Introduction to Forex Trading:

In the realm of global finance, foreign exchange (forex) trading has emerged as a dynamic and lucrative avenue for profit seeking individuals. The allure of leveraging currency fluctuations to generate wealth has captivated the imagination of experienced investors and aspiring traders alike. However, embarking on this exhilarating journey requires a thorough understanding of the forex market, its intrinsic complexities, and a judicious assessment of personal circumstances.

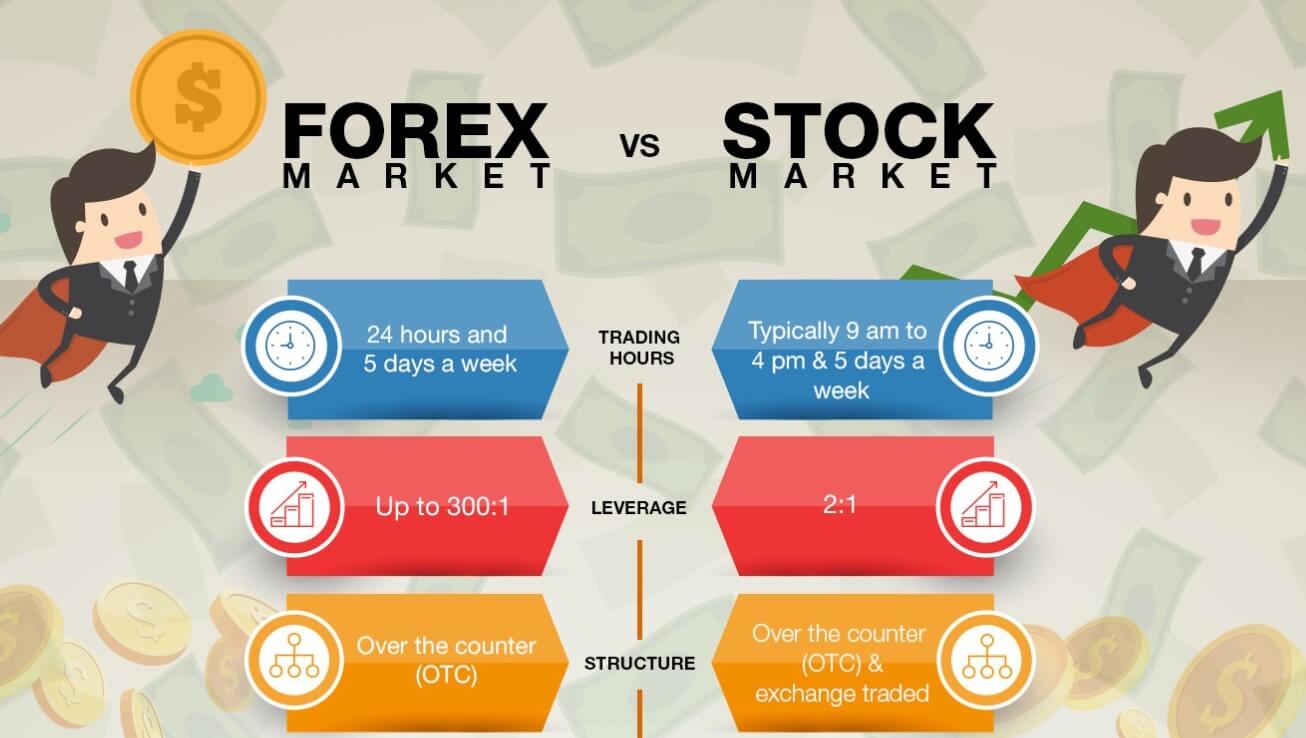

Image: www.forex.academy

Assessing Your Readiness for Forex Trading:

Before delving into the intricacies of forex trading, it is imperative to introspect and ascertain one’s suitability for this demanding endeavor. This introspection should encompass an honest evaluation of risk tolerance, financial resilience, and psychological fortitude. Forex trading, by its very nature, entails inherent risks, and the potential for substantial losses looms large. It is therefore paramount to possess a solid financial foundation, capable of withstanding potential market downturns.

Moreover, forex trading demands a high level of emotional resilience, enabling traders to navigate the rollercoaster of market sentiments and remain steadfast in the face of temporary setbacks. Impulsivity, fear, and greed are formidable foes that can lead to irrational trading decisions and erode profits. Only those who possess the discipline to adhere to a structured trading plan, grounded in sound risk management strategies, should consider venturing into this volatile arena.

A Glimpse into the Forex Trading Ecosystem:

Forex trading, the largest financial market in the world, facilitates the buying and selling of currencies from different countries. Unlike traditional stock markets, forex trading transpires 24 hours a day, 5 days a week, allowing traders to capitalize on currency fluctuations around the clock. This continuous trading environment presents both immense opportunities and formidable challenges.

Unraveling Forex Trading Strategies and Techniques:

The vast forex market offers a plethora of trading strategies, each tailored to specific risk appetites and market conditions. Scalping, day trading, swing trading, and trend following are but a few examples of the diverse approaches employed by forex traders. Regardless of one’s chosen strategy, a disciplined mindset, meticulous risk management, and a deep understanding of technical analysis are indispensable for long-term success.

Image: naimistupo.blogspot.com

Latest Trends and Innovations in Forex Trading:

The forex market is constantly evolving, with technological advancements and evolving market dynamics shaping its landscape. The advent of automated trading systems, utilizing sophisticated algorithms to execute trades, has revolutionized the way forex traders operate. Furthermore, the proliferation of social media platforms has created vibrant online communities, where traders can share insights, exchange ideas, and glean valuable market knowledge.

Expert Forex Trading Tips for Aspiring Traders:

Seasoned forex traders, through years of experience in the trenches, have accumulated a wealth of invaluable insights that can guide aspiring traders toward success. These time-tested tips, if diligently applied, can enhance trading performance and mitigate risks.

-

Develop a Comprehensive Trading Plan: Define your trading objectives, risk tolerance, and entry and exit strategies.

-

Master the Art of Technical Analysis: Study price charts, identify patterns, and employ technical indicators to forecast market movements.

-

Manage Your Risk: Implement stop-loss orders, position sizing strategies, and risk-reward ratios to protect your capital.

-

Stay Updated on Economic News and Events: Global economic events, political developments, and central bank announcements can significantly impact currency valuations.

-

Seek Continuous Education: Attend webinars, read books, and engage with experienced traders to deepen your knowledge and refine your skills.

Frequently Asked Questions on Forex Trading:

Q: Is forex trading a pyramid scheme?

A: No, forex trading is not a pyramid scheme. It is a legitimate financial market where currencies are traded.

Q: Can you make a lot of money from forex trading?

A: Yes, it is possible to make money from forex trading. However, it requires significant skill, discipline, and risk management.

Q: How much money do you need to start forex trading?

A: The amount of money you need to start forex trading depends on your trading style and risk tolerance. Most brokers require a minimum deposit of $100-$500.

Should I Do Forex Trading

Conclusion:

Forex trading offers the potential for substantial financial rewards; however, it is imperative to proceed with caution and a realistic understanding of the risks involved. Only those who are willing to embark on a journey of continual learning, disciplined risk management, and unwavering emotional resilience should consider pursuing this exhilarating yet demanding endeavor.

Are you interested in learning more about forex trading? Let us know in the comments below.