Ever wondered why the price you see to buy a currency is slightly different from the price you see to sell it? This subtle discrepancy is known as the spread, a fee charged by brokers that often goes unnoticed but significantly impacts your trading profits. Understanding the spread is crucial for any currency trader, as it can make the difference between a successful trade and a costly mistake.

Image: www.cmcmarkets.com

In this comprehensive guide, we delve into the intricate world of spreads in currency trading, explaining its mechanisms, types, implications, and how to navigate them strategically. By the end, you will possess the knowledge to factor spread into your trading decisions and optimize your trading outcomes.

What is Spread in Currency Trading?

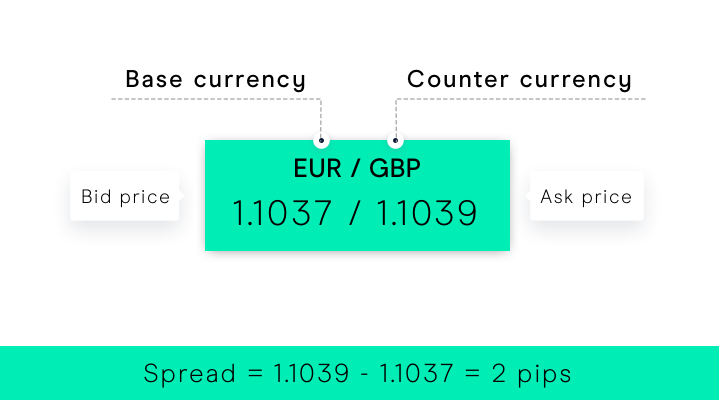

Imagine you want to buy a cup of coffee. You walk into a shop and see a sign that says “Coffee: $3.00.” However, when you ask to buy it, the cashier tells you it’s actually $3.20. This extra $0.20 is the spread – a small fee charged by the shop for providing the service of selling you the coffee. Similarly, in currency trading, the spread is a small difference between the *bid* price (the price at which you can sell a currency) and the *ask* price (the price at which you can buy a currency).

This spread is the broker’s profit margin and is generally a tiny percentage of the transaction value. However, it can accumulate into a significant expense, especially for frequent traders or those managing large volumes. It’s essential to factor the spread into your calculations to accurately assess your potential profit or loss.

Why does Spread Exist?

The spread is a fundamental component of the forex market’s mechanism, driven by several factors. One of the primary reasons is the liquidity of the market. Currency pairs with high liquidity (high trading volume) typically have lower spreads, as market makers are willing to compete for trades by offering tighter pricing.

Another significant factor is volatility. Highly volatile currency pairs tend to have wider spreads due to increased uncertainty in pricing. Brokers might widen their spread to compensate for the increased risk involved. Furthermore, market conditions such as news announcements or economic data releases can impact spreads, causing them to fluctuate.

Types of Spreads

Spreads are broadly classified into two types: fixed and variable.

Image: en.fxbangladesh.com

Fixed Spreads

Fixed spreads remain constant regardless of market volatility. They are often preferred by beginners or those who prefer predictable trading costs. Brokerage accounts offering fixed spreads are typically geared towards retail traders and usually involve higher commissions. However, fixed spreads might not be the most advantageous choice for experienced traders who are willing to capitalize on fleeting opportunities.

Variable Spreads

Variable spreads, as the name suggests, change dynamically with market conditions. They are often narrower when volatility is low and widen during periods of high activity. Variable spreads are more common in professional trading environments and are often found in accounts with lower commissions.

Impact of Spread on Trading

Spreads, seemingly insignificant at first glance, can substantially impact your trading performance. Your profit or loss is not only determined by the price difference between your entry and exit points but also influenced by the spread you pay.

Let’s consider an example. You buy 1,000 units of EUR/USD at an ask price of 1.12000 and sell it at a bid price of 1.12200. At first glance, you seem to have made a profit of 20 pips (1.12200 – 1.12000). However, let’s consider a spread of 2 pips. Now, your actual profit is only 18 pips: (1.12190 – 1.12010).

This seemingly minor difference can accumulate over time, especially for frequent traders. Consequently, it is critical to choose a broker with competitive spreads and to factor spread into your trading strategies to ensure you’re not unknowingly losing profits.

Minimizing the Impact of Spread

While eliminating spread completely is not possible, there are strategies you can employ to minimize its impact on your trading:

- Choose a broker with low spreads: Compare different brokers’ offerings and select one with competitive spreads, especially for the currency pairs you intend to trade.

- Trade liquid currency pairs: Currency pairs with high trading volume (liquidity) typically have lower spreads. Stick to major currency pairs like EUR/USD or USD/JPY, which generally offer more competitive pricing.

- Trade during low-volatility periods: During market calmness, spreads tend to be narrower. Avoid trading during volatile periods such as news releases or economic data announcements.

- Use stop-loss orders: Stop-loss orders can help you limit your losses and reduce the potential impact of unfavorable price movements, even if spread is factored in.

- Consider using a scalping strategy: Scalping involves profiting from very small price fluctuations that often occur within the spread. However, this strategy requires high volume trading and significant technical expertise.

Spread and Trading Success

Understanding and managing spread is vital for currency trading success. By choosing a reliable broker with competitive spreads and implementing appropriate trading strategies, you can navigate the forex market effectively, minimize trading costs, and optimize your profitability.

Remember, spread is just one of the many factors to consider in currency trading. It is crucial to understand other aspects of the market to make informed trading decisions. Furthermore, it’s essential to practice risk management, diversify your portfolio, and continuously learn and adapt to the ever-evolving dynamics of the forex market.

Spread In Currency Trading

Conclusion

The spread is an often-overlooked but crucial aspect of currency trading. Understanding its mechanisms, types, and impact on your profits is key to managing costs and optimizing your trading outcomes. By choosing the right broker, trading liquid currency pairs during low-volatility periods, and employing strategic approaches, you can mitigate the effect of spread and maximize your chances of success. Further research and continuous learning are always encouraged to navigate the intricacies of currency trading and maximize your profitability in this complex and dynamic market.