In the realm of international finance, forex transfers play a pivotal role in facilitating cross-border payments, currency conversions, and global investments. Whether you’re a seasoned traveler, an online shopper, or a business venturing into new markets, understanding forex transfers to bank accounts is essential for navigating the complexities of international money movement.

Image: akowedananipa.web.fc2.com

Forex, short for foreign exchange, refers to the global market where currencies are traded. When transferring forex from one currency to another, you essentially convert it at the prevailing exchange rate. The process involves several interconnected players, including banks, currency exchanges, and brokers, ensuring the seamless conversion and transfer of funds.

The Importance of Forex Transfers: A Globalized Perspective

In today’s interconnected world, forex transfers are indispensable for:

- International payments: Sending money abroad for business or personal expenses, such as tuition fees, property purchases, or family remittances.

- Currency trading: Participating in the global currency market to speculate on exchange rate fluctuations and potentially profit.

- Foreign investments: Investing in stocks, bonds, or real estate in countries with different currencies, maximizing investment opportunities.

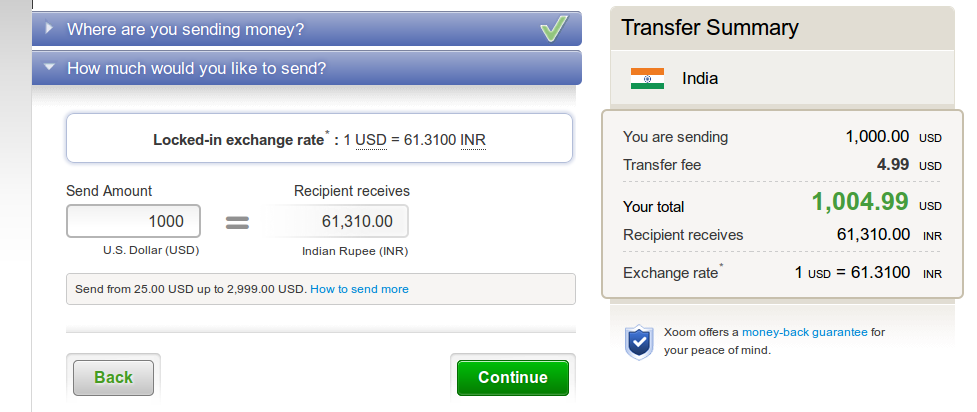

Understanding Exchange Rates: The Key to Currency Conversion

The exchange rate is the price of one currency in terms of another. It determines how much of one currency you receive when you convert it to another. Exchange rates are constantly fluctuating based on supply and demand, economic conditions, and political events.

When transferring forex, it’s important to be aware of the following types of exchange rates:

- Spot rate: The real-time exchange rate at the time of the transaction.

- Forward rate: An agreed-upon exchange rate for a future date, used to lock in a rate for anticipated future payments.

- Interbank rate: The wholesale exchange rate negotiated between banks, often the most favorable rate available.

Choosing the Right Exchange Platform: A Matter of Fees and Convenience

Several options are available when choosing a platform for your forex transfer: banks, currency exchanges, and online brokers. Each option has its advantages and disadvantages.

- Banks: Offer stability, physical branches, and secure transactions, but may have higher fees and limited exchange rate options.

- Currency exchanges: Provide competitive rates and quick transfers, but may have limited currency options and lack physical presence.

- Online brokers: Offer a range of currency options, flexibility, and potentially lower fees, but may require a higher transaction volume and may not have physical locations.

Image: 25penny.com

Tips for Maximizing Your Forex Transfer: Saving Money and Time

Here are some tips to help you get the most out of your forex transfer:

- Compare exchange rates: Use online comparison tools to find the best rates from different providers.

- Negotiate fees: Don’t hesitate to ask for lower fees, especially if you’re a regular customer.

- Use a currency exchange account: This can streamline your transfers and provide access to more favorable rates.

- Consider using a forward contract: If you expect future currency value changes, a forward contract can lock in a favorable rate.

- Watch for hidden fees: Some providers charge hidden fees, such as transfer fees or administrative costs, so be sure to read the fine print.

Forex Transfer To Bank Account

https://youtube.com/watch?v=mN-5yaz-hhI

Conclusion: Empowering Global Transactions

Forex transfers to bank accounts are essential tools for navigating the international financial landscape. Whether you’re sending money abroad, converting currencies, or investing in foreign markets, understanding exchange rates, choosing the right platform, and maximizing your transfer efficiency is crucial.

By embracing these strategies, you can navigate the forex market confidently, save money on transaction fees, and enhance your global financial reach. Remember, in the ever-changing world of finance, knowledge is power, and knowledge of forex transfers empowers you to make informed decisions that open up a world of financial possibilities.