Introduction:

Gone are the days of carrying bulky cash or worrying about unfavorable exchange rates abroad. The HDFC Forex Plus Card emerges as the perfect travel companion, offering a seamless, secure, and cost-effective way to manage your finances on international journeys. This comprehensive guide will delve into the nuances of the HDFC Forex Plus Card, empowering you with the knowledge to harness its benefits and elevate your travel experiences.

Image: www.pdfprof.com

What is an HDFC Forex Plus Card?

An HDFC Forex Plus Card is a prepaid card specifically designed for international travelers. It works like a debit card, allowing you to load Indian Rupees (INR) and convert them into foreign currencies at competitive exchange rates. The card can be used for:

- Making purchases at retail stores and restaurants

- Withdrawing cash at ATMs

- Booking flights and hotels

Benefits of Using HDFC Forex Plus Card:

Going beyond traditional exchange methods, the HDFC Forex Plus Card presents an array of advantages:

-

Competitive Exchange Rates: Benefit from real-time currency conversion, ensuring maximum value for your money.

-

No Hidden Charges: Enjoy transparency with zero transaction fees and no markup on conversion rates.

-

Ease of Use: Experience hassle-free payments and withdrawals, accepted globally wherever Visa or Mastercard is accepted.

-

Security and Convenience: Travel with peace of mind knowing your funds are protected with chip-based technology and 24/7 customer support.

-

Track Your Expenses: Monitor your transactions in real-time via SMS alerts and online statements, keeping you in control of your spending.

Getting Your HDFC Forex Plus Card:

Obtain your HDFC Forex Plus Card with ease:

- Visit your nearest HDFC Bank branch with your identity and address proof.

- Complete the application form and submit it along with the required documents.

- Load your card with INR and select the desired foreign currency/currencies.

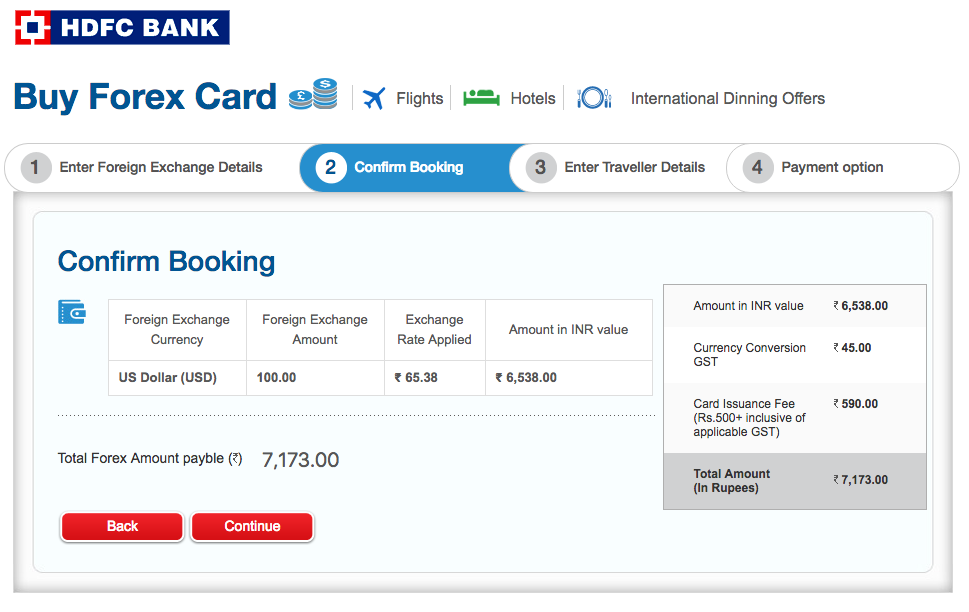

Image: www.hdfcbank.com

Using Your HDFC Forex Plus Card Abroad:

Make the most of your HDFC Forex Plus Card while traveling:

- Activate Your Card: Call the HDFC Bank Customer Care number to activate your card before using it.

- Load Foreign Currency: Load multiple currencies onto your card for flexibility and convenience.

- Manage Your PIN: Set a secure PIN for ATM withdrawals and POS transactions.

Tips for Using HDFC Forex Plus Card:

Enhance your travel experience with these valuable tips:

- Inform HDFC Bank about Your Travel: Notify the bank about your travel dates and itinerary for smooth transactions.

- Use ATMs Sparingly: While ATM withdrawals are convenient, they may incur higher fees compared to POS transactions.

- Choose Local Currency: Opt for local currency when making purchases to avoid unnecessary conversion fees.

- Monitor Your Balance: Keep track of your balance to prevent overspending and avoid card blocking.

Customer Support:

HDFC Bank provides dedicated customer support for Forex Plus Card holders:

- 24/7 Assistance: Reach out to HDFC Bank’s 24/7 customer care service for immediate assistance with your card.

- Online Support: Access your account and transactions online for easy management.

- Emergency Blocking: Report a lost or stolen card instantly to prevent unauthorized use.

Hdfc Forex Plus Card Statement

Conclusion:

The HDFC Forex Plus Card redefines international financial management, providing travelers with a secure, cost-effective, and convenient solution. Its competitive exchange rates, ease of use, and global acceptance empower you to explore the world without the burden of currency concerns. Whether you’re an occasional traveler or a seasoned globetrotter, the HDFC Forex Plus Card is your indispensable travel companion, promising a seamless and rewarding journey.