Introduction

Image: www.cmcmarkets.com

In the dynamic world of finance, where opportunities beckon from every corner, forex margin trading emerges as a mesmerizing realm of possibilities. Unleash the power of leverage to amplify your profits or incur significant losses – the choice is yours. But before venturing into this captivating arena, a comprehensive understanding of its nuances is paramount. This article delves into the intricacies of forex margin trading, guiding you through the fundamentals to empower informed decisions.

Understanding Forex Margin Trading

Forex margin trading is a leveraged form of currency trading that allows you to access higher trading capital by borrowing from your broker. This magnifies both your earning potential and risk exposure, transforming forex trading into a high-reward, high-risk proposition.

Principles of Margin Trading

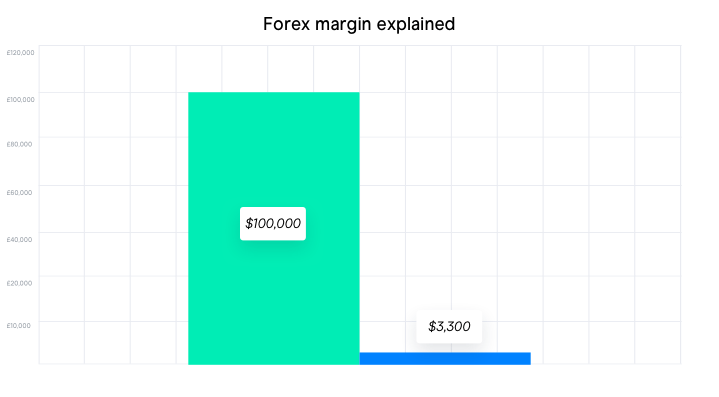

When engaging in margin trading, you typically deposit a margin, which acts as a collateral against your borrowed funds. The leverage ratio determines the extent of your borrowed capital, impacting the potential for both substantial gains and significant losses. For instance, a leverage of 100:1 implies that for every $100 in your account, you can trade $10,000 worth of currency pairs.

Mechanics of Leverage

Leverage operates as a double-edged sword. While it enhances your profit potential, it amplifies both your earnings and losses. For instance, if you trade a currency pair with a leverage of 100:1 and your trade moves in your favor by 1%, your profit will be amplified by a factor of 100, yielding a 100% return on your original investment. However, if the trade moves against you, your losses will be equally magnified.

Benefits of Margin Trading

- Increased Profit Potential: Leverage offers the tantalizing prospect of magnifying profits. By leveraging your trading capital, you can control a larger trading position, potentially leading to substantial gains.

- Flexibility and Opportunity: Margin trading grants you the flexibility to make larger trades, enabling you to seize opportunities that would otherwise be inaccessible with limited trading capital.

- Hedging: Advanced traders can employ margin trading for hedging purposes, reducing the risks associated with currency fluctuations.

Risks Associated with Margin Trading

- Magnified Losses: As mentioned earlier, leverage amplifies both your profits and losses. If the market moves against you, your losses can accumulate rapidly, exceeding your initial investment.

- Margin Calls: If your account balance falls below a certain threshold, known as a margin call, your broker may require you to deposit additional funds to maintain the required margin. Failure to meet a margin call may result in the liquidation of some or all of your trading positions.

- Psychological Impact: Margin trading can be emotionally taxing, especially when losses occur. The potential for significant losses can induce stress and anxiety, affecting your trading decisions.

Expert Insights and Actionable Tips

“Leverage is a powerful tool, but it’s crucial to use it wisely,” advises forex trading expert Mark Richards. “Thoroughly understand the risks involved before employing leverage in your trading.”

Another renowned trader, Sarah Jones, emphasizes the importance of risk management. “Establish clear stop-loss and take-profit levels before initiating any trade,” she says. “This helps to mitigate losses and protect your capital.”

Conclusion

Forex margin trading presents a captivating realm of possibilities, offering the tantalizing allure of amplified profits. However, it’s imperative to approach margin trading with prudence and a thorough understanding of its risks. By leveraging the insights and guidance provided in this article, you can navigate the complexities of forex margin trading, making informed decisions and increasing your chances of success. Remember, knowledge is the key to unlocking the full potential of this dynamic financial instrument.

Additional Resources

- Forex Margin Trading: A Comprehensive Guide – [Insert URL]

- Risk Management Strategies for Margin Trading – [Insert URL]

- Expert Insights into Leveraging Forex Trading – [Insert URL]

As you expand your knowledge of forex margin trading, remember to delve into credible sources, consult reputable experts, and adopt a diligent approach to risk management. The journey to mastering forex margin trading may be arduous, but the rewards can be substantial. Embrace the learning process, and the path to financial freedom will unfold before you.

Image: www.mql5.com

Forex Margin Trading