Introduction

In the realm of financial markets, forex trading stands out as a lucrative avenue for investors seeking to generate lucrative returns. With daily earnings reaching impressive heights, the allure of forex trading has captivated traders worldwide. But how much can you realistically earn in a day? And what strategies can you employ to maximize your earnings? Embark on this comprehensive guide as we delve into the heart of forex trading, exploring its intricacies and arming you with the insights necessary to unlock your full earning potential.

Image: www.beyond2015.org

Understanding Forex Trading: A Gateway to Global Markets

Forex trading, short for foreign exchange trading, involves the buying and selling of currencies from different countries. Unlike stocks or commodities, forex trading is conducted over-the-counter (OTC), connecting buyers and sellers directly through a vast network of banks and institutions. This decentralized structure fosters unmatched liquidity, enabling traders to execute trades swiftly and efficiently.

Factors Influencing Daily Forex Trading Earnings

The amount you can earn in forex trading per day is influenced by several key factors, including:

- Trading Capital: The amount of capital you invest directly impacts your potential earnings. A larger capital base allows you to trade larger positions, increasing the scope for profits.

- Market Volatility: Forex markets are known for their volatility, with currency prices fluctuating constantly. Higher volatility presents opportunities for substantial gains but also elevates the risk of losses.

- Trading Strategy: Your trading strategy dictates how you enter and exit the market, influencing your overall earnings. Different strategies cater to varying risk appetites and market conditions.

- Risk Management: Effective risk management practices help safeguard your capital and maximize returns. Techniques like setting stop-loss orders and managing position size are crucial for long-term success.

Proven Strategies for Optimizing Forex Trading Earnings

To maximize your daily forex trading earnings, consider implementing the following strategies:

- Scalping: This short-term trading strategy involves profiting from tiny price movements over brief periods, typically within minutes or seconds.

- Day Trading: Day traders capitalize on intraday market fluctuations, entering and exiting trades within the same trading day to avoid overnight risks.

- Swing Trading: Swing traders hold positions for several days or weeks, seeking to profit from larger price swings.

- Position Trading: Position traders maintain positions for even longer periods, aiming to capture long-term trends in currency markets.

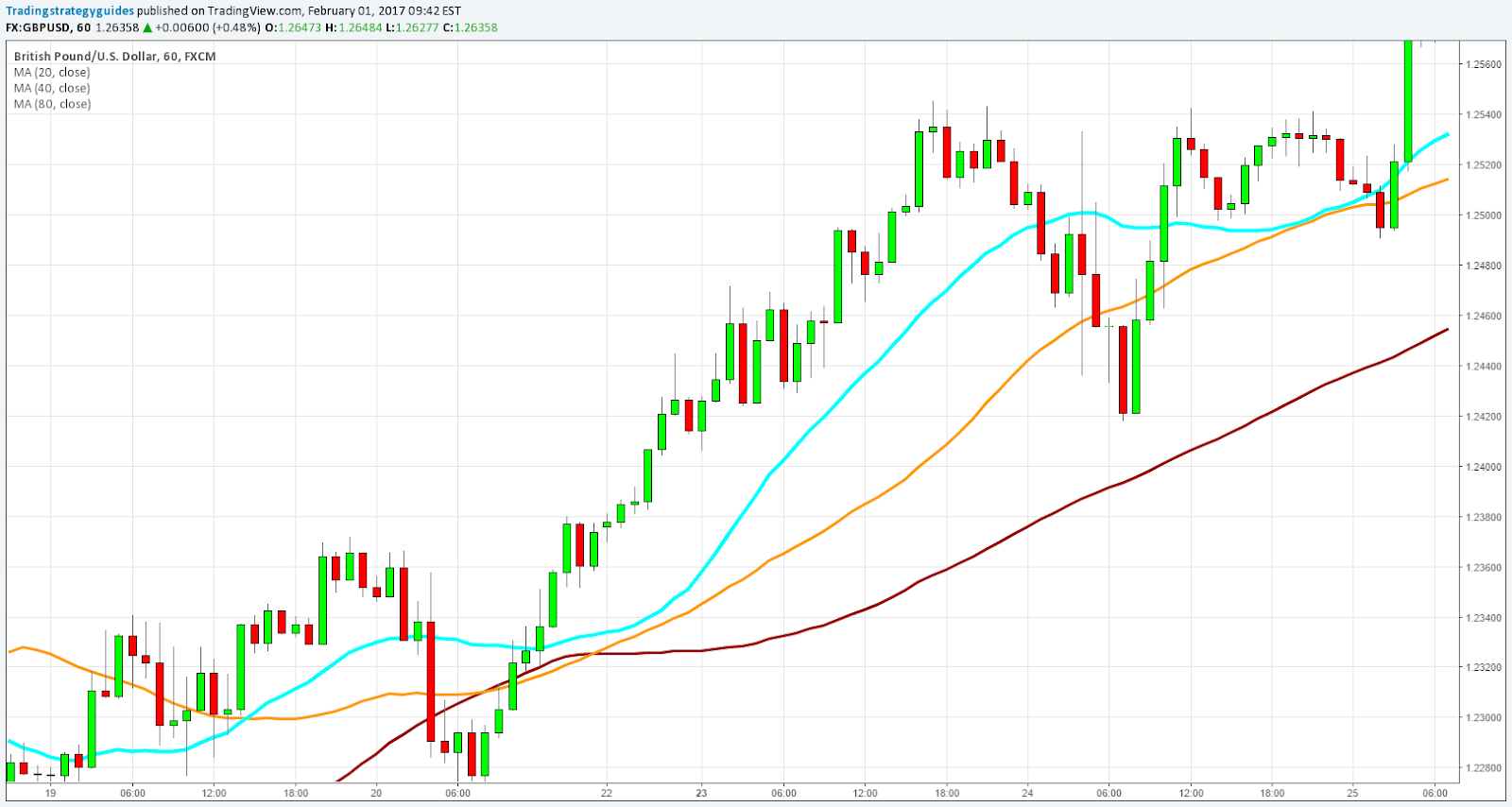

Image: www.dolphintrader.com

Leverage Discipline and Risk Management for Consistent Profits

While forex trading offers the potential for substantial earnings, it’s imperative to approach it with discipline and prudent risk management. Here are some essential principles to follow:

- Establish Realistic Expectations: Don’t chase excessive profits or expect overnight riches. Forex trading requires patience, strategy, and realistic goals.

- Manage Risk Effectively: Use stop-loss orders to limit potential losses and position size wisely to avoid risking more than you can afford to lose.

- Control Your Emotions: Greed and fear can sabotage trading decisions. Stay disciplined and stick to your trading plan, even in turbulent markets.

- Continuously Educate Yourself: Forex markets are constantly evolving. Stay abreast of the latest market trends, trading strategies, and economic events.

Forex Trading Earnings Per Day

Conclusion

Forex trading presents a compelling opportunity to generate lucrative daily earnings. While the exact amount you can earn depends on various factors, implementing sound strategies, managing risk effectively, and maintaining discipline can significantly enhance your earnings potential. By embracing a continuous learning mindset and adhering to proven principles, you can unlock the full potential of the forex markets and pave the way for financial success. Remember, as with any financial endeavor, investing in forex carries both rewards and risks. Approach trading with caution, seeking guidance from reputable sources and managing your expectations wisely.