Embrace Clarity and Maximize Your Forex Potential

In the dynamic realm of forex trading, acronyms and abbreviations abound, often leaving traders scratching their heads. Among these enigmatic terms lies DTFC, a cryptic code that has puzzled many a newcomer. But fear not, for in this comprehensive guide, we shall unravel the mystery of DTFC, empowering you with profound knowledge to navigate the forex markets with precision.

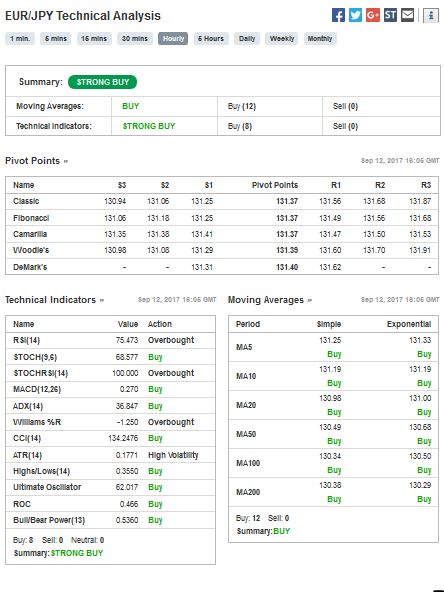

Image: www.forexfactory.com

Forex, an abbreviation for foreign exchange, stands as the largest and most liquid financial market globally. Traders from diverse corners of the world flock to this global bazaar, seeking to profit from fluctuating currency values. Understanding the nuances of forex trading is paramount to success in this fiercely competitive arena.

DTFC – Unveiling the Enigma

DTFC, in the context of forex, stands for “Don’t Trust For Consolation.” This acronym serves as a stern warning to traders, cautioning them against the perils of relying solely on technical indicators or trading signals. While these tools can be valuable guiding lights, they should never be blindly trusted.

The forex market is a complex and ever-evolving beast, swayed by myriad factors ranging from economic news and political events to central bank decisions. No single indicator or signal can consistently predict market movements with foolproof accuracy. Overreliance on such tools can lead traders down a treacherous path paved with false hope and substantial losses.

Cultivating Informed Trading Decisions

To thrive in the forex arena, traders must cultivate a nuanced understanding of market dynamics. This entails diligent analysis of fundamental factors, technical indicators, and market sentiment. By synthesizing these diverse perspectives, traders can gain a more comprehensive view of the market landscape, empowering them to make calculated and informed trading decisions.

Technical indicators, for instance, can provide valuable insights into past and present market behavior. However, it is crucial to remember that these indicators are based on historical data and cannot reliably predict future price movements. They should be employed as complementary tools, not as infallible guides.

Wisdom from the Trenches – Expert Advice

In the tumultuous world of forex trading, experience is a priceless asset. Seasoned traders have weathered countless market storms and possess a wealth of wisdom to share. Here are some invaluable tips gleaned from their collective experiences:

- Risk Management is Paramount: Always adhere to prudent risk management practices. Determine your risk tolerance, set realistic profit targets, and employ stop-loss orders to limit potential losses.

- Avoid Emotional Trading: Emotions can cloud judgment and lead to impulsive decisions. Strive to remain detached from market fluctuations and stick to your trading plan with unwavering discipline.

- Embrace Continuous Learning: The forex market is constantly evolving, and so should your knowledge. Devote time to studying market dynamics, economic indicators, and trading strategies. This ongoing pursuit of knowledge will sharpen your analytical skills and keep you abreast of the ever-changing financial landscape.

Image: www.forexbroker.com

Frequently Asked Questions About DTFC

To further clarify the concept of DTFC and its implications for forex trading, here are some frequently asked questions along with their concise and informative answers:

- Q: What is the significance of DTFC in forex trading?

A: DTFC reminds traders to exercise caution and avoid placing excessive trust in technical indicators or trading signals. - Q: How can I make more informed trading decisions?

A: Conduct thorough analysis of fundamental factors, technical indicators, and market sentiment. Incorporating multiple perspectives enhances your understanding of market dynamics. - Q: Is it possible to rely solely on technical indicators for successful trading?

A: While technical indicators can provide valuable insights, they should not be relied upon exclusively. Market movements are influenced by a complex interplay of factors, and overdependence on any single indicator can lead to missed opportunities or substantial losses.

Dtfc Full Form In Forex

https://youtube.com/watch?v=FnItIE7DtFc

Conclusion: Empowering You to Conquer DTFC

DTFC serves as a poignant reminder that successful forex trading demands a balanced approach that incorporates both technical analysis and an astute understanding of market fundamentals. By heeding this advice, you can avoid falling into the trap of overreliance on technical indicators and empower yourself to make informed trading decisions that maximize your chances of success in the ever-evolving forex market.

Are you eager to delve deeper into the world of forex trading? Share your questions and insights in the comments section below, and let us continue this educational journey together. Remember, knowledge is the key to unlocking your full potential in this thrilling and rewarding financial arena.