Introduction:

In the ever-evolving global financial landscape, understanding foreign exchange rates holds paramount importance for individuals and businesses alike. Federal bank forex rates, the benchmarks for currency conversions, play a pivotal role in international trade, travel, and investments. This article unveils the nuances of federal bank forex rates, unraveling their significance and empowering readers with valuable insights to make informed decisions.

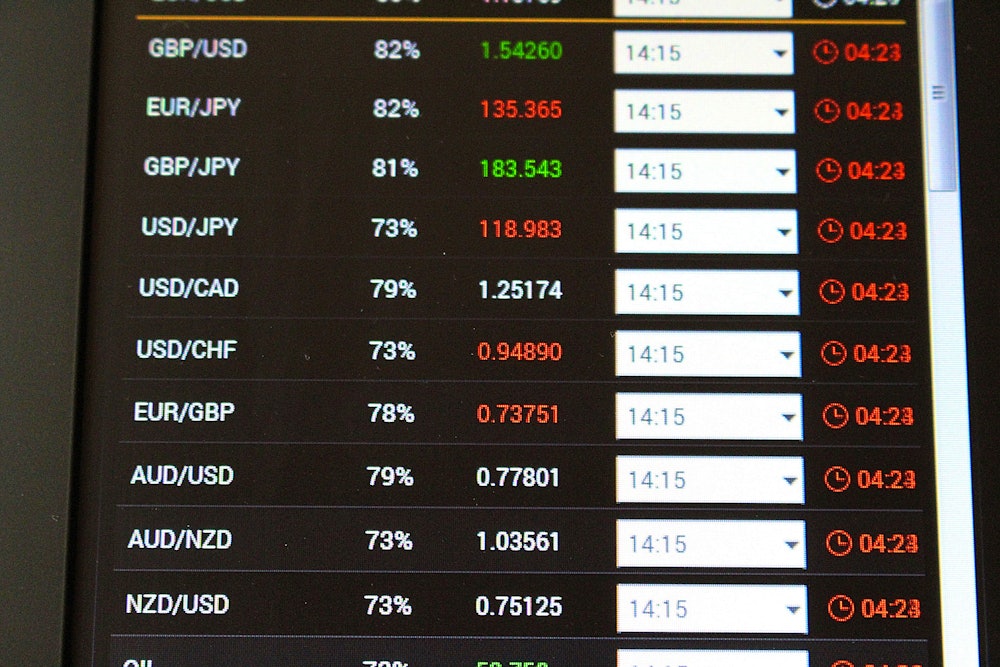

Image: whatbeautytips.blogspot.com

Dive into the complexities of federal bank forex rates, unraveling their significance and empowering readers with valuable insights to make informed decisions.

Delving into Federal Bank Forex Rates:

What are Federal Bank Forex Rates?

Federal bank forex rates are the official exchange rates determined and disseminated by a nation’s central bank. These rates serve as the benchmark for financial institutions, businesses, and individuals when transacting foreign currencies.

Factors Influencing Federal Bank Forex Rates:

A myriad of factors influence federal bank forex rates, including:

-

Interest rate differentials: Central banks adjust interest rates to control inflation, economic growth, and currency value, leading to fluctuations in exchange rates.

-

Economic growth: Strong economic growth signals a high demand for the country’s currency, leading to its appreciation.

-

Political stability: Political uncertainty and instability can erode confidence in a currency, resulting in its depreciation.

-

Global events: Major geopolitical events, such as wars or natural disasters, can significantly impact forex rates.

Image: www.wikijob.co.uk

Types of Federal Bank Forex Rates:

Federal banks typically set two types of forex rates:

-

Spot rate: The exchange rate applicable for immediate transactions.

-

Forward rate: The exchange rate agreed upon for future transactions, locking in the exchange at a set time and date.

Understanding the Significance of Federal Bank Forex Rates:

Impact on International Trade:

Forex rates directly impact the cost of importing and exporting goods and services. Favorable exchange rates can enhance competitiveness, while unfavorable ones increase costs.

Influence on Travel:

Fluctuating forex rates can significantly affect travel expenses, particularly when exchanging currency at banks or currency exchange bureaus.

Implications for Investments:

Currency conversions play a crucial role in international investments, as investors seek to maximize returns by taking advantage of exchange rate movements.

Harnessing Forex Rates for Informed Decisions:

Monitoring Exchange Rate Trends:

Stay informed of the latest economic and political developments that impact forex rates through reputable news sources and financial portals.

Utilizing Currency Conversion Tools:

Leverage online tools and apps that provide real-time exchange rates and allow you to compare rates from different financial institutions.

Seeking Professional Guidance:

Consult with financial advisors or currency brokers for tailored advice on managing forex risk and optimizing currency conversions.

Federal Bank Forex Rates Today

Conclusion:

Federal bank forex rates are multifaceted metrics that significantly influence global financial transactions. By delving into their complexities, individuals and businesses can navigate the complexities of foreign exchange and make informed decisions that optimize their financial outcomes. As the world becomes increasingly interconnected, understanding federal bank forex rates has become imperative for anyone seeking to navigate the global economy with confidence.