Unveiling the Invisible Hand: Economic News and its Impact on Forex

The foreign exchange (forex) market, a global network where currencies are traded, is a fast-paced environment where every move canripple through the financial world. Amidst this volatility, economic news serves as a guiding compass, providing traders and investors with indispensable insights into the health and direction of economies. These economic indicators have a profound impact on currencies, shaping their value and determining their trajectory within the forex market. Stay tuned to catch the waves of economic news and leverage them for your forex trading endeavors.

Image: forexseo.com

The Symphony of Economic Indicators: A Chorus of Critical Information

Economic news encompasses various reports, releases, and announcements that paint a vivid picture of an economy’s underlying strength and performance. These critical data points include:

- Gross domestic product (GDP): Measures the total value of goods and services produced within a country, providing a comprehensive snapshot of economic activity.

- Inflation: Indicates the pace at which prices rise, shedding light on the purchasing power of a currency.

- Interest rates: Set by central banks, these rates influence the cost of borrowing, impacting both consumer spending and business investments.

- Employment data: Unemployment rates and job creation figures offer insights into the health of the labor market, a crucial aspect of economic growth.

- Consumer confidence indices: Measure the degree of optimism among consumers, an essential gauge of future economic activity.

Harnessing the Power of Economic News for Forex Success

By closely monitoring economic news, traderscan make informed trading decisions, anticipating market movements and capitalizing on opportunities. For instance, a robust GDP report often strengthens a currency, while weak inflation data can trigger a devaluation.

Expert Insights and Proven Strategies for Forex Traders

- Stay informed: Subscribe to newsfeeds and track reliable sources to stay abreast of the latest economic releases.

- Understand the impact: Study the historical correlation between economic news and currency movements to gauge the potential impact on exchange rates.

- Be nimble: The forex market reacts swiftly to news, so be prepared to adjust positions and react quickly to shifting market conditions.

- Manage risks: Use stop-loss orders and other risk management tools to mitigate potential losses.

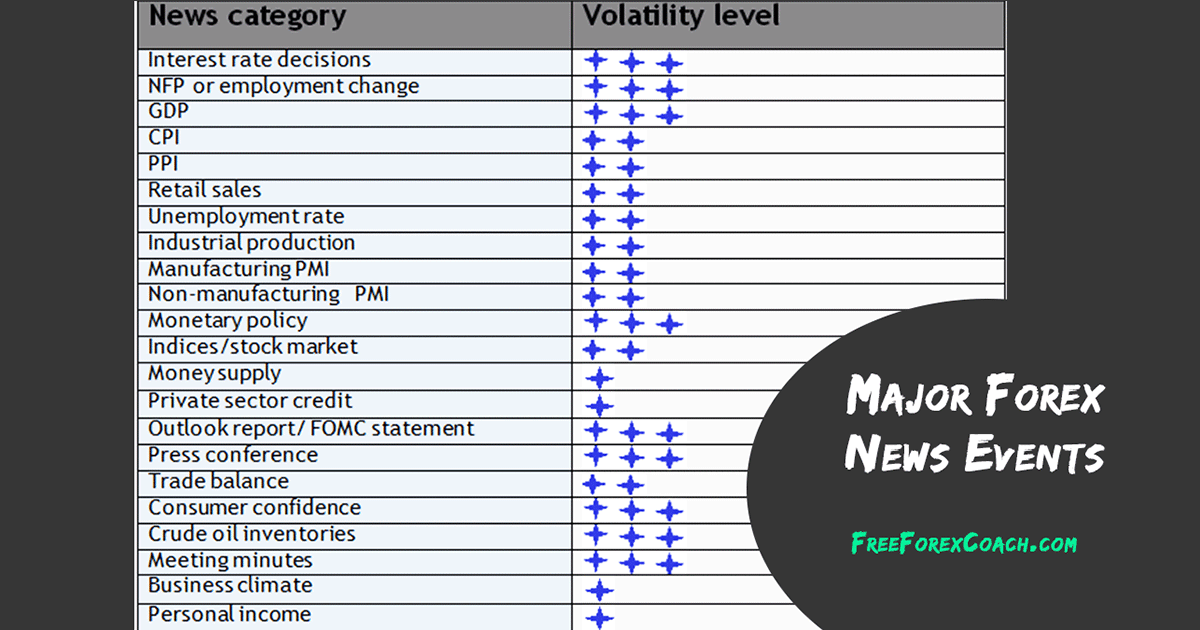

Image: freeforexcoach.com

FAQs: Demystifying Economic News and Forex Trading

Q: What is the most important economic news for forex traders?

A: While the specific relevance of economic news varies depending on the currency pair traded, GDP, inflation, interest rates, and employment data are generally considered the most influential.

Q: How do I stay updated on economic news?

A: Utilize financialnews websites, subscribe to email alerts, or follow reputable news sources on social media for real-time updates.

Q: How can I use economic news to improve my forex trading?

A: By understanding the potential impact of economic news on currency values, traders can make informed decisions, adjust their positions, and harness market opportunities.

Most Important Economic News Forex

Conclusion: Embracing Economic News for Forex Success

In the dynamic world of forex trading, it is imperative to have a firm grasp of the economic news landscape. By decoding the symphony of economic indicators, traders can navigate market volatility with confidence, making sound judgments that align with the ebb and flow of economies. Embrace the power of economic news, let it guide your trading decisions, and witness your forex endeavors transform into a harmonious symphony of success.

Are you ready to harness the power of economic news and elevate your forex trading journey? Take the next step now and unleash the potential that awaits.