Forex trading holds immense potential for financial gains, but it also demands a deep understanding of profit calculation. Plotting your path to success begins with grasping this crucial aspect of the trading game. Join us as we embark on a comprehensive journey, unraveling the intricacies of calculating profit in forex trading.

Image: forextradingontdameritrade.blogspot.com

Profit – The Essence of Forex Trading

In the world of forex, profit blossoms from the difference between the purchase and sale prices of currency pairs. This fundamental principle governs every transaction, and comprehending it is paramount.

Imagine you step into the forex arena and purchase the EUR/USD pair at 1.1200. With fortune on your side, the pair ascends to 1.1300. This upward surge signifies a profit of 100 pips, translating to a gain of $10 for every standard lot traded.

Formula for Precision: Profit Calculation

The formula for calculating your forex trading profit is as lucid as it gets:

Profit = (Closing Price – Opening Price) Contract Size Number of Lots

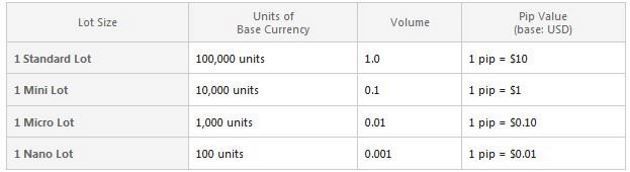

Breaking it down, the closing price represents the price at which you exit the trade, while the opening price symbolizes the point of entry. Contract size, typically 100,000 units of the base currency, signifies the volume of the transaction. Finally, the number of lots denotes the quantity of contracts traded.

For instance, if you buy one standard lot of EUR/USD (100,000 euros) at 1.1200 and sell it at 1.1250, your profit calculation would be:

Profit = (1.1250 – 1.1200) 100,000 1 = $500

Leverage: The Power Tool of Forex Trading

Leverage, a double-edged sword in the forex realm, allows traders to wield amplified purchasing power. By tapping into the magic of leverage, you can trade with sums far exceeding your account balance.

Yet, it’s crucial to tread cautiously with leverage. While it magnifies potential profits, it also magnifies potential losses. Prudence dictates using leverage judiciously, ensuring a comfortable margin of safety.

Image: old.sermitsiaq.ag

Slippage: The Unseen Cost of Execution

Slippage, the subtle thief in forex trading, arises when the actual execution price differs from the anticipated price. This often occurs during periods of high volatility, when the market moves swiftly, leaving orders scrambling to catch up.

Slippage can nibble away at your profits or even transform potential gains into losses. To minimize its impact, opt for market orders that execute trades instantly, albeit at the prevailing market price.

Expert Insight: Embracing the Wisdom of Success

To truly master the art of calculating profit in forex trading, heed the wisdom of seasoned traders:

-

Precise entries and exits: Meticulous planning and pinpoint execution are the cornerstones of successful forex trading.

-

Risk management: Managing risk is not a mere afterthought but an integral part of every trade. Assess your risk appetite thoroughly.

-

Discipline and patience: Forex trading is a marathon, not a sprint. Stay disciplined, control your emotions, and cultivate patience.

How To Calculate Profit In Forex Trading

Conclusion: The Path to Profit

The journey of calculating profit in forex trading is an ongoing pursuit of knowledge and experience. By embracing the principles elucidated above, you lay the groundwork for a prosperous trading career.

Remember, forex trading is a challenging yet rewarding endeavor. With perseverance and a thirst for knowledge, you can unlock the secrets of profit calculation and emerge as a formidable force in the forex market.