Introduction

Have you ever wondered why the price of a loaf of bread in India is different from that in the United States? Or why a new iPhone costs more in one country than another? The answer lies in the foreign exchange (forex) rate, the value of one country’s currency relative to another. In this comprehensive guide, we will delve into the intricate world of forex exchange rates in India, empowering you with the knowledge to navigate currency fluctuations and protect your financial interests.

Understanding Forex Exchange Rates

Forex exchange rates represent the amount of one currency that must be exchanged to get one unit of another currency. They are determined by supply and demand, influenced by factors such as economic growth, inflation, interest rates, and political stability. India’s forex exchange rate is primarily determined by the interplay of domestic and international economic factors, including its foreign trade, foreign investment, and the demand for its currency in global markets.

Historical Perspective and Key Factors

The Indian rupee has historically been subject to fluctuations against major currencies like the US dollar. Significant events, such as economic reforms in the 1990s and global financial crises in the 2000s, have impacted the rupee’s value. The Reserve Bank of India (RBI), India’s central bank, plays a crucial role in managing the forex exchange rate, intervening when necessary to prevent extreme volatility.

Implications for Foreign Currency Exchange

Understanding forex exchange rates is essential for individuals and businesses engaging in foreign currency exchange. Tourists, students, business travelers, and importers/exporters need to be aware of the prevailing exchange rate to optimize their transactions and avoid unnecessary losses. Fluctuations in the forex rate can affect the cost of travel, education, and imports or exports.

Expert Insights and Practical Tips

Dr. Raghuram Rajan, former Governor of the RBI, emphasizes the importance of “considering long-term economic fundamentals and avoiding short-term speculation” when dealing with forex rates. He advises individuals to “be patient, monitor the market, and make informed decisions.” Foreign currency exchange platforms offer valuable services to facilitate smooth transactions and provide competitive rates. Choosing a reliable and secure platform is essential to ensure peace of mind.

Navigating Currency Fluctuations

A volatile forex market can pose challenges for those dealing with foreign currencies. Engaging in forward contracts or currency hedging techniques can help mitigate risks associated with exchange rate fluctuations. Individuals and businesses can also monitor economic news and market forecasts to stay informed about potential movements in the forex rate.

Conclusion

Navigating forex exchange rates in India requires a comprehensive understanding of their dynamics and practical strategies to manage financial risks. By staying informed about economic indicators, monitoring market trends, and utilizing expert insights, individuals and businesses can make informed decisions, protect their financial well-being, and seize opportunities in the global market. Remember, while forex exchange rates can fluctuate, the knowledge acquired through this guide will empower you to navigate currency challenges confidently.

Image: www.business-standard.com

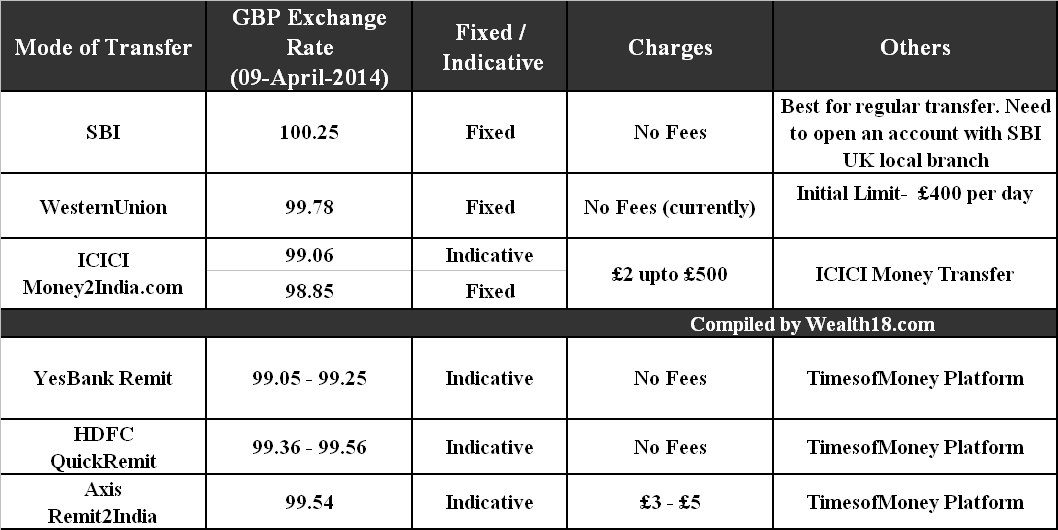

Image: wealth18.com

Forex Exchange Rate In India