levels: Pay attention to round numbers, such as 1.0000 or 1.5000, as they often act as psychological barriers in the minds of traders and can influence price action.

-

Trendlines: Connect a series of swing highs or lows using a trendline. A broken trendline can indicate a potential reversal point.

-

Moving Averages: Use moving averages, such as the 50-day or 200-day, to smooth out price fluctuations and identify potential support and resistance zones.

Image: www.pinterest.co.uk

How To Identify Support And Resistance In Forex

Exploiting Support and Resistance: Unleashing Your Sniper Precision

Once you’ve identified support and resistance levels, you can use them to pinpoint profitable trading opportunities:

-

Buy at Support: When price approaches a support level during a downtrend, it presents a potential buying opportunity as buyers are likely to step in and halt the decline.

-

Sell at Resistance: Similarly, when price approaches a resistance level during an uptrend, it’s a potential selling opportunity as sellers are likely to become active and reverse the trend.

-

False Breakouts: Prices sometimes break through support or resistance levels, only to reverse and continue the original trend. This is called a false breakout, and it can be a profitable swing trading strategy.

-

Pending Orders: Use pending orders, such as buy stop orders at support or sell stop orders at resistance, to capitalize on potential breakouts and reversals.

In conclusion, mastering the art of identifying support and resistance in forex is a pivotal skill for successful trading. By following the outlined steps, traders can elevate their ability to anticipate price movements, seize profitable opportunities, and navigate the ever-shifting forex landscape with sniper-like precision. Remember, the key to success in forex lies in continuous learning, adaptation, and a deep understanding of the market’s ebb and flow.