In the ever-evolving realm of online payments, Skrill stands out as a robust and reliable e-wallet service that empowers users to transfer funds, receive payments, and manage their finances seamlessly. It has gained immense popularity for its user-friendliness, security measures, and wide reach across the globe. Understanding the intricacies of a Skrill account can unlock a world of financial convenience and open doors to a range of online transactions.

Image: bookmaker-info.com

Initially known as Moneybookers, Skrill was founded in 2001 and has since become a pioneer in the fintech industry. With over 40 million users and a presence in more than 200 countries, it has carved a niche for itself as a trusted platform for online payments and money transfers. Skrill accounts offer a myriad of benefits, catering to the needs of individuals, businesses, and online merchants.

Basics of a Skrill Account

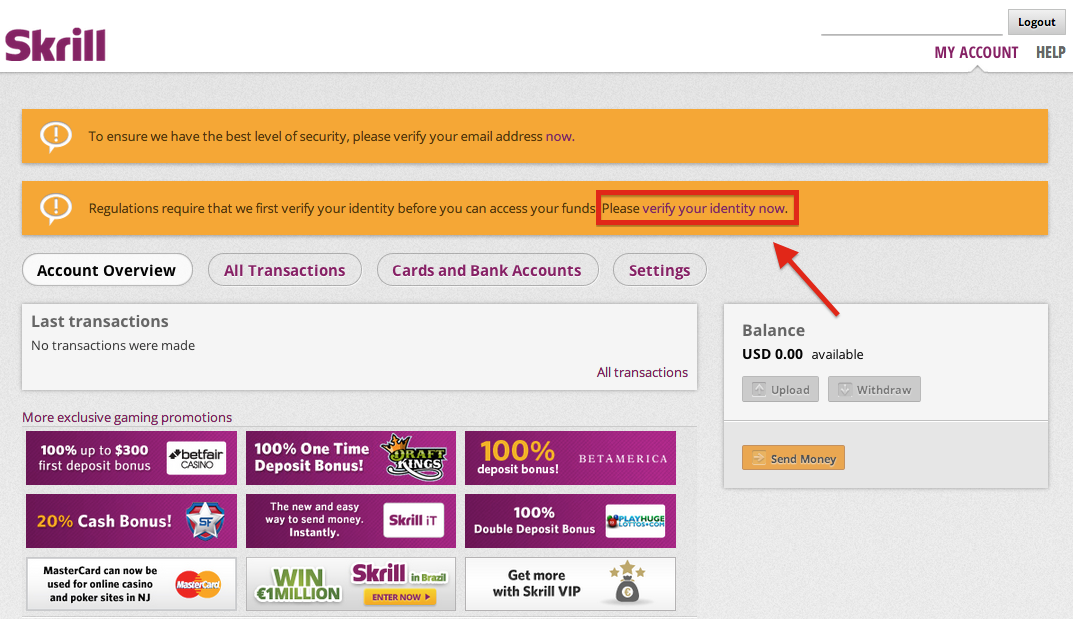

To delve into the world of Skrill accounts, the first step is to create one. The process is straightforward and can be completed in a matter of minutes. Users are required to provide basic personal information, such as their name, email address, and phone number. Once the account is set up, users can link it to their bank accounts or credit/debit cards for seamless fund transfers.

Skrill accounts come in three primary tiers: Personal, Business, and VIP. The Personal tier is designed for individual users who wish to make online payments and transfer funds. The Business tier is tailored towards small and medium-sized businesses that require a platform for efficient invoicing and payment processing. The VIP tier offers exclusive benefits, including priority support, lower transaction fees, and tailored services for high-volume users.

Advantages of a Skrill Account

The benefits of a Skrill account are numerous, making it a compelling choice for online payments and financial management. Here are some of the key advantages:

- Convenience: Skrill makes it effortless to send and receive money online, eliminating the need for tedious bank transfers or physical cash transactions. Users can send funds to other Skrill users instantly, even across borders.

- Security: Skrill employs robust security measures to protect user data and transactions. It is PCI DSS compliant and utilizes SSL encryption to safeguard sensitive information.

- Low fees: Skrill offers competitive transaction fees, making it an economical option for frequent online payments. Fees vary depending on the transaction type and the amount transferred.

- Global reach: Skrill’s extensive global reach allows users to make payments in multiple currencies and to recipients in over 200 countries. This feature is particularly beneficial for international businesses and individuals.

- Flexibility: Skrill accounts can be funded through various methods, including bank transfers, credit/debit cards, and other e-wallets. This flexibility ensures that users can make payments and manage their finances from a single, convenient platform.

How to Use a Skrill Account

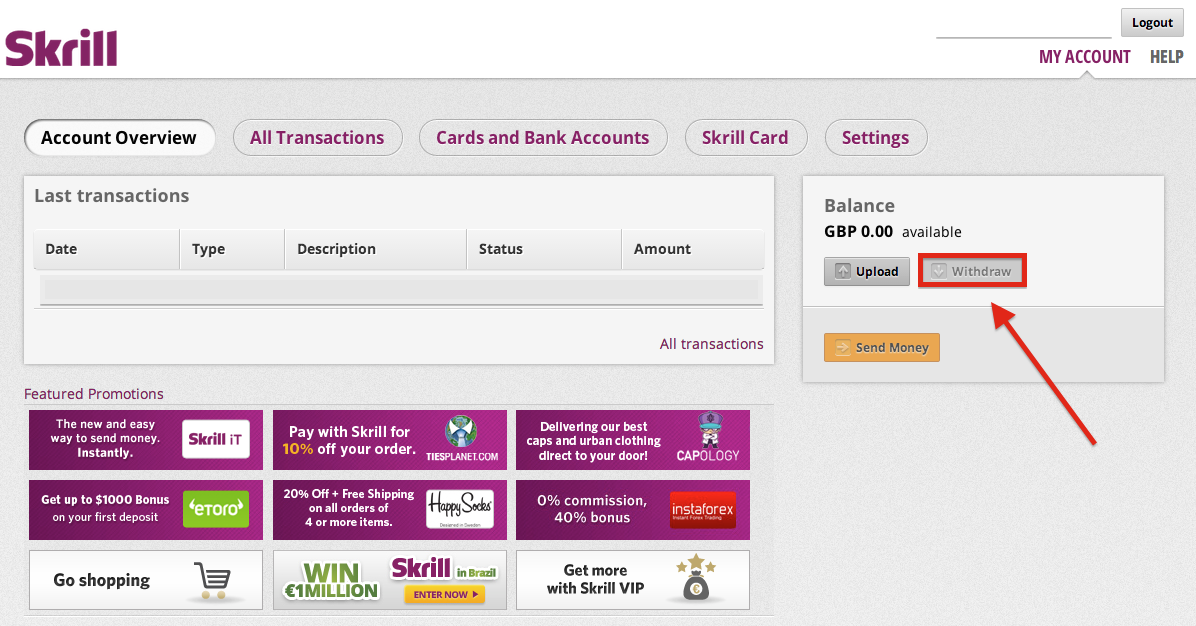

Utilizing a Skrill account is a straightforward process. Once an account is created and funded, users can access a range of services:

- Send money: Skrill allows users to send money to other Skrill users, bank accounts, or credit/debit cards. The process is quick, easy, and secure.

- Receive money: Users can also receive money from other Skrill users or from businesses that accept Skrill payments. Funds can be withdrawn to a bank account or used for other transactions.

- Make online payments: Skrill is accepted by a wide range of online merchants, enabling users to make payments for goods and services with ease.

- Manage finances: Skrill accounts provide users with a comprehensive dashboard where they can track their transactions, view account balances, and manage multiple currencies.

- Get rewarded: Skrill offers a loyalty program that rewards users for their activity. Users can earn points that can be redeemed for various benefits, such as lower fees and exclusive offers.

Image: bookmaker-info.com

What Is Skrill Account

Conclusion

A Skrill account is an essential tool for anyone who engages in online payments or manages finances globally. It offers a secure, convenient, and cost-effective way to transfer funds, make online payments, and access a range of financial services. Whether you’re an individual looking to send money to friends and family or a business seeking a reliable payment platform, a Skrill account can empower you to navigate the digital financial landscape with confidence.