Unveiling the World of Easy FX Trading

The forex market, the largest and most liquid financial market globally, is a complex beast. For many, the sheer volume of information and potential risks can be daunting. But what if there was a way to simplify forex trading, making it more accessible for beginners and seasoned traders alike? That’s where “Easy FX Trading” comes in, promising a user-friendly experience and potentially lucrative returns.

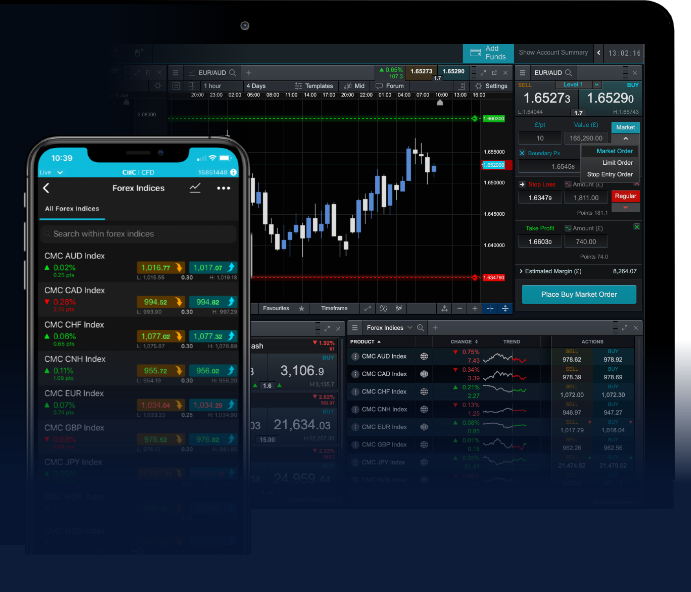

Image: www.cmcmarkets.com

This review dives deep into the world of Easy FX Trading, exploring its features, advantages, and disadvantages. We’ll analyze whether it aligns with its claims of simplicity and profitability, providing insights for anyone considering this platform as a gateway to forex trading.

Understanding the Concept of Easy FX Trading

What is Easy FX Trading?

Easy FX Trading, while not a singular platform, refers to a broader concept encompassing tools, strategies, and resources designed to simplify forex trading. It aims to demystify the intricacies of the market, making it approachable for individuals with varying levels of experience and financial expertise.

Why Make Forex Trading Easy?

The allure of easy FX trading stems from the inherent complexity of the forex market. The rapid fluctuations, diverse currency pairs, and vast amount of data can overwhelm new traders, potentially leading to hasty decisions and financial losses. “Easy FX Trading” platforms and resources provide a streamlined approach, focusing on key elements like:

- Simplified Trading Interfaces: User-friendly platforms with intuitive navigation and clear data visualizations.

- Educational Resources: Tutorials, articles, and webinars to build knowledge and understanding of forex fundamentals.

- Automated Trading Tools: Algorithms and robots that execute trades based on pre-defined rules, removing emotional bias.

- Pre-Set Trading Strategies: Templates and guides for beginner traders to follow, minimizing the need for complex analysis.

Image: www.waybinary.com

The Appeal of Easy FX Trading

The appeal of easy FX trading lies in its potential to democratize forex trading. It promises to level the playing field by providing individuals with limited experience and resources access to a powerful market.

However, it’s crucial to approach easy FX trading with a healthy dose of skepticism. While simplifying complex concepts can be helpful, it’s essential to understand the inherent risks involved in forex trading and to approach it responsibly.

Exploring Easy FX Trading Platforms

Popular Easy FX Trading Platforms

Several platforms claim to provide a user-friendly approach to forex trading. Some popular examples include:

- MetaTrader 4 (MT4): A widely used platform known for its intuitive interface and vast selection of indicators and expert advisors.

- TradingView: A popular charting platform offering social trading features, allowing users to follow and learn from experienced traders.

- eToro: A social trading and investment platform offering copy trading features, enabling users to replicate the strategies of successful traders.

Understanding the Features of Easy FX Trading Platforms

These platforms differ in their offerings, catering to different trading styles and preferences. Key features to consider include:

- Account Types: Different account options with varying minimum deposits and trading features.

- Trading Instruments: Access to a diverse range of currency pairs, commodities, and indices.

- Leverage: The ability to amplify trading positions, both increasing potential profits and losses.

- Spreads and Commissions: The fees charged for executing trades.

- Customer Support: Availability of support channels, helpful resources, and knowledgeable staff.

Benefits and Drawbacks of Easy FX Trading

Benefits

- Accessibility: Simplifies trading for beginners by providing user-friendly interfaces and educational resources.

- Reduced Learning Curve: Makes forex trading more approachable by offering pre-set strategies and automated tools.

- Potential for Higher Returns: Leverage can amplify potential profits but also increases potential losses.

- Flexibility: Allows for trading from various devices, including smartphones and tablets.

Drawbacks

- Oversimplification: Can lead to a lack of in-depth understanding of forex market dynamics and risk management.

- Limited Control: Automated trading tools may not always align with changing market conditions, potentially resulting in losses.

- Hidden Costs: Spreads, commissions, and other fees can eat into profits.

- Higher Risk: Leverage can significantly amplify both profits and losses, potentially leading to substantial financial losses.

Tips for Success in Easy FX Trading

While “Easy FX Trading” platforms can be helpful, it’s essential to remember that trading requires skill, knowledge, and discipline. Here are some tips to improve your chances of success:

- Start Small: Begin with a small deposit to minimize potential losses while learning the ropes.

- Focus on Education: Invest time in understanding forex basics, market dynamics, and risk management.

- Practice with a Demo Account: Test strategies and familiarize yourself with the platform before trading with real money.

- Manage Risk Effectively: Implement stop-loss orders to limit potential losses and define clear risk-reward ratios for each trade.

- Stay Informed: Keep up-to-date with economic news, market trends, and geopolitical events that can influence currency prices.

- Be Patient: Forex trading is not a get-rich-quick scheme. Avoid impulsive decisions and focus on consistent growth over time.

FAQs About Easy FX Trading

Q: Is Easy FX Trading a Scam?

Not necessarily. While some platforms may be fraudulent, many legitimate platforms offer easy-to-use trading features. However, thorough research and due diligence are crucial before choosing a platform.

Q: Can I Really Get Rich Quick with Easy FX Trading?

No. Forex trading involves inherent risks, and there are no guarantees of quick wealth. Focus on building a solid trading strategy and managing your risk effectively.

Q: Are Automated Trading Tools Reliable?

Automated trading tools can be helpful, but they are not foolproof. They should be used in conjunction with your own analysis and understanding of the market.

Q: How Much Money Do I Need to Start Easy FX Trading?

Minimum deposit requirements vary depending on the platform. Start with a small amount and gradually increase your investment as you gain experience.

Q: What are the Risks Associated with Easy FX Trading?

Forex trading involves risks, including potential losses beyond your initial investment. Understand the inherent risks and manage them effectively before trading.

Easy Fx Trading Review

Conclusion

The concept of Easy FX Trading can be a valuable tool for those seeking simplified access to the forex market. However, it’s essential to approach it with a balanced perspective, understanding both its advantages and drawbacks. Remember that forex trading involves risks, and success requires discipline, knowledge, and ongoing learning.

Are you interested in learning more about Easy FX Trading, or have any specific questions? Share your thoughts below!