Unveiling the Secrets of HDFC Bank Forex Card Charges: A Guide to Wise Spending

Image: www.forex.academy

Introduction:

Embark on an extraordinary journey as we delve into the world of foreign exchange, a domain where currencies dance and economies intertwine. If you’re a savvy traveler seeking seamless global adventures, the HDFC Bank Forex Card could be your passport to financial liberation. In this comprehensive guide, we’ll explore the intricacies of HDFC Bank’s forex card charges, empowering you with the knowledge to navigate cross-border transactions with confidence and ease. From real-world scenarios to expert insights, we’ll unravel the mysteries and help you make informed decisions that can unlock a world of financial possibilities.

Understanding HDFC Bank Forex Card Charges:

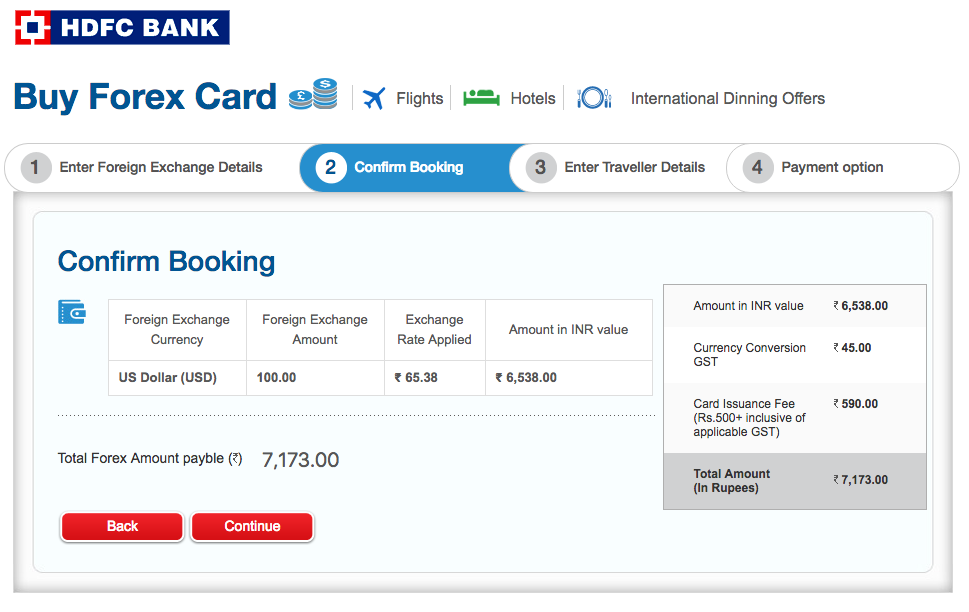

HDFC Bank’s Forex Card, a prudent companion for globetrotters, offers a convenient and secure mode of managing your finances while abroad. However, understanding the associated charges is paramount to ensuring that your travels remain budget-friendly. The bank levies a transaction fee, typically a percentage of the transaction value, ranging from 2 to 3%. This fee is a small price to pay for the convenience and security the card provides. Additionally, HDFC Bank may charge a currency exchange markup, representing the difference between the bank’s exchange rate and the prevailing market rate. This markup, typically around 2%, varies depending on market conditions and the card variant you possess.

Navigating Forex Card Charges: Tips for Frugal Travelers:

-

Opt for Zero Markup Forex Card: HDFC Bank offers a premium variant of their Forex Card with zero currency exchange markup. While the transaction fee might be slightly higher, you’ll enjoy significant savings on currency exchange rates, particularly for higher-value transactions.

-

Use ATMs Wisely: Withdrawing cash from ATMs using your HDFC Bank Forex Card may incur additional transaction fees. To minimize these charges, consider withdrawing larger amounts at once, which typically incurs a fixed fee rather than a percentage-based charge.

-

Stick to Chip-and-PIN Transactions: When making purchases abroad, always opt for chip-and-PIN transactions as they are more secure and often result in lower transaction fees compared to swipe-only transactions.

-

Avoid Dynamic Currency Conversion: Some foreign merchants may offer currency conversion, but this often comes with inflated exchange rates. To avoid falling into this trap, always choose to pay in the local currency and let the HDFC Bank Forex Card handle the conversion process, which offers more favorable rates.

Expert Insights on Forex Card Usage:

“The HDFC Bank Forex Card is an invaluable tool for travelers, offering quick and easy access to funds,” says Mr. Avinash Anand, a veteran foreign exchange expert. “However, it’s crucial to understand the various charges associated with the card to avoid unnecessary expenses. By opting for a zero markup card and using ATMs judiciously, you can optimize your spending while traveling abroad.”

Conclusion:

The HDFC Bank Forex Card is an indispensable tool for globetrotters, providing the convenience and security to manage your finances seamlessly in foreign lands. By comprehending the card’s charges and implementing smart spending habits, you can unlock the true potential of your Forex Card. Remember, traveling is not just about visiting new destinations but also about creating memories and embracing new experiences. Let HDFC Bank’s Forex Card enhance your journeys by empowering you with the financial freedom to live your travel dreams without limits.

Image: jilllextre.blogspot.com

Hdfc Bank Forex Card Charges