Imagine this: You’ve worked tirelessly, building a life of comfort and security in South Africa. You’ve managed to accumulate a substantial sum, a proud 3 million Rand, representing years of dedication and sacrifice. Now, a new opportunity beckons, perhaps a dream home abroad, a business venture in the US, or simply the desire to diversify your investments. But how much is that 3 million Rand worth in the currency of your aspirations, the mighty US dollar?

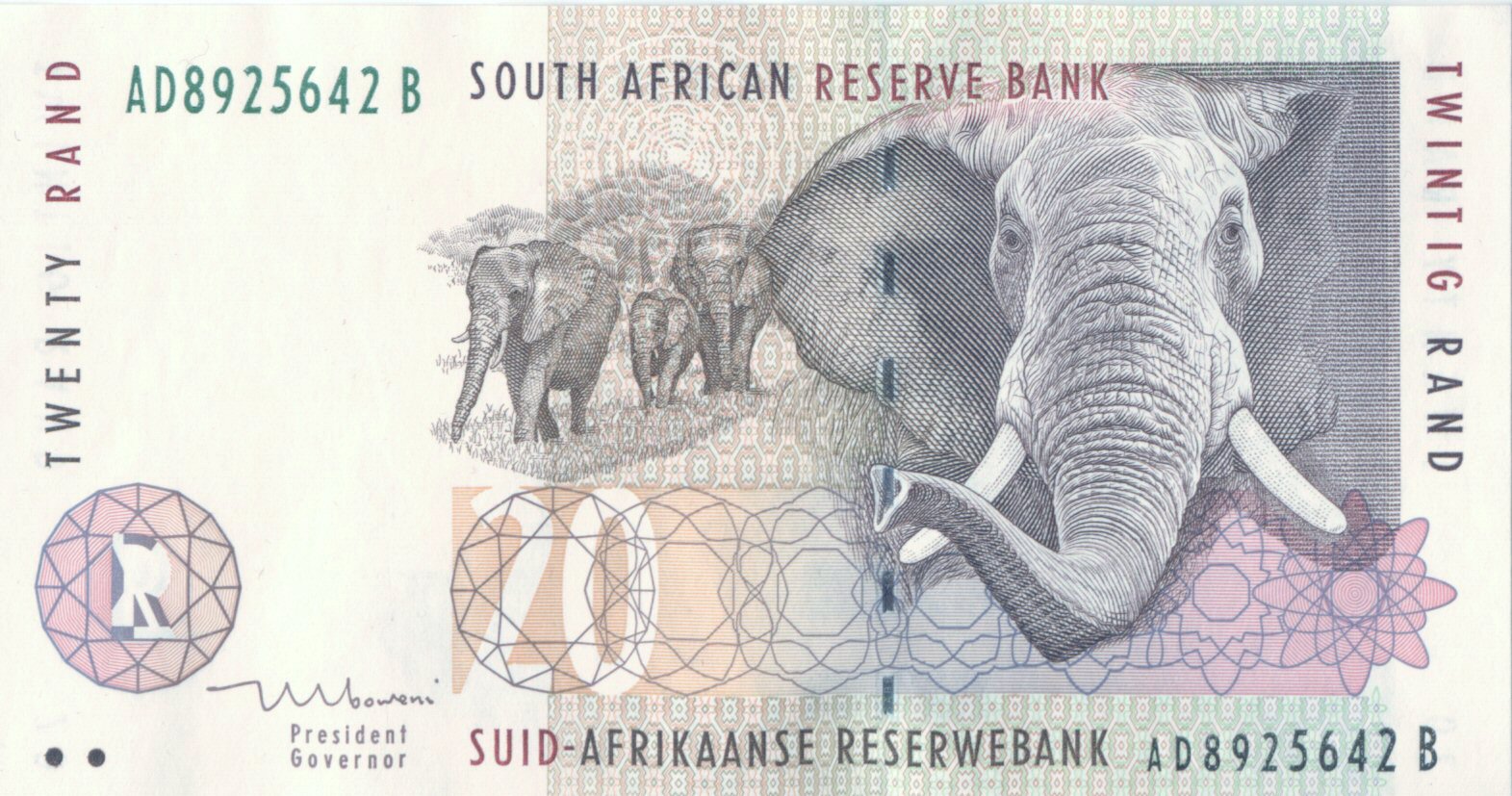

Image: businesstech.co.za

This question is not just about numbers; it’s about dreams, choices, and the power of understanding the global financial landscape. This article delves into the intricate world of currency conversion, armed with the knowledge you need to navigate the exchange rate between the South African Rand and the US dollar. We’ll unravel the factors influencing this conversion, equip you with practical tools to make informed decisions, and guide you towards realizing your financial aspirations.

Understanding the Currency Exchange: A Bridge Between Worlds

The South African Rand (ZAR) and the US dollar (USD) are two of the most traded currencies globally, reflecting the economic prowess of their respective nations. The rate at which they exchange fluctuates constantly, a constant dance driven by a complex interplay of economic forces:

- Interest Rates: When the South African Reserve Bank raises interest rates, investors are attracted to ZAR, increasing its value against the USD. Conversely, a decrease in interest rates can weaken the Rand.

- Inflation: High inflation in South Africa erodes the purchasing power of the Rand, making it less valuable compared to the USD. Conversely, low inflation in the US strengthens the dollar.

- Economic Growth: Strong economic performance in South Africa typically drives up the value of the Rand, while economic challenges can weaken it. Similarly, a thriving US economy usually strengthens the USD.

- Political Stability: Political uncertainty or instability in South Africa can negatively impact the Rand’s value.

- Commodity Prices: South Africa’s exports include gold and platinum. When these commodity prices rise, the Rand tends to strengthen.

- Global Market Sentiment: Events like a global recession or geopolitical tensions can influence the exchange rate.

Navigating the Exchange: Your Guide to Making Informed Decisions

Armed with this understanding, you can make informed financial decisions. When considering the conversion of 3 million Rand to USD, you need to:

1. Choose Your Method:

- Bank Exchange: Banks offer a relatively safe and secure option, but their exchange rates often include higher fees.

- Online Currency Exchange Services: Several reputable platforms offer competitive rates, providing greater transparency.

- Money Transfer Services: Services like Western Union or MoneyGram facilitate quick international transfers but may have higher fees.

2. Factor in Exchange Rates: The exchange rate can fluctuate significantly, so it’s crucial to stay informed. Use reliable online conversion tools to check the current rate before making any transactions.

3. Fees and Charges: Remember that every method comes with fees, including commission, transfer charges, and potential mark-ups on the exchange rate. Compare different options to find the most cost-effective solution.

4. Timing is Everything: If you’re looking for the most favorable exchange rate, consider waiting for periods when the Rand is strong against the USD. However, remember that predicting exchange rate movements can be challenging.

Expert Insights: Harnessing Your Financial Power

To maximize the value of your 3 million Rand, consider these expert tips:

1. Diversify Your Investments: Invest in a mix of assets, such as stocks, bonds, and real estate, both in South Africa and internationally. This strategy helps reduce risk and potentially boost returns.

2. Seek Professional Advice: Consult a financial advisor specializing in international investments to receive tailored guidance based on your financial goals and risk tolerance.

3. Stay Informed: Keep abreast of economic developments in both South Africa and the US, understanding how they impact the exchange rate.

Image: buzzsouthafrica.com

3 Million Rand To Usd

https://youtube.com/watch?v=9FwrriB3CbY

A World of Opportunity: Unlocking Your Financial Potential

By understanding the dynamics of currency exchange, you gain control over your financial destiny. With careful planning and proactive engagement, you can navigate the world of currencies and confidently pursue your financial aspirations. Your 3 million Rand, whether in South Africa or converted to USD, represents the foundation for a brighter future. Don’t just dream about it; leverage your knowledge to make those dreams a reality.