Immerse Yourself in the Realm of Foreign Currency with the Ultimate Guide to Forex Cards

Image: www.slideshare.net

In the boundless tapestry of global travel and multifaceted financial transactions, forex cards emerge as indispensable tools. Whether you’re a seasoned globetrotter navigating diverse cultures or a savvy investor seeking currency exchanges with unparalleled ease, the acquisition of a forex card is an inevitable step. Yet, the question that lingers in the minds of many remains: How many days does it take to get a forex card? Embark on this comprehensive journey as we traverse the intricacies of forex card procurement with precision and clarity.

Defining Forex Cards: Your Currency Concierge on the Global Stage

A forex card, also known as a multi-currency card, is a specialized payment instrument meticulously designed to facilitate foreign currency transactions. It functions as a preloaded card, allowing you to store multiple currencies and make purchases or withdrawals in over 200 countries worldwide. Unlike traditional debit or credit cards that typically support a single currency, forex cards offer unparalleled flexibility, eliminating exchange rate fluctuations and hefty transaction fees commonly associated with international payments.

The Multifaceted Journey of Forex Card Acquisition

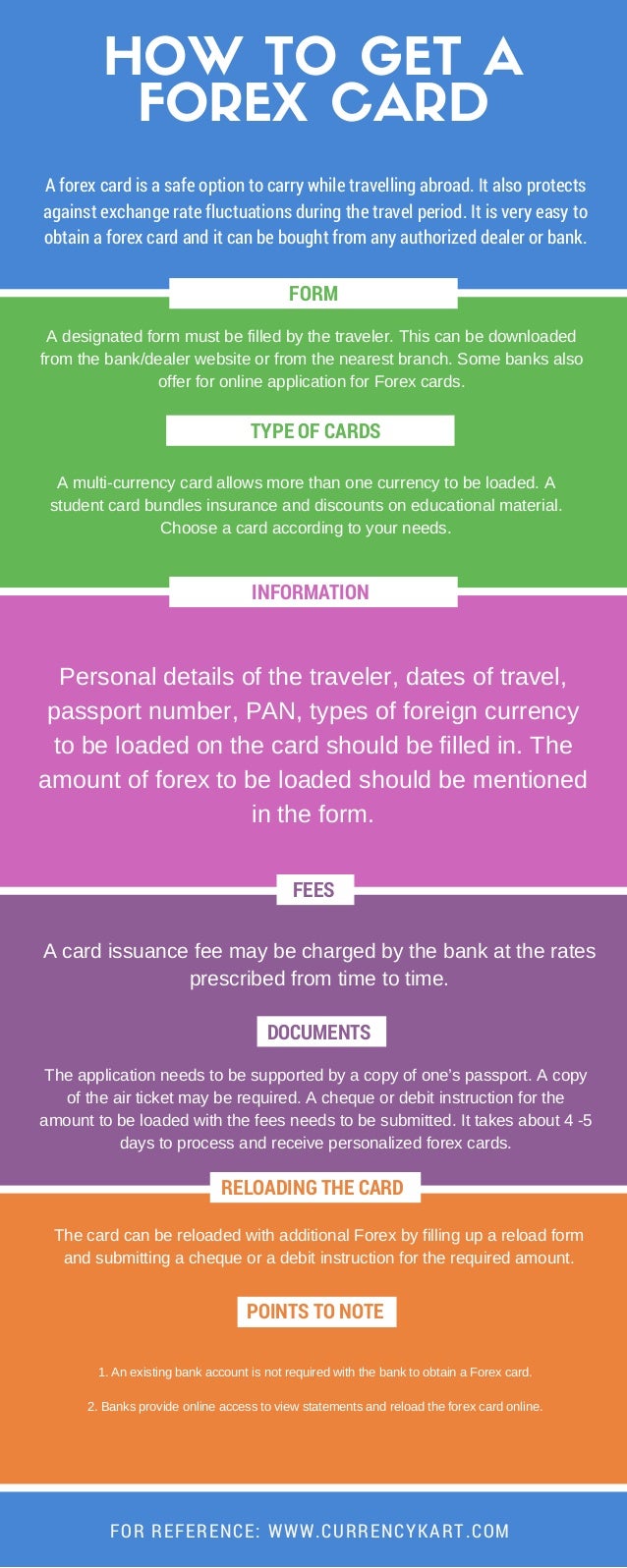

The timeline for obtaining a forex card varies depending on the issuing bank or provider. However, the general process typically encompasses a series of steps designed to ensure your identity verification, financial stability, and adherence to regulatory compliance. Let’s dissect each stage meticulously:

1. Application Initiation: Embarking on the Path to Forex Convenience

The initial phase involves completing an application form, either online or in person at a bank branch. This form typically requests personal information such as your name, address, contact details, and government-issued identification. Additionally, you may be required to furnish proof of income and employment to ascertain your financial standing.

Image: www.bankofbaroda.in

2. Identity Verification: Laying the Foundation for Trust

Once your application is received, the issuing bank meticulously verifies your identity to prevent fraudulent activities. This often entails cross-referencing your information with reputable databases and requesting supporting documentation like a passport or driver’s license.

3. Background Check: Scrutinizing for Financial Stability

In parallel with identity verification, a thorough background check is conducted to assess your financial history and creditworthiness. The bank meticulously examines your credit report to gauge your ability to manage debt and make timely payments.

4. Compliance Assurance: Navigating the Regulatory Landscape

To comply with anti-money laundering and counter-terrorism financing regulations, banks are legally obligated to conduct thorough due diligence. This may involve additional documentation requests, such as proof of address or the source of funds for large transactions.

Processing Timelines: Unraveling the Intricacies of Issuance

The processing time for a forex card can vary, predominantly influenced by the complexity of your application and the efficiency of the issuing bank. Nonetheless, as a general rule, you can anticipate the following timelines:

-

Standard Processing: For straightforward applications with minimal documentation requirements, the processing time typically ranges from 2 to 5 business days.

-

Enhanced Verification: If additional documentation is required for identity or background verification, the processing time may extend to 7 to 10 business days.

-

Complex Applications: In intricate cases involving high transaction volumes or unusual financial circumstances, the processing time may exceed 10 business days, subject to further scrutiny and review.

How Many Days To Get Forex Card

Conclusion: Embracing the Power of Forex Cards with Informed Decision-Making

Comprehending the timeline associated with forex card procurement empowers you as a discerning consumer. By meticulously following each step and diligently submitting the requisite documentation, you can expedite the process and swiftly access the transformative benefits of a forex card. These invaluable tools not only simplify foreign currency transactions but also safeguard your funds and provide unparalleled convenience on your global adventures.

As you embark on your journey of financial empowerment with a forex card, remember that knowledge is your steadfast companion. Embrace this comprehensive guide as your roadmap, navigating the intricacies of forex card acquisition with unwavering confidence. May your travels be enriched, your finances fortified, and your experiences amplified by the boundless possibilities that forex cards unfold.