Introduction

In the vibrant realm of investing, the hunt for undervalued shares presents both an alluring challenge and an immense opportunity. Like hidden gems waiting to be discovered, these stocks possess the potential to yield significant returns while minimizing risk. Embarking on this treasure hunt, however, requires a keen eye and a deep understanding of financial principles. This comprehensive guide will illuminate the path, empowering you with the knowledge and strategies to uncover these hidden gems and unlock the doors to financial success.

Image: aayushbhaskar.com

Deciphering Undervalued Shares: A Definition

Undervalued shares are stocks that trade below their intrinsic or fair value. This disparity can arise due to market inefficiencies, investor sentiment, or temporary market dislocations. Recognizing undervalued shares requires a disciplined approach that incorporates both fundamental and technical analysis.

Unlocking the Secrets of Undervalued Shares: Key Indicators

Delving into the financial labyrinth of stocks, several key indicators can guide your quest for undervalued shares:

-

Low Price-to-Earnings (P/E) Ratio: P/E ratio measures the price of a stock relative to its earnings. A low P/E ratio suggests the stock may be undervalued.

-

High Dividend Yield: Companies with high dividend yields typically distribute a significant portion of their earnings as dividends, indicating potential undervaluation.

-

Strong Balance Sheet: Examining a company’s financial health through its balance sheet can reveal hidden strengths or weaknesses, providing insights into its underlying value.

-

Technical Analysis Patterns: Studying stock price movements and patterns can unveil clues about potential undervaluation, especially in combination with fundamental indicators.

Navigating the Uncharted Waters: Step-by-Step Approach

Uncovering undervalued shares is a journey requiring both patience and strategy. Consider the following steps:

-

Define your Investment Criteria: Establish clear parameters for undervalued shares based on your risk tolerance, investment horizon, and financial objectives.

-

Conduct Thorough Research: Scour through company reports, financial statements, industry analysis, and market news to gain a comprehensive understanding of potential investment targets.

-

Apply Valuation Techniques: Utilize fundamental analysis methods, such as discounted cash flow models or comparable company analysis, to determine the intrinsic value of stocks.

-

Analyze Market Sentiment: Gauge investor sentiment towards potential candidates through news, social media, and technical analysis to identify potential overreactions.

-

Monitor and Adjust: Regularly review your portfolio and make adjustments based on market conditions and company performance to maintain alignment with your investment strategy.

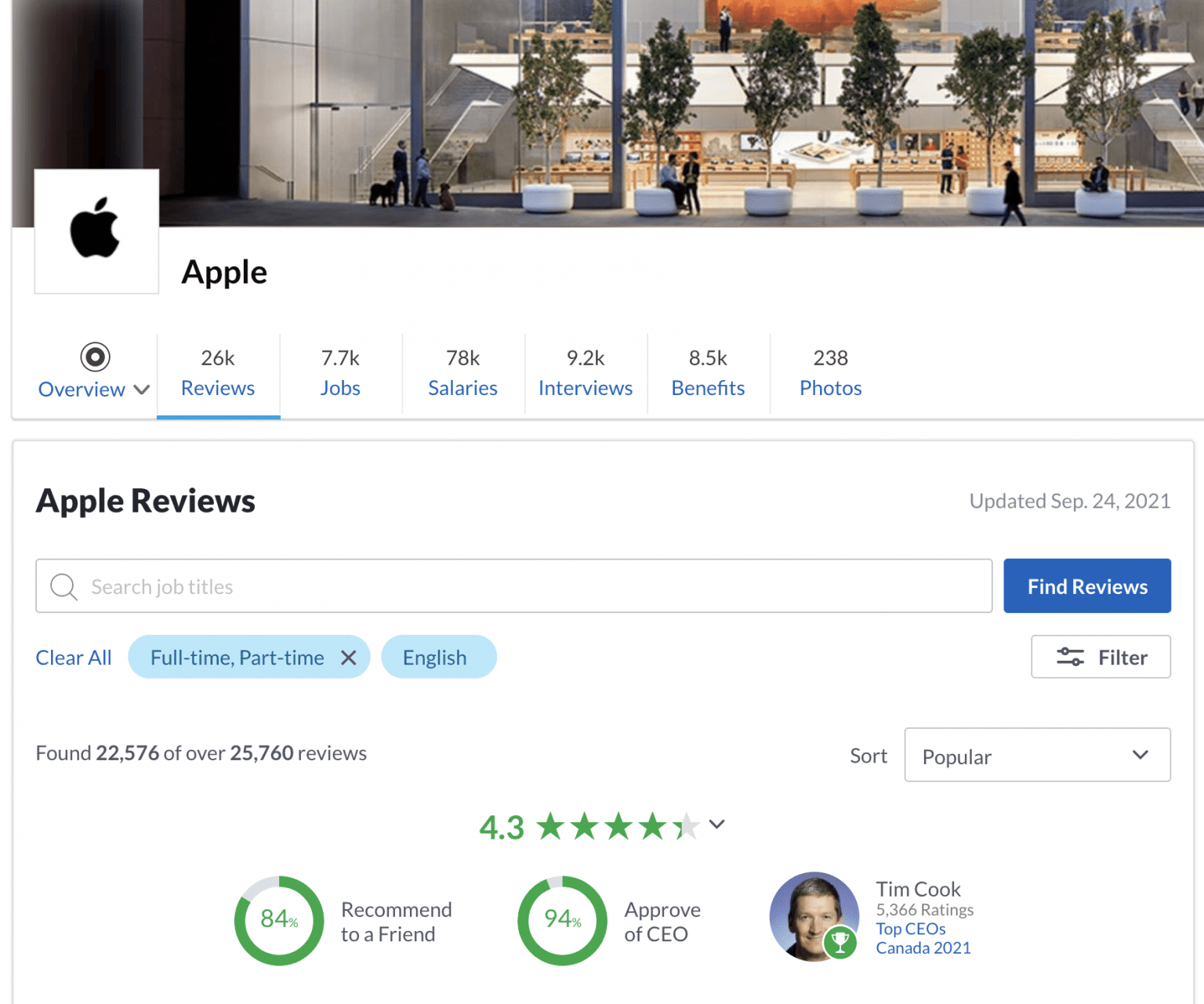

Image: blog.wisesheets.io

Seeking Wisdom from the Masters: Expert Insights

Renowned investors, throughout history, have mastered the art of spotting undervalued shares:

-

Warren Buffett: “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.” – emphasizing the importance of intrinsic value and avoiding excessive risk.

-

Benjamin Graham: “The Intelligent Investor” – a timeless guide to value investing, advocating the margin of safety and thorough research.

-

Peter Lynch: “Buy the businesses, not the stock market.” – highlighting the need to focus on the underlying company and its long-term prospects.

Empowering Investors: Actionable Tips

Empower your investment strategy with these actionable tips:

-

Be patient: Uncovering undervalued shares takes time and effort. Avoid impulsive decision-making and give your research ample time to bear fruit.

-

Leverage online resources: Numerous online platforms and databases provide access to financial data, company analysis, and market commentary. Use these resources to enhance your research process.

-

Consider exchange-traded funds (ETFs): ETFs offer diversified exposure to undervalued sectors or companies, reducing individual stock risk.

-

Invest consistently: Regular investments, regardless of market fluctuations, can help reduce the impact of market volatility and enhance long-term returns.

How To Find Undervalued Shares

Conclusion

Discovering undervalued shares is a rewarding endeavor that can amplify your investment performance. By embracing the principles outlined in this guide and drawing inspiration from the wisdom of investment masters, you can develop a keen eye for spotting hidden gems in the stock market. Remember, the path to financial success is paved with knowledge, patience, and unwavering determination. Unveil the treasures that lie in wait, and unlock the full potential of undervalued shares.