The world of trading can feel like a whirlwind of numbers, charts, and technical indicators. But amidst the chaos, there are recurring patterns that can provide valuable insights into market movements. One such pattern, woven into the fabric of the financial markets, is the Fibonacci sequence. This seemingly simple mathematical concept has been used for centuries in art, architecture, and, more recently, finance. As a trader, understanding Fibonacci levels can offer a framework for identifying potential support and resistance levels, enhancing your trading strategies.

Image: www.tpsearchtool.com

Imagine watching a stock price chart, a roller coaster of ups and downs. It’s tempting to jump on every wave, but without proper guidance, you risk getting caught in a rollercoaster ride that ends with a stomach-churning loss. That’s where Fibonacci levels come in. They act like invisible markers, highlighting potential areas where the price might pause, reverse, or even accelerate its movement.

The Golden Ratio and the Fibonacci Sequence: A Foundation for Price Levels

Unraveling the Fibonacci Sequence

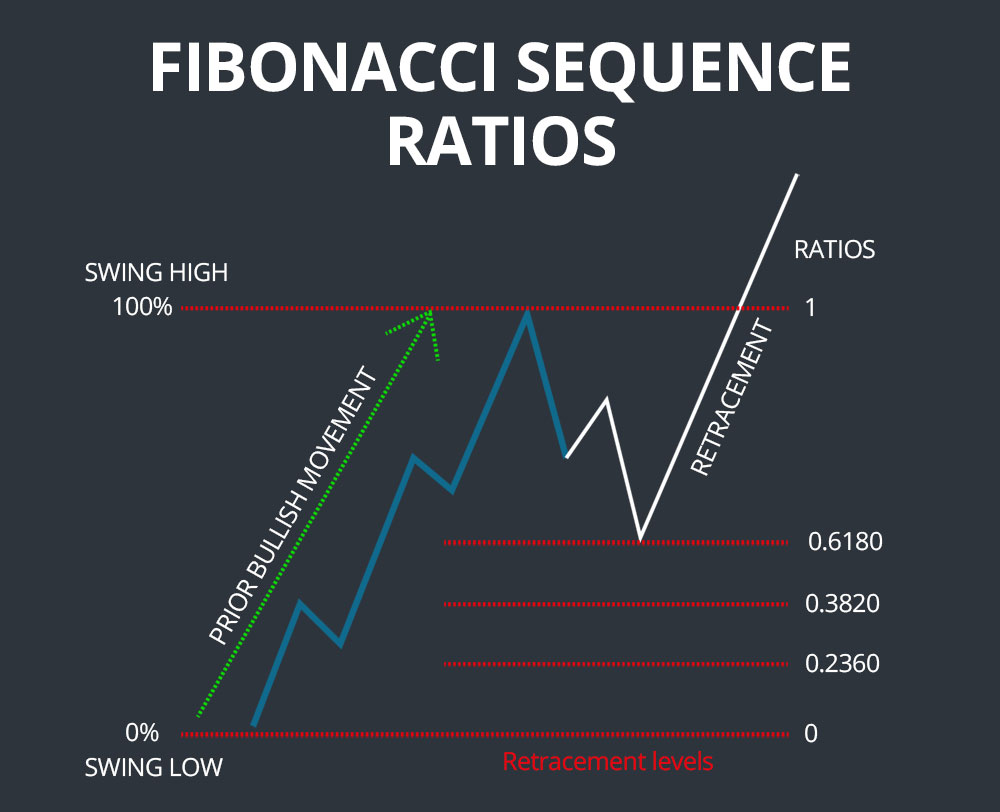

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding ones: 0, 1, 1, 2, 3, 5, 8, 13, 21, and so on. From this sequence, we derive the Fibonacci ratios, which are obtained by dividing consecutive numbers in the sequence. For example, 8/13 = 0.618, and 13/21 = 0.619. You might notice that these ratios are remarkably close to the “golden ratio” of 0.618, also known as Phi.

The Golden Ratio: A Universal Pattern

The golden ratio, represented by the Greek letter Phi (Φ), is a special number that appears frequently in nature, art, and even the human body. It’s often said to represent perfect balance and harmony. In financial markets, this ratio is believed to influence price movements, creating zones of potential support and resistance.

Image: scanz.com

Fibonacci Levels in Trading

Identifying Key Levels: Support and Resistance

Fibonacci levels are calculated by applying the Fibonacci ratios to the price range of an asset, typically a stock or cryptocurrency. The most common Fibonacci ratios used in trading include:

- 0 (Zero): This level represents the starting point of the analysis.

- 23.6%: A potential area of initial support or resistance.

- 38.2%: A significant level that often marks a potential reversal point.

- 50%: A middle point that can act as a pivot level.

- 61.8%: A major level that often attracts buyers or sellers. This is also closest to the *golden ratio*.

- 100%: The end of the trend being analyzed. It often marks a significant resistance level.

- 161.8%: Extensions of the trend, marking potential areas of further price movement.

How to Apply Fibonacci Levels in Trading: A Step-by-Step Guide

1. **Identify a Trend:** The first step in using Fibonacci levels is to identify a clear uptrend or downtrend in the price of an asset. The trend can be determined by using technical indicators such as moving averages, or simply by observing the overall direction of the price movement.

2. **Find the Swing High and Swing Low:** Once a trend is identified, find the highest price (swing high) and the lowest price (swing low) within the trend. These points define the price range that will be used to calculate the Fibonacci levels.

3. **Calculate the Fibonacci Levels:** Using your chosen trading platform or calculator, enter the swing high and swing low to calculate the Fibonacci levels. Your platform will then display the Fibonacci retracement levels on your chart.

4. **Observe and Trade:** With the Fibonacci levels drawn on your chart, you can observe how the price interacts with these levels. When the price approaches a level, it might bounce off it, indicating a possible reversal. Conversely, if the price breaks through a level, it might signal a continuation of the current trend.

Current Trends and the Future of Fibonacci Levels

The use of Fibonacci levels in trading continues to be a popular strategy amongst traders, both seasoned veterans and newcomers. One notable trend is the increasing use of Fibonacci levels alongside other technical indicators, such as moving averages and RSI (Relative Strength Index). This layered approach aims to provide more comprehensive signals and enhance trading accuracy.

However, it’s important to acknowledge that Fibonacci levels are not foolproof. They’re often used as a guide rather than a definitive prediction. The market is constantly evolving, and the effectiveness of Fibonacci levels can vary depending on the market conditions, volatility, and the time frame being analyzed.

Expert Tips & Strategies: Mastering Fibonacci Levels

1. **Focus on Major Levels:** Pay closer attention to the 61.8%, 38.2%, and 23.6% levels. These levels tend to be most significant in generating reversals or price reactions.

2. **Combine with Other Technical Indicators:** Using Fibonacci levels in conjunction with other indicators, such as moving averages or momentum indicators, can provide stronger trading signals.

3. **Consider Time Frames:** Fibonacci levels can be used on different time frames, such as daily, weekly, or monthly charts. Consider the time frame that aligns with your trading strategy and risk tolerance.

FAQ: Demystifying Fibonacci Levels

Q: Are Fibonacci levels always accurate?

A: Fibonacci levels are not always accurate. They provide a framework for potential price movements but are not guarantees of future behavior. Other factors influence market movements.

Q: Can I use Fibonacci levels for all markets?

A: Fibonacci levels can be applied to various markets, including stocks, futures, Forex, and cryptocurrencies. However, their effectiveness might vary based on the specific market dynamics.

Q: How do I learn more about Fibonacci levels?

A: There are numerous online resources, books, and courses that delve into the intricacies of Fibonacci trading. Practice with demo accounts before using real capital.

Fibonacci Levels Trading

Conclusion

Fibonacci levels offer a valuable tool for traders, providing insights into potential support and resistance levels, and improving the overall trading experience. Remember that it’s a strategy that should be used in conjunction with other technical indicators and risk management strategies for greater success. Are you interested in exploring the fascinating world of Fibonacci levels for your trading journey?