Introduction

Image: dribbble.com

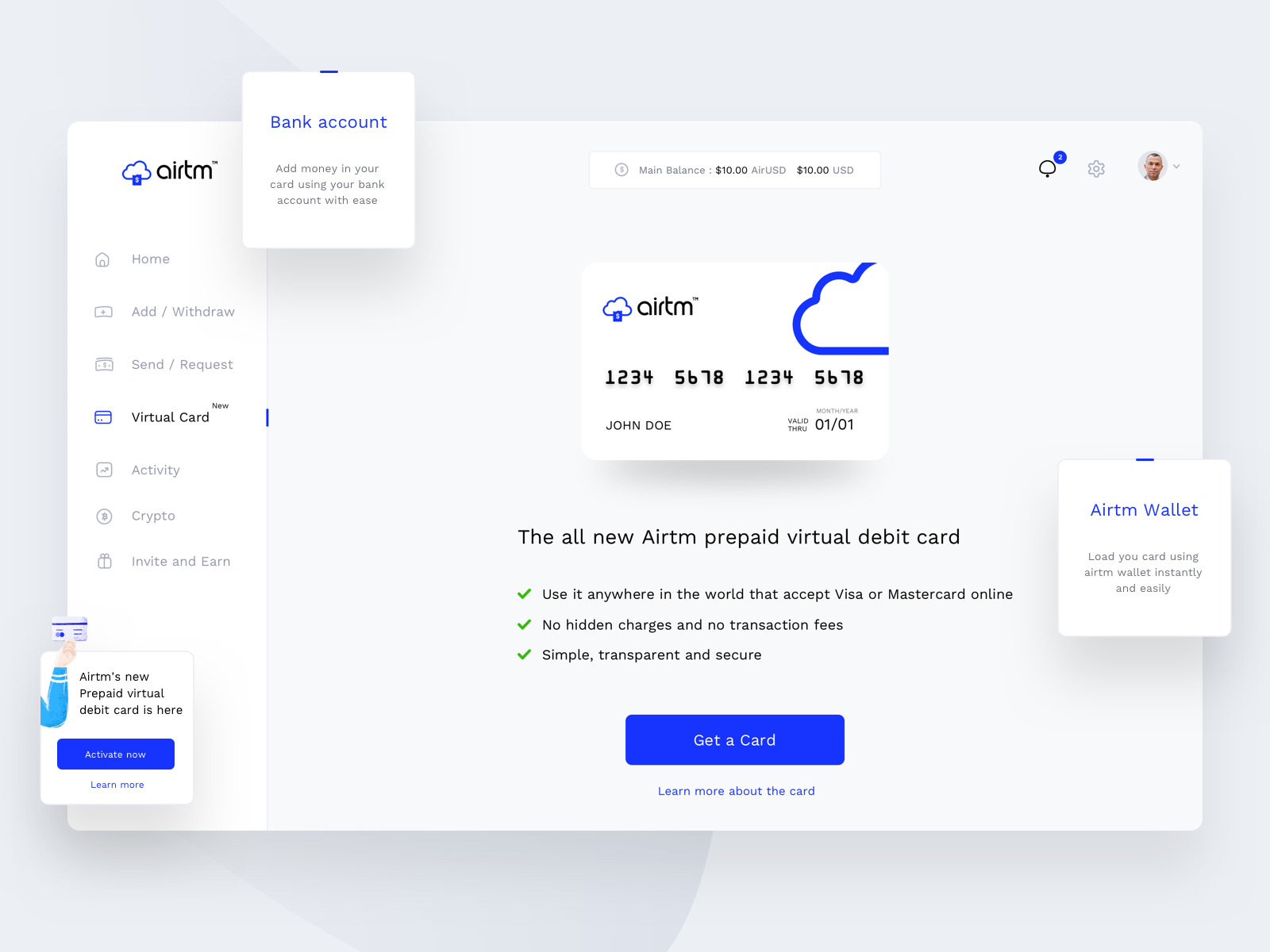

In the globalized world of today, financial accessibility is paramount. The emergence of virtual cards has revolutionized the way we transact, offering convenience, security, and flexibility like never before. Among the most trusted virtual card providers stands Airtm. This article delves into the captivating world of Airtm virtual cards, empowering you with comprehensive knowledge and actionable tips to unlock financial freedom.

Exploring Airtm Virtual Card

Airtm, established in 2015, is a renowned platform offering a range of innovative financial services. Their virtual card, akin to a physical credit card, is a digital representation that allows you to make purchases online and in stores, all while enjoying the safety and convenience of a virtual transaction.

Airtm’s virtual card transcends geographical boundaries, granting you access to global markets and online platforms. Whether it’s purchasing the latest gadgets, accessing premium streaming services, or booking travel experiences, Airtm’s virtual card seamlessly caters to your every need.

Exclusive Features and Advantages

-

Enhanced Security: Virtual cards eliminate the risk of physical card theft or fraud, providing peace of mind with each transaction.

-

Global Acceptance: Airtm’s virtual card boasts global acceptance, allowing you to make purchases from any location with an internet connection.

-

Real-time Tracking: Monitor your card activity in real-time through the Airtm mobile app. Stay informed about every transaction, ensuring transparency and control.

-

Multiple Card Options: Airtm offers a variety of virtual cards tailored to specific requirements. Choose from disposable cards for sensitive purchases or multi-use cards for regular transactions.

-

Budget-Friendly: Airtm’s virtual card fees are incredibly competitive, empowering you to make the most of your financial resources.

Expert Insights and Actionable Tips

-

Maximize Security: Utilize disposable virtual cards for heightened security in online environments.

-

Budget Wisely: Set spending limits on your virtual card to prevent overspending.

-

Monitor Your Activity: Regularly review your card statements to detect any suspicious activity.

-

Take Advantage of Rewards: Explore virtual card providers that offer rewards or incentives for usage.

Conclusion

Airtm virtual card is a game-changer in the financial landscape, empowering individuals with the freedom to transact globally, securely, and conveniently. Whether you’re an avid online shopper, a globetrotter, or simply seeking financial flexibility, the Airtm virtual card offers a transformative solution. Embrace the future of finance today and unlock the boundless possibilities that await you.

Image: learn24bd.blogspot.com

Airtm Virtual Card