Forex trading, the realm of currency exchange, presents lucrative opportunities but also harbors a treacherous web of scams. In India, where forex trading has gained immense popularity, the prevalence of such deceptive practices has raised significant concerns. This article serves as a comprehensive guide to help you recognize and avoid forex trading scams, ensuring your financial well-being amid this high-stakes market.

Image: investedwallet.com

Defining Forex Trading Scams

Forex (Foreign Exchange) trading scams involve fraudulent schemes or misrepresentations designed to exploit unsuspecting individuals seeking financial gains. These scams often promise outsized profits, guaranteed returns, or effortless trading, enticing the gullible with false hopes. Perpetrators employ various tactics, including unregulated platforms, unlicensed brokers, and unsolicited investment proposals, to trick their victims into parting with their hard-earned money.

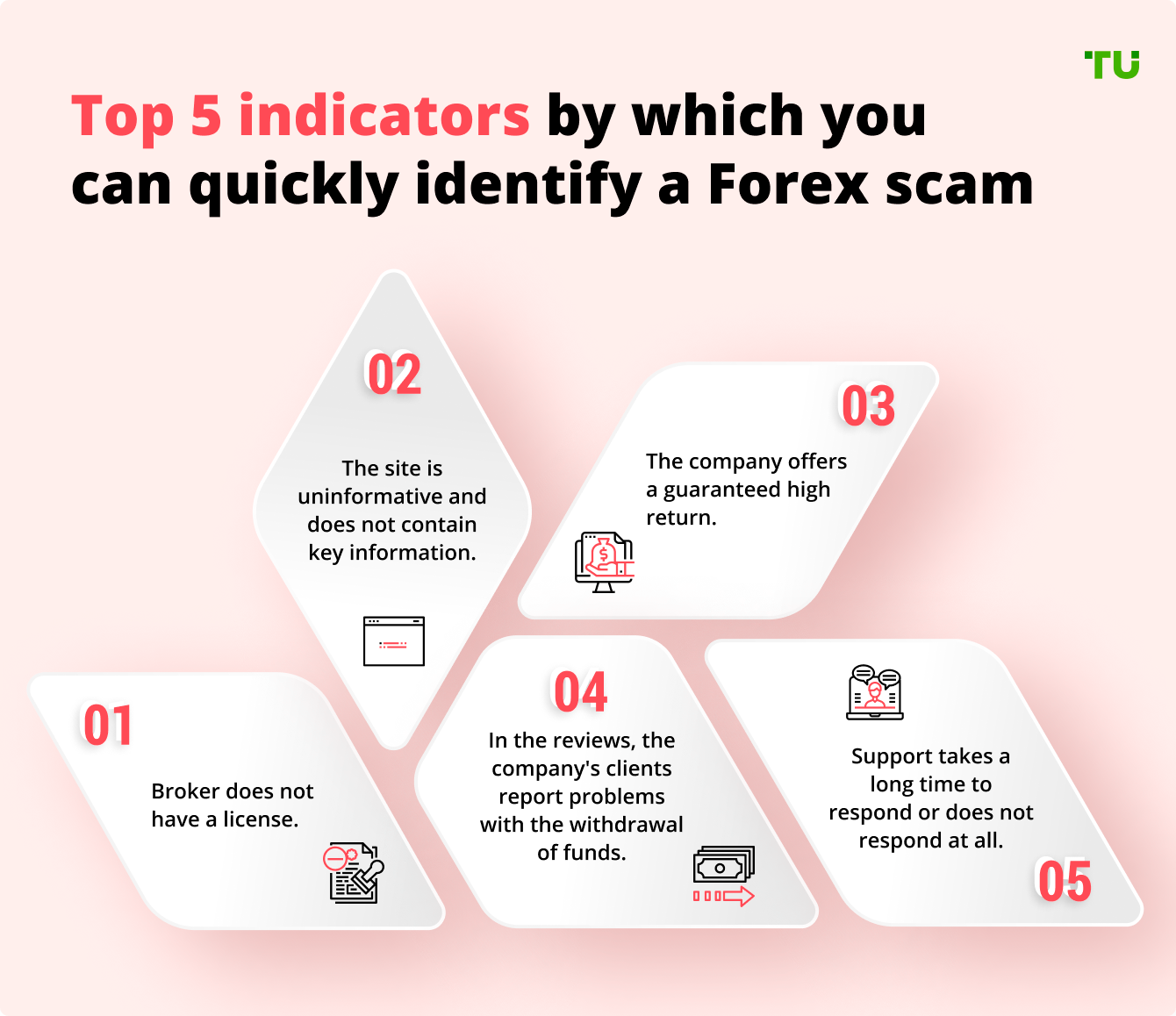

Common Red Flags of Forex Trading Scams

- Unusually High or Guaranteed Returns: Legitimate forex trading involves risk and volatility, and no entity can guarantee profits.

- Aggressive Sales Tactics and Unsolicited Contact: Scammers may employ forceful sales pitches or contact you out of the blue with irresistible offers.

- Unregulated Brokers: Ensure the broker you choose is licensed by a reputable regulatory authority, such as SEBI in India.

- Promises of Rapid or Effortless Riches: Forex trading requires skill, knowledge, and consistent effort.

- Overly Complex or Nonsensical Trading Strategies: Legitimate strategies are based on sound analysis and risk management principles.

- Lack of Transparency: Scammers often operate under false identities or provide vague information about their company and trading practices.

- Pressure to Make Quick Decisions: Scammers create a sense of urgency to rush you into making hasty investments.

Types of Forex Trading Scams

- Ponzi Schemes: These schemes promise high returns using funds from new investors, paying off earlier investors with the funds of later entrants.

- Pyramid Schemes: Similar to Ponzi schemes, these scams involve individuals recruiting new members to earn commissions, rather than from actual trading.

- Pump-and-Dump Scams: Scammers manipulate the prices of specific currencies or cryptocurrencies through coordinated efforts, inflating their value before selling their holdings at a profit.

- Robot Scams: These scams promote automated trading software that promises consistent profits without human intervention, often featuring deceptive testimonials.

- Clone Firms: Scammers impersonate legitimate forex brokers to gain credibility and lure unsuspecting investors.

Image: tradersunion.com

Protecting Yourself from Forex Trading Scams

- Conduct thorough research before selecting a forex broker or investment platform.

- Choose licensed and regulated brokers that adhere to industry standards and best practices.

- Be wary of unsolicited investment offers or aggressive sales tactics.

- Understand the risk involved in forex trading and avoid unrealistic expectations.

- Educate yourself about forex trading to empower yourself against scams.

- Consult financial advisors or reputable resources for guidance and support.

- Report suspicious activities to regulatory authorities like SEBI and the RBI.

Forex Trading Scams In India

Conclusion

Forex trading scams pose a significant threat to financial well-being, particularly in a rapidly growing market like India. By understanding the common red flags, types of scams, and protective measures, investors can safeguard themselves from falling prey to these fraudulent schemes. Remember, forex trading involves risk, and while it can offer opportunities for profit, caution and informed decision-making are paramount. By equipping yourself with knowledge and vigilance, you can navigate the forex market successfully and avoid the pitfalls of scams.