Navigating the Forex Trading Landscape in the USA

Embarking on your forex trading journey in the United States requires selecting a reliable and reputable broker. With a plethora of options available, discerning the best forex broker in the USA can be a daunting task. This comprehensive guide will equip you with the essential knowledge and tools to make an informed decision, empowering you to maximize your trading potential.

Image: www.bizcommunity.com

Factors to Consider When Choosing a Forex Broker

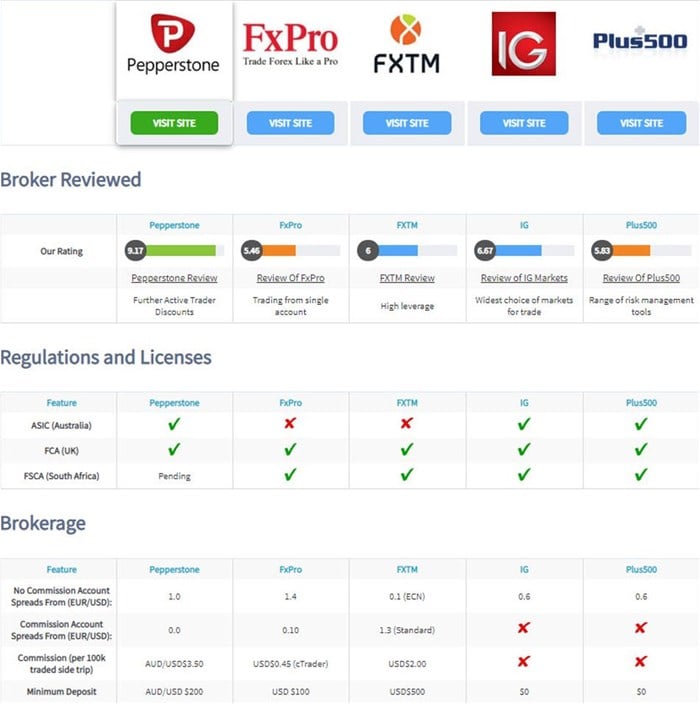

1. Regulation and Licensing

Ensure your broker is licensed and regulated by a reputable financial authority in the USA, such as the National Futures Association (NFA) or the Commodity Futures Trading Commission (CFTC). This ensures adherence to industry standards, regulatory oversight, and protection against fraudulent activities.

2. Spreads and Commissions

Trading costs, including spreads and commissions, directly impact your profitability. Choose a broker with competitive spreads and low commission rates to minimize your expenses.

Image: www.forexcracked.com

3. Account Types and Trading Conditions

Select a broker that offers account types tailored to your trading experience and risk tolerance. Consider the minimum deposit requirement, maximum leverage available, and swap fees to match your trading strategies.

4. Trading Platform

Choose a broker that provides a user-friendly and intuitive trading platform. It should offer advanced features and analytical tools, support multiple trading strategies, and ensure seamless order execution.

5. Customer Support and Education

Access to reliable customer support is crucial for timely assistance and resolving queries. Additionally, consider brokers that provide educational resources, webinars, and training materials to enhance your trading knowledge and skills.

Latest Trends and Developments in Forex Trading

Stay informed about the latest industry updates, market trends, and technological advancements. Utilize news sources, forums, and social media platforms to gather insights from experts and stay abreast of regulatory changes.

Tips and Expert Advice for Selecting the Best Forex Broker

- Read reviews and testimonials from other traders to gain firsthand perspectives.

- Test different trading platforms through demo accounts before committing to a broker.

- Seek guidance from experienced traders or financial advisors to gain valuable insights.

- Consider brokers offering bonuses or promotions to enhance your trading experience.

- Stay updated with market news and industry regulations to navigate market volatility and risks.

Remember, choosing the right forex broker is a critical decision that can significantly impact your trading success. By carefully evaluating your needs and leveraging these tips, you can select a reliable and reputable broker that aligns with your trading aspirations.

FAQs on Forex Trading in the USA

-

Q: How do I open a forex trading account in the USA?

A: Contact a regulated forex broker licensed by the NFA or CFTC and submit the required documentation, including a government-issued ID, proof of address, and tax identification number.

-

Q: What is the minimum deposit requirement to start trading forex in the USA?

A: Minimum deposit requirements vary by broker, typically ranging from $100 to $1000. Choose a broker with a minimum deposit that fits your financial situation.

-

Q: How do I choose the right leverage for forex trading?

A: Leverage amplifies your potential profits and losses. Use caution and select leverage that aligns with your risk tolerance, knowledge, and level of funds. Remember, higher leverage increases both the potential for gains and the risk of substantial losses.

-

Q: What are the tax implications of forex trading in the USA?

A: Forex trading profits and losses are subject to taxation in the USA. Consult with a tax professional to understand the specific tax implications and filing requirements.

-

Q: How do I find educational resources on forex trading?

A: Many reputable forex brokers offer educational webinars, tutorials, and courses. Additionally, there are numerous online resources, books, and forums where you can gain valuable knowledge and trading insights.

Best Forex Broker In Usa

Conclusion

Choosing the best forex broker in the USA is a journey that requires careful research and consideration. By following the guidelines outlined in this article and leveraging the tips and expert advice provided, you can navigate the forex trading landscape with confidence. Remember, selecting the right broker is a crucial step towards maximizing your trading potential and achieving success in the global forex market.

Thank you for reading. We hope this guide has empowered you with the necessary knowledge and insights to make an informed decision about choosing the best forex broker that meets your individual needs and aspirations. If you have any questions or would like further assistance, do not hesitate to reach out to us.