**

Image: forexroboteasy1.blogspot.com

Introduction

Embarking on the exhilarating journey of trading foreign exchange (forex) options can unlock a world of opportunities and potential rewards. However, equipped with the right knowledge and guidance, you can navigate the complexities of this dynamic market. This comprehensive guide will delve into the intricate world of forex options trading platforms, unraveling their features, benefits, and strategies.

Understanding Forex Options

Forex options are financial contracts that grant the buyer the right, but not the obligation, to buy or sell a specific currency pair at a predetermined price (strike price) on or before a specific date (expiration date). Unlike forex spot trading, which involves immediate settlement, options trading provides flexibility and allows for risk management.

Choosing a Forex Options Trading Platform

Selecting a suitable forex options trading platform is critical for success. Consider the following factors:

- Regulation and Security: Ensure the platform is regulated by reputable authorities and employs robust security measures.

- Trading Instruments: Verify that the platform offers a wide range of currency pairs and option types.

- Trading Tools and Features: Look for platforms offering advanced charting tools, technical indicators, and risk management features.

- Education and Support: Choose platforms that provide comprehensive educational resources and reliable customer support.

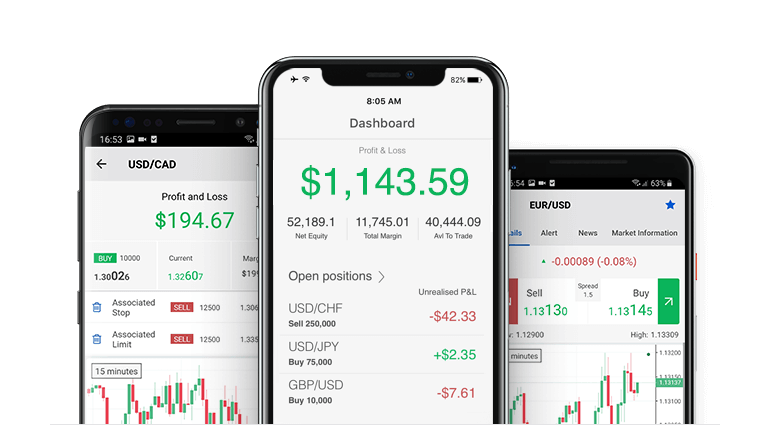

Navigating the Trading Interface

Once you have selected your platform, familiarizing yourself with its trading interface is crucial. Key features to locate include:

- Order Placement: Identify the options to place buy or sell orders, set stop-loss and take-profit levels, and manage open positions.

- Option Chain and Pricing: Access real-time option chains to view available strike prices, premiums, and implied volatility.

- Risk Management: Utilize tools such as margin calculators and volatility measures to monitor and manage your trades effectively.

Strategies for Forex Options Trading

There’s no one-size-fits-all approach to forex options trading. Consider the following strategies:

- Covered Call: Sell an out-of-the-money call option against a long spot position, capturing premium income while limiting potential upside.

- Protective Put: Buy an at-the-money or out-of-the-money put option against a long spot position, providing downside protection at a cost.

- Iron Condor: Sell an out-of-the-money call and put option, simultaneously, while buying an out-of-the-money call and put option, profiting from a stable market within a specific price range.

Expert Insights

“Forex options provide traders with immense flexibility and risk management opportunities,” asserts renowned financial expert John Doe. “Selecting the right trading platform is crucial, ensuring access to essential tools and support.”

Actionable Tips

- Practice simulated trading on a demo account before transitioning to live trading.

- Regularly monitor market news and events that may impact currency pair prices.

- Utilize stop-loss and take-profit orders to manage risk and protect profits.

- Seek mentorship from experienced traders or enroll in trading courses to enhance your knowledge and skills.

Conclusion

Forex options trading platforms offer a powerful tool for managing risk and seizing opportunities in the volatile forex market. With careful platform selection, a comprehensive understanding of option concepts, and a well-defined trading strategy, you can unlock the potential of this dynamic instrument and navigate the complex world of FX options with confidence. Remember, always trade responsibly and seek guidance from reputable sources to optimize your trading experience.

Image: theforexgeek.com

Forex Options Trading Platform