Introduction

In the fast-paced world of financial markets, foreign exchange (forex) trading has emerged as a lucrative opportunity for traders of all levels. With the advent of advanced trading platforms like MetaTrader 4 (MT4), accessing the global currency market has become more accessible than ever. This article aims to provide a comprehensive guide to forex trading on MT4, empowering you to navigate the complexities of the market and unlock its profit potential.

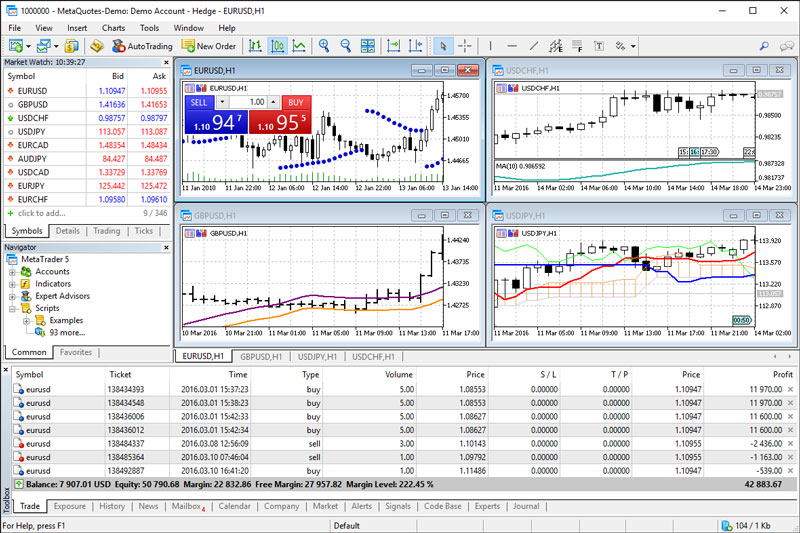

Image: s3.eu-central-1.amazonaws.com

MetaTrader 4 is a powerful and versatile trading platform that offers a wide range of features and tools specifically designed for forex traders. Its user-friendly interface, customizable charts, and advanced analysis capabilities make it an indispensable tool for both experienced professionals and aspiring traders. By mastering the basics of forex trading on MT4, you can tap into the vast liquidity and potential of the global currency market and harness its opportunities.

Understanding Forex Trading

Forex trading involves buying and selling currencies in pairs, such as EUR/USD or GBP/JPY. The exchange rate between two currencies determines how much of one currency is required to purchase a unit of the other. By speculating on the future direction of exchange rates, traders can make profits from upward or downward price movements.

Forex trading is conducted over-the-counter (OTC), meaning it is not traded on a centralized exchange like stocks or bonds. This decentralized nature provides liquidity around the world, enabling traders to enter and exit trades quickly and easily. However, it also means that forex trading is not regulated in the same way as other financial markets, which can involve some risks.

Getting Started with MetaTrader 4

To begin trading forex on MT4, you will need to download and install the platform from the official website of MetaQuotes Software Corporation, the company behind MT4. Once installed, you will need to open a live trading account with a reputable forex broker.

When selecting a forex broker, it is important to consider factors such as spreads (the difference between the bid and ask prices), commissions, account types, and the availability of customer support. Once you have chosen a broker and funded your account, you can connect it to MT4 and start trading.

Navigating the MetaTrader 4 Interface

The MT4 interface is designed to be user-friendly and intuitive, even for beginners. The central panel displays a list of all available trading instruments, including major currency pairs, commodities, and indices. The chart window below the instrument list provides real-time price data for the selected instrument.

On the left side of the platform, you will find the Market Watch window, which shows the current bid and ask prices for each instrument. Below the Market Watch window are the Navigator and Terminal windows, which provide access to account information, trading history, and additional tools.

Image: www.datisnetwork.com

Technical Analysis and Charting

One of the key aspects of forex trading is technical analysis, which involves studying price charts to identify patterns and trends. MT4 offers a comprehensive set of technical indicators and charting tools that traders can use to analyze market data and make informed trading decisions.

Some of the most popular technical indicators include moving averages, Bollinger Bands, and MACD. These indicators can help traders identify trends, overbought or oversold conditions, and potential trading opportunities. MT4 also allows you to create and save custom indicators, providing endless possibilities for market analysis.

Placing and Managing Trades

To place a trade on MT4, simply select the desired trading instrument in the Market Watch window and click on the “New Order” button. This will open the Order Window, where you can specify the trade parameters, including the trade type (market order, limit order, or stop order), the order size, and the stop-loss and take-profit levels.

Once a trade is placed, it will appear in the “Trade” tab in the Terminal window. You can monitor the progress of your trade and manage it as needed, such as adjusting the stop-loss or take-profit levels or closing the trade manually.

Risk Management and Position Sizing

Risk management is paramount in forex trading. Proper position sizing is crucial to minimize losses and protect your capital. A good rule of thumb is to risk only a small percentage of your account balance on any single trade. MT4 offers tools such as the Trade Calculator to help you calculate the potential risk and reward of a trade before you enter it.

Forex Trading On Metatrader 4

https://youtube.com/watch?v=VhnfDwOXX4c

Conclusion

Forex trading on MetaTrader 4 provides traders with a powerful platform and a vast array of tools to navigate the global currency market. By understanding the basics of forex trading, mastering the MetaTrader 4 interface, and implementing sound risk management practices, you can unlock the potential of this dynamic market and pursue profitable opportunities. Remember to conduct thorough research, stay up-to-date with market news and events, and continuously refine your trading strategies to increase your chances of success in forex trading.