Introduction

In the tapestry of international trade and travel, the foreign exchange card (forex card) has emerged as an indispensable tool, seamlessly bridging the currency divide and empowering individuals to navigate the financial complexities of a globalized world. This article aims to unravel the inner workings of the forex card, deciphering its intricate mechanisms and showcasing its myriad benefits, empowering you to experience the world with newfound financial freedom.

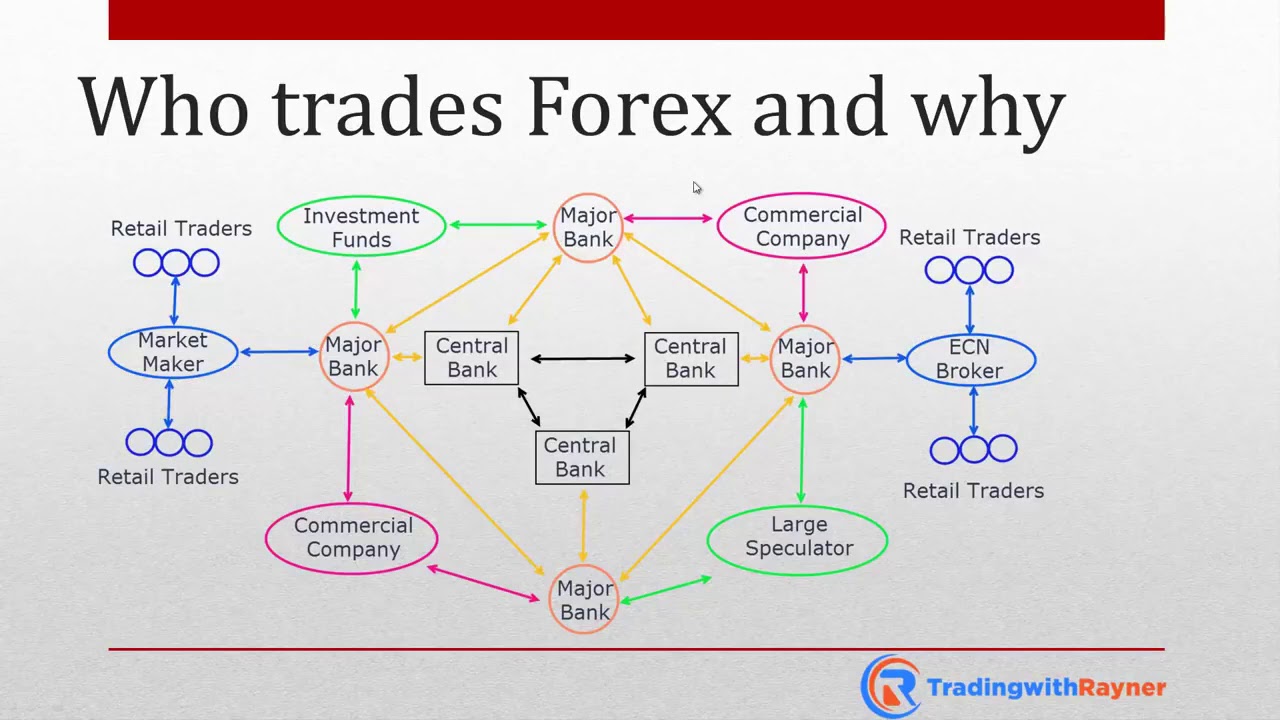

Image: www.youtube.com

The Forex Card: An Overview

A forex card, also known as a currency card or multi-currency card, is a prepaid card loaded with multiple currencies, allowing holders to make purchases, withdraw cash, and conduct other financial transactions abroad without incurring steep currency exchange fees or unfavorable rates. Unlike traditional credit or debit cards, forex cards offer real-time exchange rates, eliminating hidden charges and ensuring transparency in every transaction.

How Does a Forex Card Work?

The operation of a forex card follows a straightforward process:

-

Card Issuance: Forex cards are typically issued by banks, currency exchange agencies, and online providers. Upon application, the card is linked to a designated bank account, and you can choose which currencies to load onto the card.

-

Currency Loading: Once the card is issued, you can load it with currencies of your choice using multiple methods, including online portals, mobile apps, or in-person transactions at authorized outlets.

-

Transaction Processing: When you make a purchase or withdraw cash abroad, the transaction amount is automatically converted from the currency of the transaction into the base currency of the card. The conversion rate is determined by the prevailing interbank rates, ensuring the most favorable exchange rates available.

-

Reimbursement: The funds used for transactions are deducted from the corresponding currency balance on the card. If the balance in a particular currency is insufficient, the card automatically draws from other available currencies, ensuring uninterrupted spending.

Benefits of Using a Forex Card

The benefits of using a forex card are multifaceted and far-reaching:

-

Favorable Exchange Rates: Forex cards offer competitive exchange rates, significantly lower than the fees charged by traditional banks or currency exchange kiosks. This can translate into substantial savings, especially on large transactions or extended trips abroad.

-

Transparency and Predictability: Forex cards eliminate hidden charges and surcharges, providing clarity and predictability in financial transactions. You can view real-time exchange rates before conducting any transaction, empowering you to make informed decisions.

-

Multi-Currency Support: Forex cards allow you to carry multiple currencies simultaneously, eliminating the need to exchange cash or carry multiple cards. This simplifies financial management and provides peace of mind while traveling to multiple destinations.

-

Global Acceptance: Forex cards are accepted worldwide at millions of ATMs, point-of-sale terminals, and online merchants. This ensures seamless transactions regardless of your location, liberating you from the constraints of local currency limitations.

-

Emergency Funds: Forex cards can serve as a convenient and secure way to carry emergency funds while traveling. In the event of an unexpected situation, you can access funds quickly and easily, providing peace of mind far away from home.

Image: bestcardinfo.com

Expert Insights

Financial experts echo the advantages of using forex cards, emphasizing their cost-effectiveness and ease of use.

“Forex cards offer a convenient and cost-effective solution for travelers and global citizens. By locking in favorable exchange rates and eliminating hidden fees, they provide substantial savings and peace of mind,” says Anna Thomas, a renowned travel expert.

Practical Tips for Using Forex Cards

To maximize the benefits of using a forex card, consider these practical tips:

-

Choose a reputable provider: Opt for a reliable and established financial institution or currency exchange service to ensure favorable rates and secure transactions.

-

Load currencies wisely: Research your destination’s currency needs and load the card accordingly. Consider anticipated expenses and the duration of your stay to optimize currency allocation.

-

Monitor exchange rates: Stay informed about currency fluctuations and take advantage of favorable exchange rates whenever possible. Utilize currency tracking tools or consult reliable financial sources for up-to-date information.

-

Set transaction limits: Establish daily or weekly transaction limits to prevent unauthorized spending or overdraft charges.

-

Be aware of fees: While forex cards generally offer competitive exchange rates, some may have additional fees, such as inactivity fees or withdrawal charges. Familiarize yourself with these fees to avoid unexpected expenses.

How Does The Forex Card Work

Conclusion

The forex card has revolutionized the way we manage finances abroad, providing a convenient, cost-effective, and secure means of navigating global currency transactions. By understanding how a forex card works, its benefits, and practical tips for use, you can unlock the world with financial confidence, embracing the freedom to explore, trade, and connect with a truly global mindset.