Imagine holding the key to a vast, interconnected world of currencies—a world where billions of dollars exchange hands every second. Imagine the power to capitalize on global events, economic shifts, and political turbulence, all from the comfort of your own home. This is the world of forex trading, and the starting point is your forex trading login.

Image: forexautorobot1.blogspot.com

But navigating this complex landscape can be daunting, especially for newcomers. The sheer volume of information, the use of technical jargon, and the potential for risk can seem overwhelming. This guide aims to demystify the journey to your first forex trading login, equipping you with the knowledge and confidence to embark on your forex trading adventure.

Understanding Forex Trading: The World’s Largest Market

Forex, short for foreign exchange, is the global marketplace where currencies are traded. It’s the largest and most liquid financial market in the world, with trillions of dollars changing hands every day. Unlike traditional stock markets, forex operates 24 hours a day, five days a week, meaning you can trade at any time that suits your schedule.

At its core, forex trading involves buying one currency and simultaneously selling another. The profit or loss is determined by the difference in value between the two currencies. For example, you might buy US dollars (USD) and simultaneously sell Euros (EUR), hoping that the USD appreciates against the EUR.

The Key Players in the Foreign Exchange Market

The forex market is a bustling ecosystem of diverse participants, each with their own motivations and strategies. Understanding these players’ roles is crucial for comprehending the market’s dynamics:

- Central Banks: These government institutions play a vital role in setting interest rates, managing inflation, and influencing currency values.

- Commercial Banks: Major banks facilitate forex transactions for their clients, including corporations and individuals.

- Hedge Funds: These investment firms employ sophisticated strategies to profit from currency fluctuations.

- Retail Traders: Individuals like you and me, who enter the market with the hope of gaining profits.

- Interbank Market: This is the core of the forex market, where large financial institutions exchange currencies with each other.

Deciphering the Jargon: Essential Forex Trading Terms

To navigate the world of forex trading, you’ll need to understand the key terms used by traders. Here’s a glossary of essential concepts:

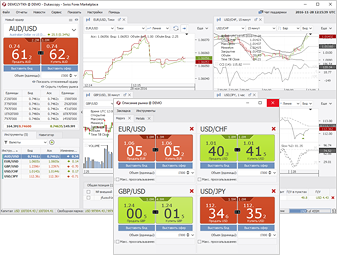

- Currency Pairs: The most common way to trade forex is through currency pairs, such as EUR/USD (Euro against US Dollar), GBP/USD (British Pound against US Dollar), and USD/JPY (US Dollar against Japanese Yen).

- Pip (Point in Percentage): The smallest unit of price movement in forex trading, often used to calculate profits and losses.

- Lots: The unit of trade size in forex markets. The larger the lot size, the greater the potential profit or loss.

- Leverage: The use of borrowed funds to amplify potential gains or losses. Forex traders often utilize leverage to increase trading power.

- Spread: The difference between the bid price (the price at which the broker is willing to buy a currency) and the ask price (the price at which the broker is willing to sell a currency).

Image: forextradingmethodmeaning.blogspot.com

Your Gateway to the Market: Navigating the Forex Trading Login Process

The first step to entering the world of forex trading is creating an account with a reputable forex broker. This involves several essential steps:

- Choose a Broker: Carefully research and select a broker that aligns with your trading style, risk tolerance, and financial goals. Consider factors like regulation, trading platform features, customer support, and fees.

- Open an Account: Most brokers offer demo accounts to practice trading without any real money. Once you’re ready, you can open a live account. This will usually require providing personal information and financial documentation.

- Fund Your Account: Deposit funds into your trading account to begin trading. Many brokers offer various payment methods, including bank transfers, credit cards, and e-wallets.

The Power of a Forex Trading Platform: Your Trading Command Center

Your forex trading platform is your command center, where you’ll place orders, manage positions, analyze market data, and execute trades. Here’s a breakdown of essential features:

- Charting Tools: Provides visual representations of currency price movements, allowing you to identify trends, patterns, and potential trading opportunities.

- Technical Indicators: Mathematical formulas used to analyze price data and generate trading signals.

- Order Types: Various order types to control your trading execution, including market orders, limit orders, and stop-loss orders.

- News and Analysis: Real-time market news and expert analysis to stay informed about global events impacting currency markets.

Understanding Your Risk and Setting Up Your Strategy

Forex trading is inherently risky. Before you even consider logging into your trading platform, take the time to understand your risk tolerance and develop a robust trading strategy to guide your decisions:

- Risk Tolerance: Evaluate how much risk you’re comfortable with, and ensure you’re comfortable with the potential for losses. Remember that every trade carries an element of risk.

- Risk Management: Implementing risk management strategies is crucial for preserving your capital. Limit your losses through stop-loss orders and never risk more than you can afford to lose.

- Trading Strategy: Develop a consistent trading plan that outlines your objectives, entry and exit points, and risk management rules. Stick to your strategy and avoid impulsive decisions.

Learning from the Experts: Forex Trading Education Resources

While this guide provides a foundational understanding, forex trading requires continuous learning and refinement. Utilize the wealth of resources available to enhance your knowledge:

- Online Courses: Numerous online platforms offer forex trading courses, covering everything from basic concepts to advanced strategies.

- Trading Books: Classic and contemporary books delve into various aspects of forex trading, including technical analysis, fundamental analysis, and risk management strategies.

- Webinars and Seminars: Free and paid webinars and seminars by experienced traders offer valuable insights into current market trends and trading approaches.

- Trading Communities: Join online forums, social media groups, and chatrooms to interact with experienced traders, share insights, and learn from their experiences.

Forex Trading Login

Finding Your Path to Success: Conclusion

Your forex trading login is your key to unlocking a world of financial opportunities. By understanding the market, the key players, and its terminology, you can make informed trading decisions. Remember to approach forex trading responsibly, prioritize risk management, and continuously seek knowledge and refinement. With practice, patience, and a willingness to learn, you can master the art of forex trading and achieve your financial goals.

Now that you’re ready to take your first steps, don’t hesitate to explore the vast resources available online. Join trading forums, connect with experienced traders, and start your journey towards financial independence in the exciting world of forex trading. The path to success begins with your first login.