“`

Navigating the labyrinthine world of financial markets requires a keen eye and a deep understanding of price fluctuations. Those seeking success in this endeavor often turn to price action trading, an approach rooted in observing and interpreting the raw price movements of an asset without relying on technical indicators. By unlocking the secrets of price action trends, traders seek to predict future market behavior and make informed trading decisions. This in-depth guide delves into the intricacies of price action trends, empowering you with the knowledge and strategies to master this indispensable trading technique.

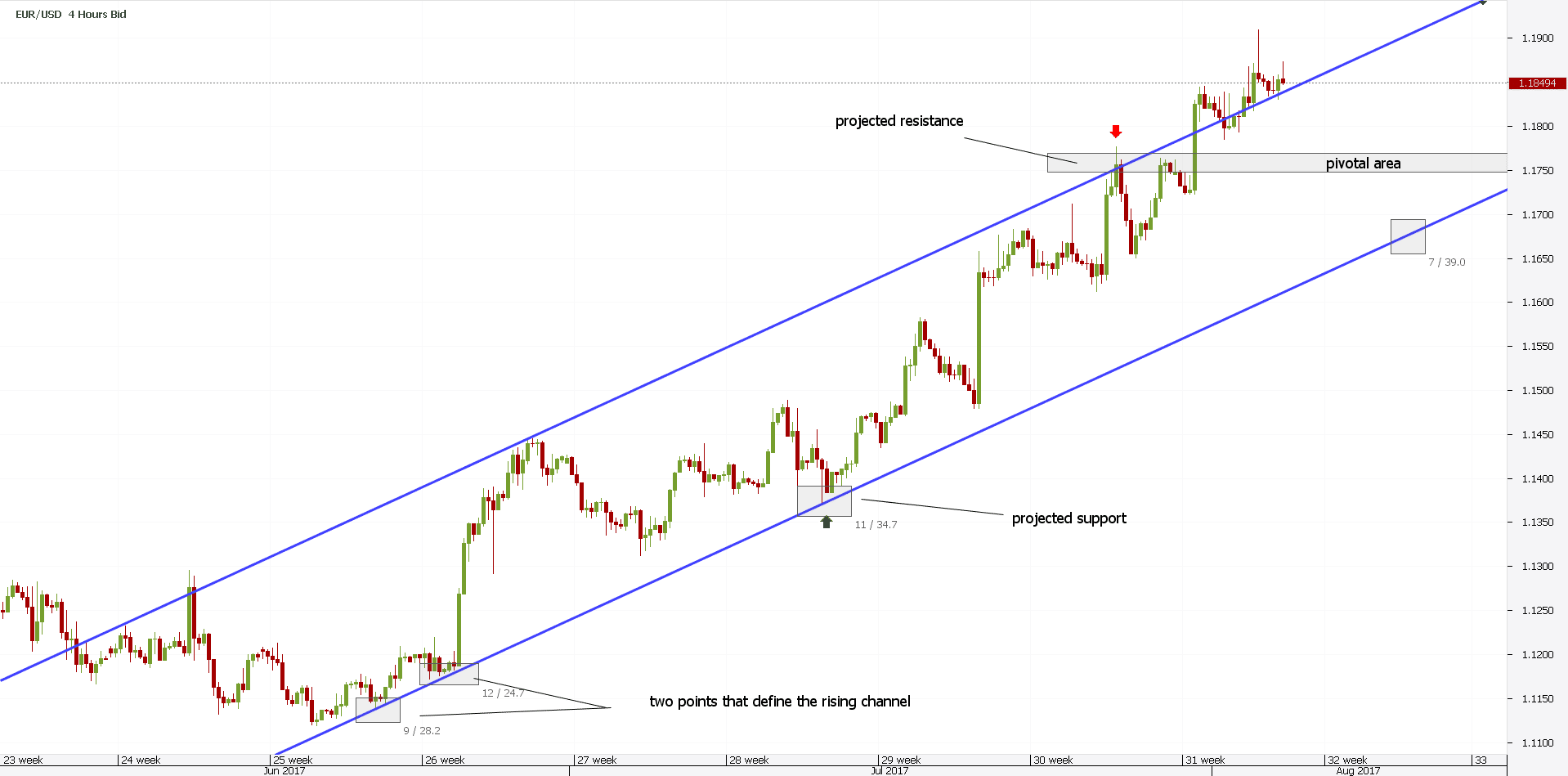

Image: eaglesinvestors.com

Unveiling Price Action Trends

In the realm of price action trading, trends refer to persistent movements in a particular direction. These trends can be identified by analyzing the formation of higher highs and higher lows (uptrends) or lower highs and lower lows (downtrends). The most significant trends are those that align with the overall market sentiment, which is influenced by a confluence of economic factors, geopolitical events, and market psychology. Understanding these trends is paramount for traders who want to increase their chances of profitable trades.

Spotting price action trends requires a meticulous examination of price charts. Traders scrutinize candlestick patterns, which graphically depict the price movement of an asset over a specified time frame, to identify trend reversals and potential trading opportunities. Common candlestick patterns include the engulfing pattern, the hammer, the hanging man, and the doji. Each pattern conveys a unique message about the market sentiment and the likely direction of the trend.

Mastering Price Action Strategies

Once a trend has been identified, traders can employ a range of strategies to capitalize on its momentum. One popular approach is trend following, which involves entering trades in the direction of the trend and holding positions until the trend reverses. Another strategy is counter-trend trading, where traders bet against the prevailing trend, aiming to profit from brief trend reversals before the dominant trend reasserts itself.

Successful price action trading requires discipline, patience, and a well-thought-out risk management strategy. Traders should never trade with more than they can afford to lose and should always use stop-loss orders to limit potential losses. It is also important to maintain a level of self-control and confidence in the face of market volatility.

Expert Insights and Trading Tips

To further enhance your price action trading skills, consider the following tips shared by seasoned traders:

- **Trade with the trend:** Don’t swim against the current. Stay aligned with the major trend to increase the probability of profitable trades.

- **Confirm your trends:** Multiple time frames can provide validation. Trends appearing on intraday, daily, and weekly charts offer a stronger signal than those visible on a single time frame.

- **Focus on support and resistance levels:** These levels act as magnets for price movements, providing reliable trading opportunities.

- **Be patient and wait for confirmations:** Impulse moves are often followed by retracements. Avoid hasty trades and wait for the market to confirm its intentions before executing a trade.

- **Manage your risk and emotions:** Trade within your risk tolerance and stay disciplined in all market conditions.

Image: www.bank2home.com

Frequently Asked Questions on Price Action Trends

Q: What is the key to identifying price action trends?

A: The key to identifying price action trends is to look for higher highs and higher lows or lower highs and lower lows in a sustained manner.

Q: Can I trade both short-term and long-term trends using price action?

A: Yes, price action can be utilized to trade trends of any duration, including intraday, daily, and weekly trends.

Q: How can I improve my price action trading skills?

A: Practice and experience are crucial for honing your skills. Study candlestick patterns, paper trade to refine your strategies, and constantly monitor the markets to develop an intuitive understanding of price movements.

Trading Price Action Trends Pdf

Conclusion

Mastering price action trends is an ongoing journey that rewards traders with the ability to navigate financial markets with greater confidence and accuracy. By embracing the insights and strategies presented in this guide, you can unlock the potential to identify and capitalize on market trends, ultimately elevating your trading game. Are you ready to embark on this exciting adventure?