In the dynamic world of energy markets, the ability to trade crude oil effectively can empower individuals and businesses alike. With the advent of user-friendly trading apps, the barriers to entry have diminished, enabling anyone with an internet connection to participate in this lucrative market. This article will unravel the complexities of crude oil trading, highlighting the advantages and pitfalls associated with using a trading app. Armed with this knowledge, you’ll be poised to make informed decisions that could yield substantial financial rewards.

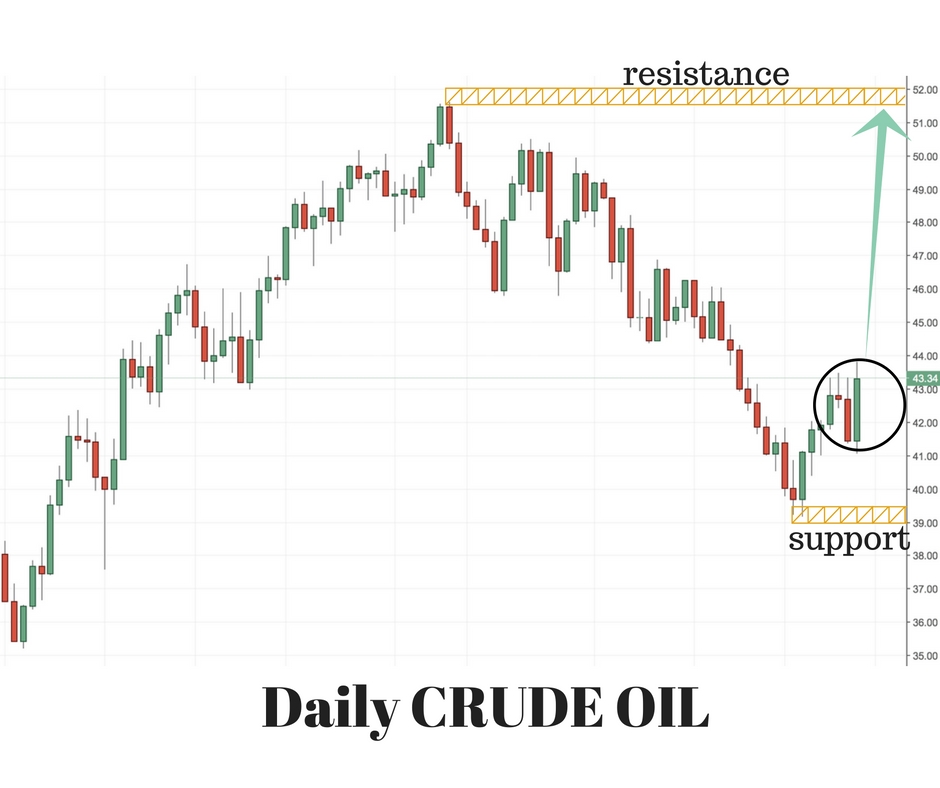

Image: www.tradingview.com

Navigating the Crude Oil Trading Landscape

Crude oil, a non-renewable natural resource, serves as the lifeblood of global economies. Its price fluctuations impact a wide range of industries, from transportation to manufacturing. Understanding the factors that drive oil prices is paramount for successful trading. These factors include global economic growth, geopolitical tensions, supply and demand imbalances, and natural disasters.

The Promise of Crude Oil Trading Apps

Crude oil trading apps have revolutionized the way people access this market. These platforms offer a host of advantages, including:

-

Convenience: With trading apps, you can trade crude oil from anywhere with an internet connection.

-

Accessibility: Trading apps have lowered the barriers to entry, making it possible for anyone to participate in the crude oil market.

-

Real-time data: Apps provide traders with real-time data on oil prices and market conditions, allowing them to make informed decisions.

-

User-friendly interface: Trading apps are designed with user-friendly interfaces, making them easy to navigate even for beginners.

Unveiling the Potential Pitfalls

While crude oil trading apps offer numerous advantages, it’s crucial to be aware of the potential pitfalls:

-

Volatility: The crude oil market is highly volatile, and prices can fluctuate rapidly, leading to substantial losses if traders are not cautious.

-

Lack of professional guidance: Trading apps typically do not provide professional guidance, which can be a disadvantage for inexperienced traders.

-

Technical issues: Trading apps rely on technology, and technical glitches can occur, potentially affecting trades and profitability.

-

Hidden fees: Some trading apps charge hidden fees that can reduce profitability if not considered in your trading strategy.

-

Scams: Be vigilant against fraudulent trading apps that can result in financial losses.

Image: www.colibritrader.com

Maximizing Success with Crude Oil Trading Apps

To maximize your success in crude oil trading using an app, consider the following expert insights and actionable tips:

-

Choose a reputable app: Conduct thorough research to select a trading app with a strong reputation for reliability, security, and customer support.

-

Understand your risk tolerance: Determine your risk tolerance before entering the market to avoid excessive losses.

-

Start small: Begin with small trades until you gain experience and become comfortable with the market dynamics.

-

Stay informed: Continuously monitor the latest news and market analysis to stay abreast of factors influencing oil prices.

-

Consider using stop-loss orders: Set stop-loss orders to limit your losses in case of adverse price fluctuations.

Crude Oil Trading App

Empowering Traders with Crude Oil Trading Apps

Crude oil trading apps have democratized access to the energy markets, enabling anyone with an interest to participate. However, it’s essential to approach this endeavor with a balanced blend of knowledge, caution, and a commitment to ongoing learning. By adhering to the insights and advice presented in this article, you’ll be well-equipped to navigate the intricacies of crude oil trading and reap its potential rewards. Unleash the power of crude oil trading apps today and unlock a world of financial possibilities.