Introduction

In the tumultuous realm of forex trading, where precision and timely decisions reign supreme, technical analysis software stands as an indispensable ally for traders seeking to decipher market intricacies and seize lucrative opportunities. By meticulously analyzing historical price data, these software solutions empower traders to identify trends, patterns, and potential trading signals, providing a distinct edge in the fast-paced forex market.

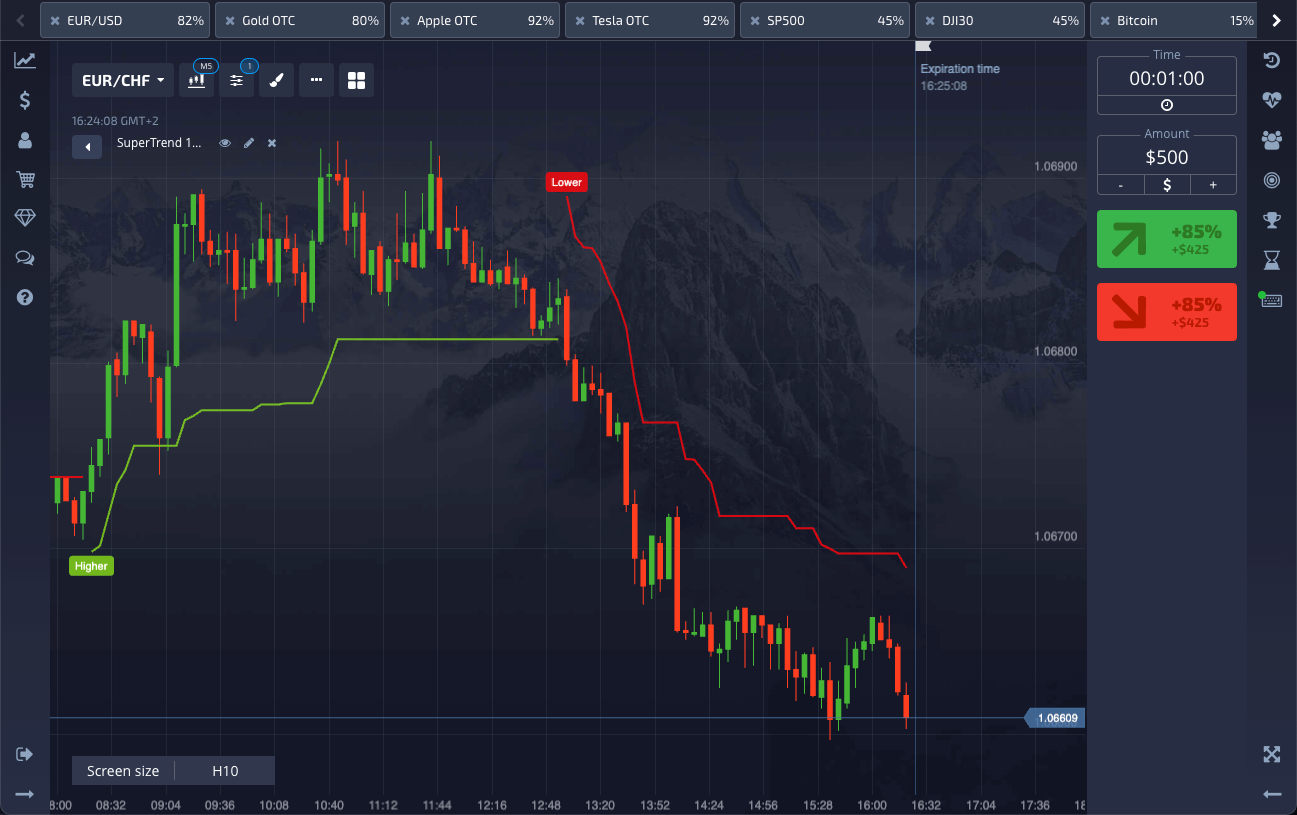

Image: mexicobpo.weebly.com

Navigating the Myriad of Options

Selecting the optimal technical analysis software for your forex trading endeavors can be a daunting task amidst the plethora of options available. To assist traders in their quest, we embark on an in-depth exploration of the leading software solutions, delving into their features, advantages, and suitability for various trading strategies.

MetaTrader 4 and MetaTrader 5: Industry Standard Software

MetaTrader 4 and MetaTrader 5, developed by MetaQuotes Software, have ascended to prominence as the industry-leading technical analysis platforms. Renowned for their user-friendly interface, extensive charting capabilities, and vast ecosystem of third-party plugins, these software solutions have become the de facto choice for a multitude of forex traders.

TradingView: A Feature-Rich Web-Based Solution

TradingView has garnered acclaim as a comprehensive web-based platform offering an unparalleled range of technical analysis tools. Its intuitive interface and highly customizable charting features cater to both novice and seasoned traders alike, enabling them to conduct in-depth market analysis and share trading ideas seamlessly.

Image: tradingwalk.com

eSignal: Advanced Technical Analysis Powerhouse

Seasoned technical analysts hold eSignal in high regard for its sophisticated charting and analysis capabilities. The software’s advanced tools for identifying patterns, conducting backtesting, and developing trading strategies make it a compelling option for traders seeking an edge in complex market conditions.

NinjaTrader: Ideal for Order Flow Analysis

Traders specializing in order flow analysis find NinjaTrader to be an invaluable companion. The software’s intuitive interface, user-defined hotkeys, and advanced charting tools empower traders to analyze order flow dynamics, identify market imbalances, and make informed trading decisions.

Choosing the Right Software for Your Trading Needs

The choice of technical analysis software hinges upon the trader’s individual preferences, trading strategy, and skill level. Beginner traders may find web-based platforms like TradingView appealing due to their ease of use and accessibility. Intermediate traders seeking more sophisticated tools may gravitate towards MetaTrader 4 or MetaTrader 5, while advanced traders requiring advanced charting and analysis capabilities may find eSignal or NinjaTrader more suitable.

Essential Features to Consider

When evaluating technical analysis software, traders should prioritize the following core features:

Charting Capabilities: Comprehensive charting capabilities are paramount, enabling traders to visualize price data and identify trends, patterns, and support and resistance levels. Look for software that offers customizable chart types, multiple timeframes, and various drawing tools.

Technical Indicators: A wide selection of technical indicators is vital for conducting thorough technical analysis. Ensure the software includes a comprehensive library of both basic and advanced indicators, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI).

Backtesting Functionality: Backtesting allows traders to simulate trading strategies and evaluate their performance on historical data. This feature is invaluable for refining trading strategies and assessing their viability.

Real-Time Data: Real-time data is crucial for making informed trading decisions. Choose software that provides real-time market data with minimal delays and supports various data sources, such as brokers and data vendors.

Ease of Use: User-friendliness is essential, especially for novice traders. Look for software with an intuitive interface, easy-to-navigate menus, and clear documentation to facilitate a smooth learning curve.

Best Technical Analysis Software For Forex

Conclusion

In the competitive world of forex trading, technical analysis plays a pivotal role in identifying profitable trading opportunities. By leveraging the power of technical analysis software, traders gain the ability to analyze historical price data, identify market trends, and make informed trading decisions. From novice traders to seasoned professionals, the choice of the right technical analysis software can significantly enhance trading performance and yield substantial returns. By carefully considering the features, capabilities, and suitability of various software solutions, traders can equip themselves with the insights necessary to navigate the complexities of the forex market and achieve trading success.