Introduction: Understanding Fill Policy, a Crucial MT5 Concept

In the fast-paced world of electronic trading, understanding the intricacies of order execution is essential for any aspiring trader. Among the various parameters that shape trade execution, fill policy plays a pivotal role in determining how market orders are filled. This article delves into the concept of Fill Policy MT5, providing a comprehensive guide to its types, nuances, and implications for traders.

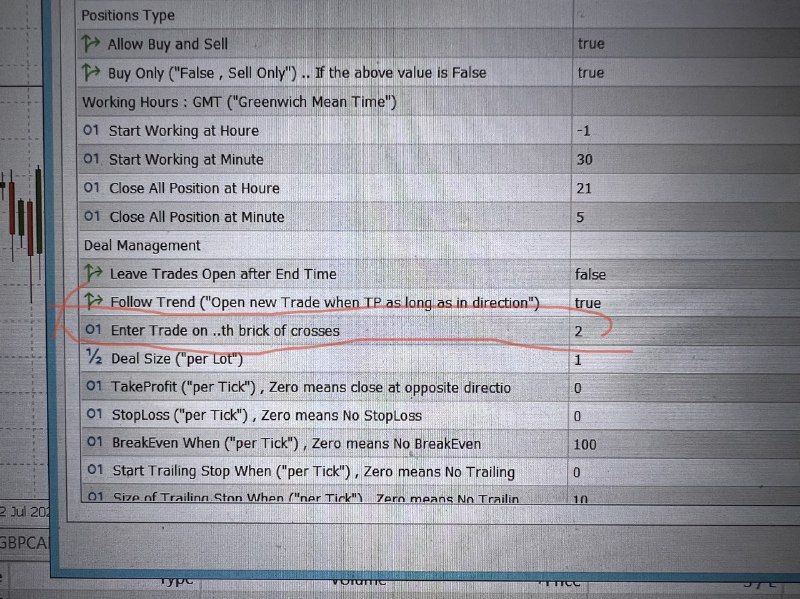

Image: www.mql5.com

MT5 (MetaTrader 5) is the advanced trading platform from MetaQuotes Software, widely adopted by brokers and traders alike. It offers a robust set of features and tools tailored to the needs of modern market participants. Fill Policy is one of the key settings that traders can configure within MT5, influencing how their orders are executed.

Exploring Fill Policy Types: Instant, Market Execution, and More

Within MT5, there are several fill policy options available, each catering to distinct trading strategies and preferences. Understanding the differences between these policies is crucial for traders to optimize their execution:

-

Instant Execution: As the name suggests, Instant Execution attempts to execute orders instantaneously at the prevailing market price. This fill policy is ideal for scalpers and traders seeking immediate execution, particularly in highly volatile markets.

-

Market Execution: Market Execution is the standard fill policy in MT5. It ensures that orders are executed at the best available market price upon submission. Market Execution can incur slippage, especially during periods of high market volatility or low liquidity.

-

Request Execution: Request Execution gives traders greater control over order execution. By selecting this policy, the broker sends a request to the liquidity provider to fill the order at the requested price. However, Request Execution does not guarantee execution, and the order may be partially filled or rejected depending on market conditions.

-

Fill or Kill: Fill or Kill is a strict fill policy that demands immediate execution of the entire order at the specified price. Similar to Request Execution, it may result in order rejection or partial execution if the exact conditions cannot be met.

Choosing the Optimal Fill Policy for Your Trading Style

The choice of Fill Policy in MT5 depends on a trader’s specific trading strategy, risk appetite, and market conditions. For instance:

- Scalpers and high-frequency traders may benefit from Instant Execution to capitalize on fast-moving market conditions.

- Traders seeking certainty in execution may prefer Market Execution, accepting potential slippage in return for guaranteed execution.

- Sophisticated traders may opt for Request Execution or Fill or Kill to exercise more control over their orders and mitigate execution risk.

Real-World Applications: Fill Policy in Practice

Understanding the implications of Fill Policy in real-world scenarios is vital for traders to make informed decisions. Consider the following examples:

-

Example 1: A trader places an Instant Execution market order to buy 100 shares of Apple (AAPL) at $150. The order is filled immediately at the prevailing market price of $150.25, resulting in slippage of $0.25 per share.

-

Example 2: A trader using Market Execution submits an order to sell 500 shares of EUR/USD at 1.1050. However, due to a sharp market movement, the order is executed at 1.1045, incurring slippage of 5 pips.

-

Example 3: A trader selects Request Execution for an order to buy 200 shares of Microsoft (MSFT) at $250. The broker sends the request to the liquidity provider, who rejects the order due to insufficient liquidity at that price.

Image: www.mql5.com

Fill Policy Mt5

Conclusion: Harnessing Fill Policy MT5 for Trading Success

Fill Policy in MT5 empowers traders to tailor their order execution to their specific trading objectives. By understanding the various Fill Policy types and their implications, traders can make informed choices that align with their risk tolerance and trading strategy. Selecting the optimal Fill Policy can enhance trade execution outcomes, minimize execution risk, and improve overall trading performance.