Image: db-excel.com

Delving into the world of forex trading, one crucial aspect that often determines a trader’s success or failure is their ability to manage their money effectively. A well-crafted money management system serves as a roadmap, guiding traders through the volatile terrain of currency markets and maximizing their chances of navigating the challenges ahead.

Defining Money Management in Forex Trading

Money management in forex trading encompasses a set of strategies and techniques employed by traders to control and mitigate financial risk. It involves determining the appropriate position size, leverage, and risk-reward ratios for each trade. By adhering to a disciplined money management system, traders can prevent impulsive decisions driven by emotions or irrational market fluctuations, leading to more informed and controlled trading endeavors.

Essential Components of an Effective Money Management System

At the core of a robust money management system lie several key components:

1. Risk Management:

Traders must assess their risk tolerance and establish a predefined level of risk they’re willing to accept per trade. This risk appetite serves as a foundation for determining appropriate trade size and leverage.

Image: riset.guru

2. Position Sizing:

Determining the appropriate position size is crucial to managing risk and maximizing reward potential. Traders should establish a consistent methodology for calculating position size based on their risk appetite, account balance, and the market volatility.

3. Leverage:

Leverage is a powerful tool that can magnify both profits and losses. Traders should carefully consider their risk tolerance and experience level before employing leverage and use it judiciously to enhance their potential returns.

4. Stop-Loss Orders:

Stop-loss orders are invaluable risk management tools that help traders limit potential losses by automatically closing trades if the market moves against their position.

5. Take-Profit Orders:

Take-profit orders play a complementary role to stop-loss orders. They enable traders to lock in profits by executing trades once a predefined price target is reached.

Benefits of a Well-defined Money Management System

Adopting a rigorous money management system offers numerous advantages for forex traders:

-

Reduced Risk Exposure: By establishing clear guidelines for position size and leverage, traders can effectively control their financial risk.

-

Improved Emotional Control: A disciplined system helps traders stay grounded during market fluctuations, preventing impulsive decisions driven by emotions or fear.

-

Increased Consistency: A structured approach to money management promotes consistency in trading behavior, reducing the likelihood of erratic decision-making.

-

Long-term Sustainability: By preserving capital and managing risk effectively, traders increase their chances of long-term success and sustainability in the forex markets.

Choosing and Implementing a Money Management System

The choice of money management system depends on the individual trader’s risk tolerance, trading style, and capital availability. Some popular systems include:

-

Fixed-Ratio: This system involves trading a fixed percentage of the account balance per trade, regardless of market volatility.

-

Kelly Criterion: This more advanced system calculates optimal position size based on historical data, risk tolerance, and expected profit margin.

-

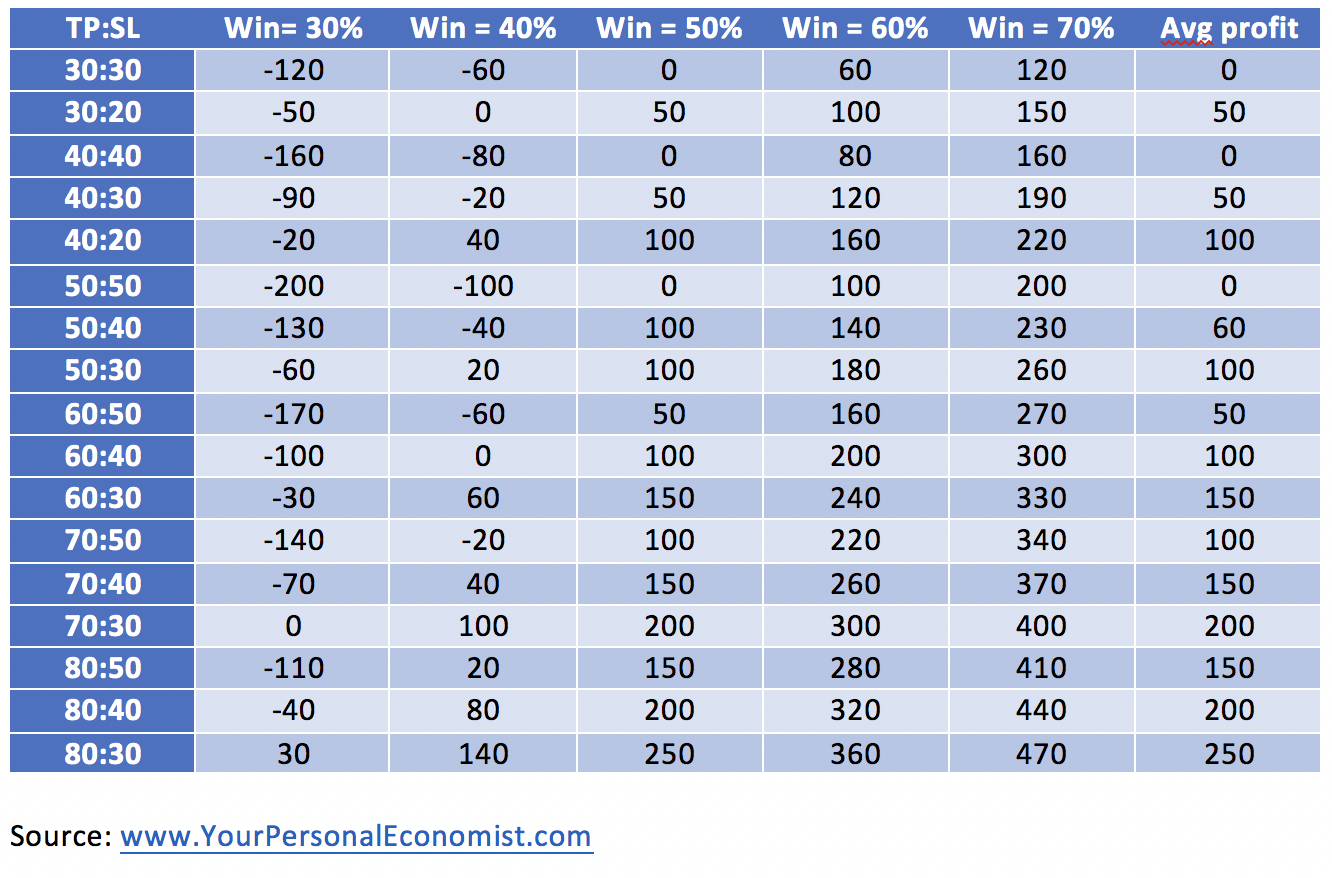

Risk-Reward Ratio: This system emphasizes balancing potential rewards with risk, ensuring that potential profits outweigh potential losses.

Implementation involves integrating the chosen system into the trading process and adhering to it consistently. Regular evaluation and adjustments are crucial to ensure alignment with market dynamics and changes in the trader’s circumstances.

Disciplined Execution and Continuous Improvement

Maintaining a money management system requires discipline and self-control. It entails adhering to the established guidelines even when faced with market volatility or emotional fluctuations. Self-evaluation and continuous improvement are essential to optimize the system based on lessons learned and changes in the trading environment.

Forex Trading Money Management System

Conclusion

A well-defined money management system serves as an indispensable foundation for successful forex trading. By controlling risk, managing position size, leveraging wisely, and adhering to a disciplined approach, traders can significantly improve their chances of navigating the challenges and unlocking the opportunities presented by the forex markets. Embracing a robust money management system empowers traders to