In the dynamic world of forex trading, predicting trends can be akin to navigating a celestial tapestry. However, with the right tools and techniques, traders can decipher the subtle whispers of the market and gain an edge in their endeavors. This comprehensive guide will illuminate the intricacies of forex trend prediction, providing a roadmap to success for both seasoned and aspiring traders.

Image: instaforex.org

Embracing the Essence of Forex Trends

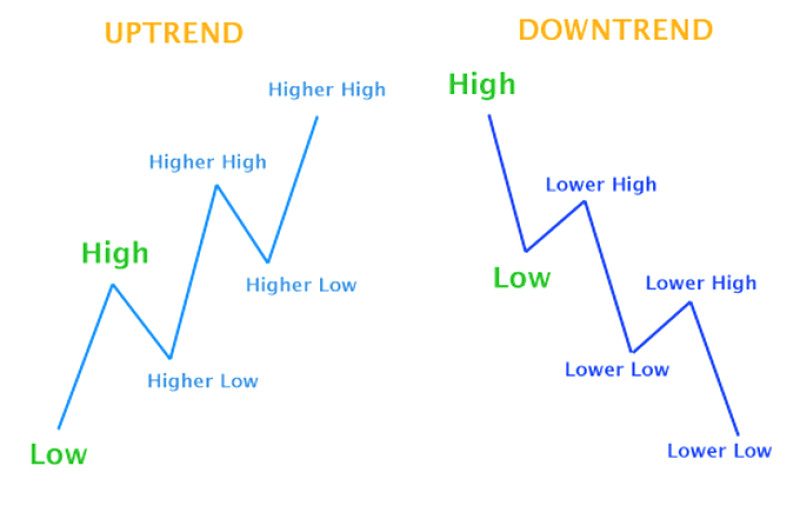

Forex trading revolves around the exchange of currencies, such as the US dollar, the euro, and the Japanese yen. These currencies are traded in pairs, with each pair exhibiting its unique set of behaviors and trends. A trend reflects the consistent rise or fall in the value of a currency pair over time. Accurately predicting these trends can empower traders to make informed decisions, maximizing profits and minimizing losses.

Decoding the Market’s Language: Technical Analysis

Technical analysis, a cornerstone of forex trading, involves analyzing historical price data to identify patterns and trends. By studying charts and graphs, traders can gain insights into the market’s behavior. One popular technical analysis tool is the candlestick chart, which provides visual cues representing open, close, high, and low prices for a given time period. Candlesticks can reveal candlestick patterns, such as the bullish engulfing pattern, which indicate a shift from a downtrend to an uptrend.

Moving averages, another widely used technical indicator, smooth out price fluctuations, helping traders identify the overall trend. Fibonacci retracement levels and support and resistance zones are also integral to technical analysis, offering traders valuable insights into potential price targets and areas where trends may reverse.

Harnessing the Power of Fundamental Analysis

While technical analysis focuses on price action, fundamental analysis examines the underlying economic factors that influence currency values. Factors such as interest rates, inflation, GDP growth, and political stability all play a crucial role in shaping forex trends. By staying abreast of economic news and data releases, traders can gauge the impact on currency pairs and make informed predictions.

Central bank decisions, for instance, can have a significant effect on currency values. When a central bank raises interest rates, it can make its currency more attractive to investors, leading to an appreciation in value. Conversely, a rate cut can weaken the currency. Understanding these economic fundamentals provides traders with a deeper layer of analysis to complement their technical insights.

Image: www.pinterest.ca

The Art of Trend Confirmation: Combining Techniques

In the realm of forex trend prediction, confirmation is key. Reliance on a single indicator or technique can lead to false signals. A prudent approach involves combining multiple techniques to enhance confidence in trend predictions.

For instance, a trader may identify an uptrend using technical analysis, such as a bullish candlestick pattern and a moving average sloping upwards. To confirm this trend, the trader can assess fundamental factors, such as positive economic data or news of an interest rate hike in the country of the base currency.

Conversely, if the fundamental analysis contradicts the technical signals, the trader may need to reassess their trend prediction or wait for further confirmation. By triangulating information from various sources, traders can minimize the risk of false signals and make more informed decisions.

Mastering the Art of Market Timing

Timing is everything in forex trading, and predicting trends is one aspect of the equation. Once a trend has been identified, traders need to determine the optimal time to enter or exit a trade. This involves setting stop-losses to mitigate risk, identifying profit targets, and managing positions effectively.

Risk-to-reward ratios should be carefully considered, ensuring that potential profits outweigh potential losses. Money management strategies, such as position sizing and hedging, can also help traders preserve capital and enhance their trading performance over time.

How To Predict Trends In Forex

Embracing the Evolving Nature of Forex Markets

The forex market is a dynamic and ever-evolving landscape. Trends can change rapidly, and traders must remain adaptable and continuously refine their skills. Keeping up with the latest economic developments, technological advancements, and market news is crucial to maintaining an edge in the ever-changing world of forex trading.

By adopting a comprehensive approach that combines technical and fundamental analysis, traders can navigate the complexities of forex trends and increase their chances of success. Remember, mastering the art of forex trend prediction requires dedication, practice, and a willingness to continuously learn and adapt to the evolving market conditions.