The world of trading can be exhilarating and lucrative, but it also demands a significant amount of time, effort, and expertise. For many aspiring traders, the learning curve can feel daunting, and the risk of losing capital can be a major deterrent. But what if there was a way to learn from the best and even automate your trades, without the need for years of experience? Enter the world of trade copying, a powerful tool that enables you to automatically mirror the trades of experienced traders, potentially boosting your returns and minimizing risk.

Image: www.mql5.com

Tradovate, a leading online brokerage platform, offers a comprehensive suite of tools and services, including a renowned trade copier that empowers both novice and experienced traders alike. With Tradovate’s trade copier, you can connect your account with a successful trader’s account and automatically execute their trades in your own account. This article delves into the advantages and nuances of using Tradovate’s trade copier, exploring its capabilities, benefits, and considerations to help you make informed decisions about your trading journey.

Understanding Tradovate’s Trade Copier

The Mechanics of Trade Copying

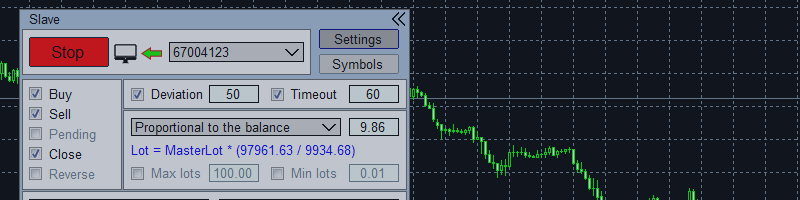

At its core, Tradovate’s trade copier acts as a bridge between two accounts: the “signal provider” and the “subscriber.” The signal provider, typically an experienced trader, executes trades in their account, and these trades are automatically relayed to the subscriber’s account, replicating them with a predefined ratio. This ratio, often expressed as a percentage, determines the amount of capital allocated to each trade and can be adjusted based on individual risk tolerance and trading strategies.

Advantages of Trade Copying

Trade copying offers several key benefits for traders of all experience levels:

- Access to Expert Expertise: Tap into the knowledge and experience of seasoned traders, potentially boosting your returns and minimizing losses.

- Time Efficiency: Free up time and focus on other aspects of life, as trade copying automates the execution process.

- Reduced Emotional Biases: Trade copying can help eliminate the emotional factors that often plague traders, such as fear, greed, and overtrading.

- Scalability: Adjust your trade sizes based on your risk tolerance and capital allocation.

Image: www.youtube.com

Key Considerations

While trade copying holds significant potential, it’s essential to consider some important factors:

- Signal Provider Selection: The success of trade copying is heavily reliant on the skill and expertise of the signal provider. Thoroughly research potential providers, considering their track record, trading style, and risk management approach.

- Transparency and Fees: Look for signal providers with transparent performance reports, clear fee structures, and a focus on long-term sustainability.

- Backtesting and Risk Management: Before copying trades, backtest the provider’s performance history, simulate the trades on your own account, and establish a robust risk management plan.

The Future of Trade Copying

Trade copying is rapidly evolving, fueled by the growing demand for automated trading solutions. Advancements in artificial intelligence (AI) and machine learning (ML) are paving the way for more sophisticated and data-driven trading algorithms. This means that trade copying is becoming increasingly dynamic, offering traders more personalized and adaptive strategies based on individual preferences and risk profiles.

Social trading platforms are also playing a significant role in the future of trade copying. These platforms connect traders with shared interests, allowing them to follow, learn from, and copy the trading styles of successful individuals. This collaborative approach fosters community and transparency, empowering traders to make informed decisions and improve their trading outcomes.

Expert Tips for Maximizing Trade Copying Benefits

Here are some key tips for maximizing the benefits of trade copying:

1. Diversify Your Signal Providers

Don’t rely solely on one signal provider. Diversifying your portfolio across multiple providers can help mitigate risk and potentially enhance returns. By tracking the performance of various providers, you can identify those who best align with your trading goals and risk tolerance.

2. Implement a Strict Risk Management Plan

Never invest more than you can afford to lose. Develop a sound risk management plan that includes setting stop-loss orders, defining position sizes, and adhering to pre-determined risk limits. Remember, even the most successful traders experience occasional losses, so it’s crucial to protect your capital and manage risk effectively.

Frequently Asked Questions (FAQs)

1. Is trade copying suitable for all traders?

Trade copying can be valuable for both beginner and experienced traders. Beginners benefit from learning through mirroring skilled traders, while experienced traders can test new strategies or diversify their portfolio with minimal effort. However, it’s crucial to remember that trade copying is not a foolproof strategy and success depends heavily on the signal provider’s expertise and your risk management approach.

2. Can I customize the trades copied from the signal provider?

Typically, trade copying platforms offer some level of customization. You might be able to adjust the trade size, stop-loss orders, and profit targets. However, the level of customization available can vary between platforms and signal providers.

3. What are the risks associated with trade copying?

As with any trading activity, trade copying involves risks. The performance of the signal provider can fluctuate, and you may experience losses due to market volatility, unforeseen events, or even the signal provider’s errors. Therefore, it’s crucial to select providers carefully, backtest their performance, and implement a robust risk management plan.

Tradovate Trade Copier

Conclusion: Embracing the Power of Trade Copying

Trade copying represents an exciting evolution in trading technology, providing traders with a powerful tool for learning, earning, and streamlining their operations. By leveraging the expertise of experienced traders and automating trade execution, trade copying can potentially boost returns, reduce risk, and empower both novice and seasoned traders to achieve their financial goals. As trade copying continues to evolve, it promises to play an increasingly significant role in the future of online trading.

Are you ready to explore the world of trade copying and unlock its potential? Share your thoughts and experiences in the comments below!