In the realm of investing, recognizing and interpreting trading patterns holds immense significance. Patterns provide valuable insights into market behavior, allowing investors to make informed decisions and enhance their trading strategies. This article delves into the world of common trading patterns, exploring their history, application, and the expert perspectives that guide successful traders.

Image: medium.com

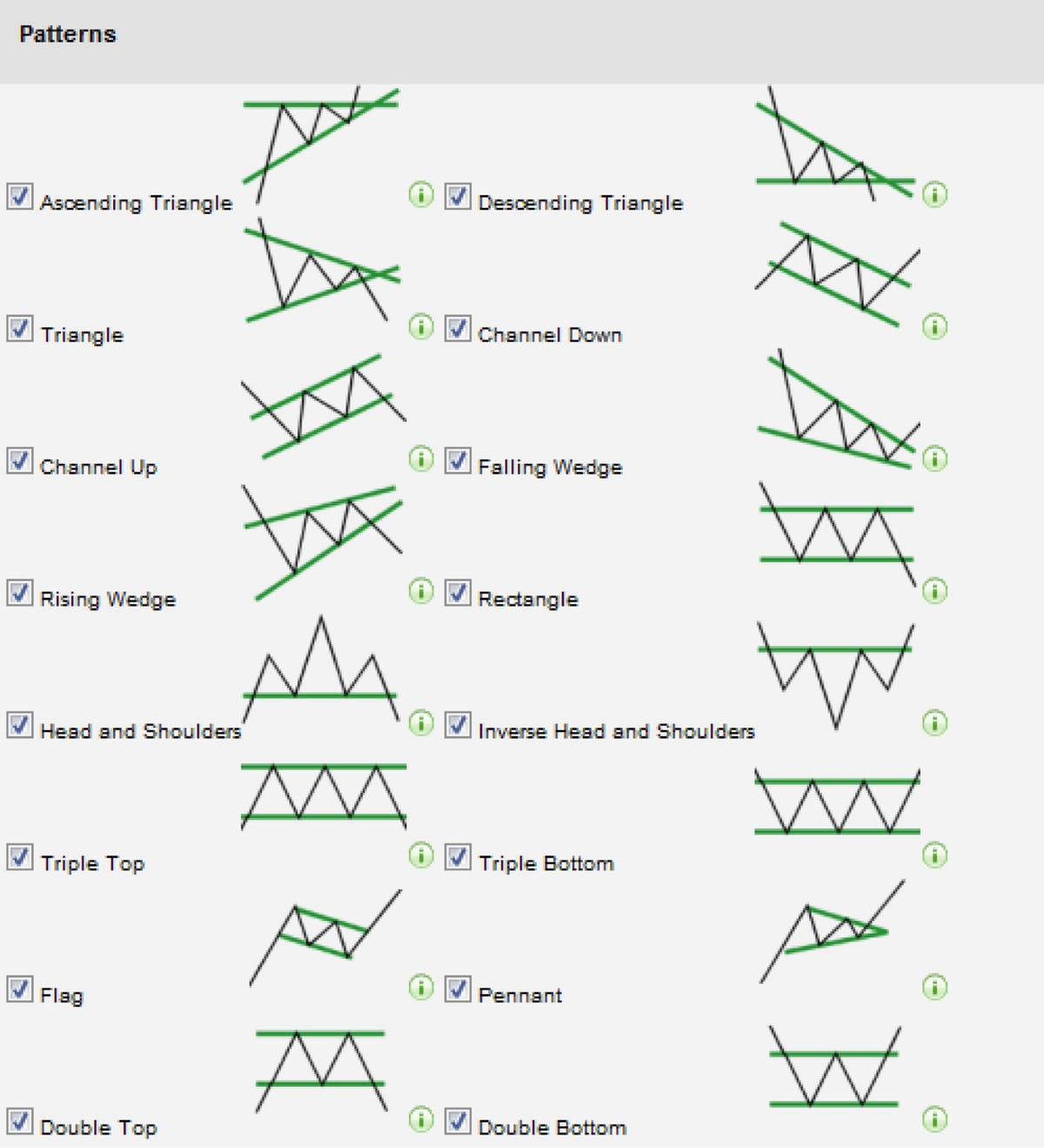

Trading patterns are essentially recurrent formations in price charts that indicate potential market movements. These patterns can be simple, consisting of a few data points, or complex, spanning extended periods. Understanding them empowers investors to anticipate market trends, identify entry and exit points, and mitigate risk.

Head and Shoulders Pattern: One of the most well-known patterns, the head and shoulders formation signals a potential trend reversal. It consists of three consecutive highs, with the middle high (the “head”) being the largest. The neckline is the line connecting the lows of the two shoulders. A break below the neckline confirms a downtrend.

Cup and Handle Pattern: Resembling a cup with a handle, this pattern suggests a bullish trend. The cup is formed when prices fall to a low, rise to a peak, and then decline again. The handle is a consolidation period that represents a pullback in prices before continuing the upward trend.

Double Top and Bottom Patterns: These patterns indicate indecision in the market. A double top forms when prices reach two consecutive highs approximately the same, followed by a decline. A double bottom forms when prices reach two consecutive lows approximately the same, followed by an upturn.

Triangles: Triangles occur when price action is confined within two converging trendlines. Ascending triangles signal a potential breakout to the upside, while descending triangles indicate a potential breakout to the downside.

Flags and Pennants: These patterns represent continuation patterns where prices consolidate within two parallel trendlines. Flags are characterized by a sharp downward movement followed by a bullish recovery, while pennants are characterized by a symmetrical triangular consolidation pattern.

Expert Insights

- Peter Brandt: “Technical analysis is about probability, not certainty. The more confluence there is, the higher the probability of success.”

- Mark Douglas: “Successful trading is not about making money. It’s about controlling your risk.”

- Dr. Alexander Elder: “Trend lines are not just lines on a chart; they represent psychological levels of support and resistance in the market.”

Actionable Tips

- Study multiple patterns before making any trading decisions.

- Combine technical analysis with other factors such as fundamentals and sentiment.

- Never trade against the trend.

- Always use stop-loss orders to protect your capital.

- Practice risk management and avoid excessive leverage.

Conclusion

Common trading patterns provide a valuable toolkit for investors to navigate the often complex world of financial markets. By understanding their formations, implications, and expert insights, investors can enhance their trading strategies and increase their chances of success. However, it’s crucial to remember that no pattern guarantees profitability and that diligent research and risk management should always be at the forefront of any trading endeavors.

Image: www.tradingview.com

Common Trading Patterns